- Canada

- /

- Electrical

- /

- TSX:BLDP

Investors ignore increasing losses at Ballard Power Systems (TSE:BLDP) as stock jumps 9.8% this past week

Some Ballard Power Systems Inc. (TSE:BLDP) shareholders are probably rather concerned to see the share price fall 39% over the last three months. But that doesn't change the fact that shareholders have received really good returns over the last five years. It's fair to say most would be happy with 136% the gain in that time. So while it's never fun to see a share price fall, it's important to look at a longer time horizon. Ultimately business performance will determine whether the stock price continues the positive long term trend. Unfortunately not all shareholders will have held it for the long term, so spare a thought for those caught in the 60% decline over the last twelve months.

Since it's been a strong week for Ballard Power Systems shareholders, let's have a look at trend of the longer term fundamentals.

See our latest analysis for Ballard Power Systems

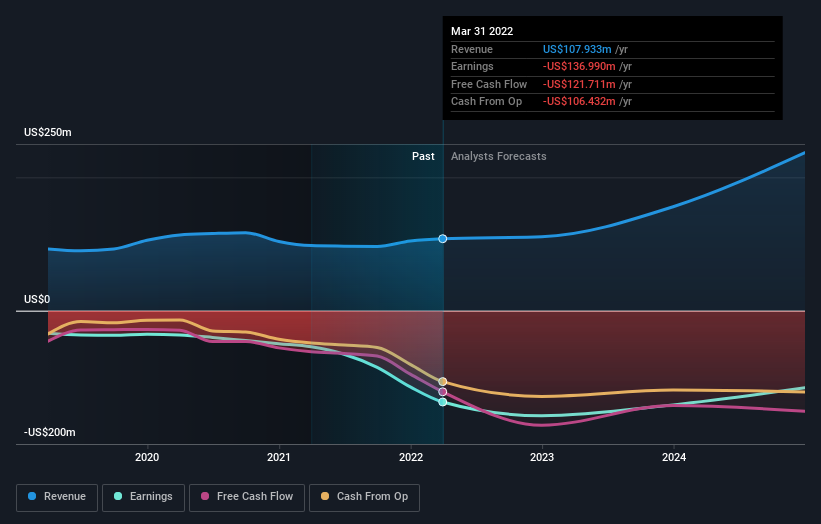

Given that Ballard Power Systems didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last half decade Ballard Power Systems' revenue has actually been trending down at about 0.7% per year. On the other hand, the share price done the opposite, gaining 19%, compound, each year. It just goes to show tht the market is forward looking, and it's not always easy to predict the future based on past trends. Still, this situation makes us a little wary of the stock.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Ballard Power Systems is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

While the broader market lost about 1.4% in the twelve months, Ballard Power Systems shareholders did even worse, losing 60%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Longer term investors wouldn't be so upset, since they would have made 19%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Ballard Power Systems has 2 warning signs we think you should be aware of.

Of course Ballard Power Systems may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Ballard Power Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:BLDP

Ballard Power Systems

Engages in the design, development, manufacture, sale, and service of proton exchange membrane (PEM) fuel cell products.

Flawless balance sheet and overvalued.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026