- Canada

- /

- Electrical

- /

- TSX:HPS.A

What You Can Learn From Hammond Power Solutions Inc.'s (TSE:HPS.A) P/E After Its 30% Share Price Crash

To the annoyance of some shareholders, Hammond Power Solutions Inc. (TSE:HPS.A) shares are down a considerable 30% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 22% share price drop.

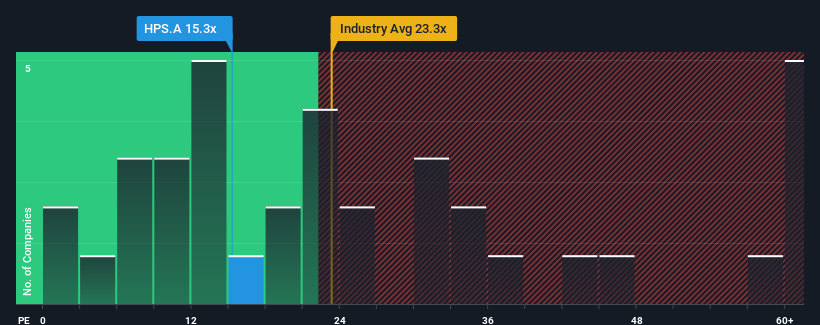

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Hammond Power Solutions' P/E ratio of 15.3x, since the median price-to-earnings (or "P/E") ratio in Canada is also close to 15x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Recent times have been advantageous for Hammond Power Solutions as its earnings have been rising faster than most other companies. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Hammond Power Solutions

Is There Some Growth For Hammond Power Solutions?

In order to justify its P/E ratio, Hammond Power Solutions would need to produce growth that's similar to the market.

If we review the last year of earnings growth, the company posted a worthy increase of 10.0%. This was backed up an excellent period prior to see EPS up by 349% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Shifting to the future, estimates from the four analysts covering the company suggest earnings should grow by 12% per year over the next three years. With the market predicted to deliver 12% growth per year, the company is positioned for a comparable earnings result.

In light of this, it's understandable that Hammond Power Solutions' P/E sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Key Takeaway

Following Hammond Power Solutions' share price tumble, its P/E is now hanging on to the median market P/E. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Hammond Power Solutions maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. Unless these conditions change, they will continue to support the share price at these levels.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Hammond Power Solutions with six simple checks on some of these key factors.

If you're unsure about the strength of Hammond Power Solutions' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Hammond Power Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:HPS.A

Hammond Power Solutions

Engages in the design, manufacture, and sale of various transformers in Canada, the United States, Mexico, and India.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives