- Canada

- /

- Electrical

- /

- TSX:HPS.A

Hammond Power Solutions Inc. (TSE:HPS.A) Is About To Go Ex-Dividend, And It Pays A 4.9% Yield

It looks like Hammond Power Solutions Inc. (TSE:HPS.A) is about to go ex-dividend in the next 4 days. Ex-dividend means that investors that purchase the stock on or after the 18th of March will not receive this dividend, which will be paid on the 26th of March.

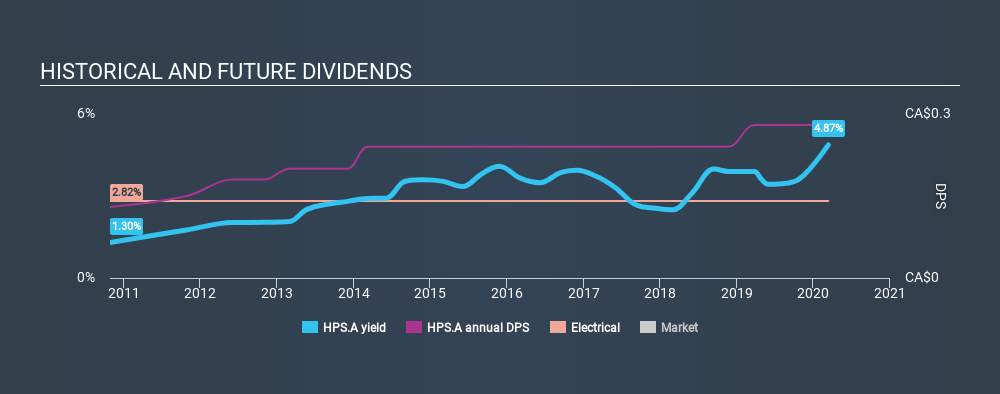

Hammond Power Solutions's upcoming dividend is CA$0.085 a share, following on from the last 12 months, when the company distributed a total of CA$0.28 per share to shareholders. Looking at the last 12 months of distributions, Hammond Power Solutions has a trailing yield of approximately 4.9% on its current stock price of CA$5.75. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. We need to see whether the dividend is covered by earnings and if it's growing.

Check out our latest analysis for Hammond Power Solutions

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Fortunately Hammond Power Solutions's payout ratio is modest, at just 27% of profit. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. Over the past year it paid out 116% of its free cash flow as dividends, which is uncomfortably high. We're curious about why the company paid out more cash than it generated last year, since this can be one of the early signs that a dividend may be unsustainable.

While Hammond Power Solutions's dividends were covered by the company's reported profits, cash is somewhat more important, so it's not great to see that the company didn't generate enough cash to pay its dividend. Were this to happen repeatedly, this would be a risk to Hammond Power Solutions's ability to maintain its dividend.

Click here to see how much of its profit Hammond Power Solutions paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. If earnings fall far enough, the company could be forced to cut its dividend. Fortunately for readers, Hammond Power Solutions's earnings per share have been growing at 14% a year for the past five years. Earnings have been growing at a decent rate, but we're concerned dividend payments consumed most of the company's cash flow over the past year.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. In the last nine years, Hammond Power Solutions has lifted its dividend by approximately 8.9% a year on average. It's encouraging to see the company lifting dividends while earnings are growing, suggesting at least some corporate interest in rewarding shareholders.

Final Takeaway

Is Hammond Power Solutions worth buying for its dividend? We're glad to see the company has been improving its earnings per share while also paying out a low percentage of income. However, it's not great to see it paying out what we see as an uncomfortably high percentage of its cash flow. While it does have some good things going for it, we're a bit ambivalent and it would take more to convince us of Hammond Power Solutions's dividend merits.

While it's tempting to invest in Hammond Power Solutions for the dividends alone, you should always be mindful of the risks involved. Case in point: We've spotted 4 warning signs for Hammond Power Solutions you should be aware of.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:HPS.A

Hammond Power Solutions

Engages in the design, manufacture, and sale of various transformers in Canada, the United States, Mexico, and India.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion