- Canada

- /

- Electrical

- /

- TSX:HPS.A

We Like Hammond Power Solutions' (TSE:HPS.A) Returns And Here's How They're Trending

Finding a business that has the potential to grow substantially is not easy, but it is possible if we look at a few key financial metrics. Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. Speaking of which, we noticed some great changes in Hammond Power Solutions' (TSE:HPS.A) returns on capital, so let's have a look.

Return On Capital Employed (ROCE): What Is It?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. To calculate this metric for Hammond Power Solutions, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.30 = CA$74m ÷ (CA$423m - CA$173m) (Based on the trailing twelve months to March 2024).

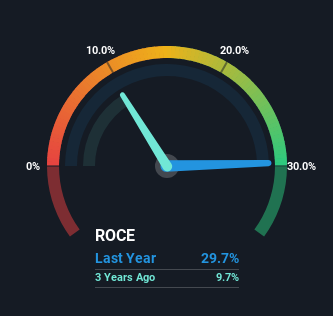

So, Hammond Power Solutions has an ROCE of 30%. In absolute terms that's a great return and it's even better than the Electrical industry average of 14%.

See our latest analysis for Hammond Power Solutions

Above you can see how the current ROCE for Hammond Power Solutions compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like, you can check out the forecasts from the analysts covering Hammond Power Solutions for free.

What The Trend Of ROCE Can Tell Us

Investors would be pleased with what's happening at Hammond Power Solutions. Over the last five years, returns on capital employed have risen substantially to 30%. The company is effectively making more money per dollar of capital used, and it's worth noting that the amount of capital has increased too, by 113%. So we're very much inspired by what we're seeing at Hammond Power Solutions thanks to its ability to profitably reinvest capital.

On a side note, Hammond Power Solutions' current liabilities are still rather high at 41% of total assets. This effectively means that suppliers (or short-term creditors) are funding a large portion of the business, so just be aware that this can introduce some elements of risk. Ideally we'd like to see this reduce as that would mean fewer obligations bearing risks.

The Bottom Line

In summary, it's great to see that Hammond Power Solutions can compound returns by consistently reinvesting capital at increasing rates of return, because these are some of the key ingredients of those highly sought after multi-baggers. Since the stock has returned a staggering 1,800% to shareholders over the last five years, it looks like investors are recognizing these changes. Therefore, we think it would be worth your time to check if these trends are going to continue.

While Hammond Power Solutions looks impressive, no company is worth an infinite price. The intrinsic value infographic for HPS.A helps visualize whether it is currently trading for a fair price.

High returns are a key ingredient to strong performance, so check out our free list ofstocks earning high returns on equity with solid balance sheets.

Valuation is complex, but we're here to simplify it.

Discover if Hammond Power Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:HPS.A

Hammond Power Solutions

Engages in the design, manufacture, and sale of various transformers in Canada, the United States, Mexico, and India.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives