- Canada

- /

- Construction

- /

- TSX:BDT

Should Bird Construction’s (TSX:BDT) Role in Peel Memorial Redevelopment Influence Its Investment Narrative?

Reviewed by Sasha Jovanovic

- On October 27, 2025, Infrastructure Ontario and William Osler Health System announced that Bird Construction Inc. entered into a Development Phase Agreement as Development Partner for the Peel Memorial Hospital Phase 2 Redevelopment project.

- This milestone cements Bird’s involvement with the project under a progressive design-build model, highlighting its collaborative capabilities on major Canadian healthcare infrastructure initiatives.

- We’ll look at how Bird’s new hospital redevelopment role may influence its investment narrative and long-term contract pipeline.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Bird Construction Investment Narrative Recap

The big picture for Bird Construction centers on capitalizing on sustained Canadian infrastructure investment and demonstrating execution strength amid economic and sector-specific uncertainties. The Peel Memorial Hospital redevelopment agreement further solidifies Bird’s role as a partner on large public projects, but this milestone does not meaningfully offset the near-term risk of project delays or deferrals driven by macroeconomic or client caution, which remains a key factor for future revenue and earnings momentum.

The September 29 announcement, when Bird was selected as Preferred Proponent for the Peel Memorial Hospital project, is directly relevant. It positioned Bird to enter the new Development Phase Agreement by leveraging its collaborative delivery capabilities and underscores the importance of such major public projects in sustaining the company’s multi-year backlog, an ongoing catalyst for future contract wins and lasting revenue streams as infrastructure spending persists.

By contrast, investors should pay attention to potential project pushouts or cancellations if economic uncertainty persists, because ...

Read the full narrative on Bird Construction (it's free!)

Bird Construction's narrative projects CA$4.6 billion in revenue and CA$257.8 million in earnings by 2028. This requires 10.6% yearly revenue growth and a CA$159.4 million earnings increase from CA$98.4 million today.

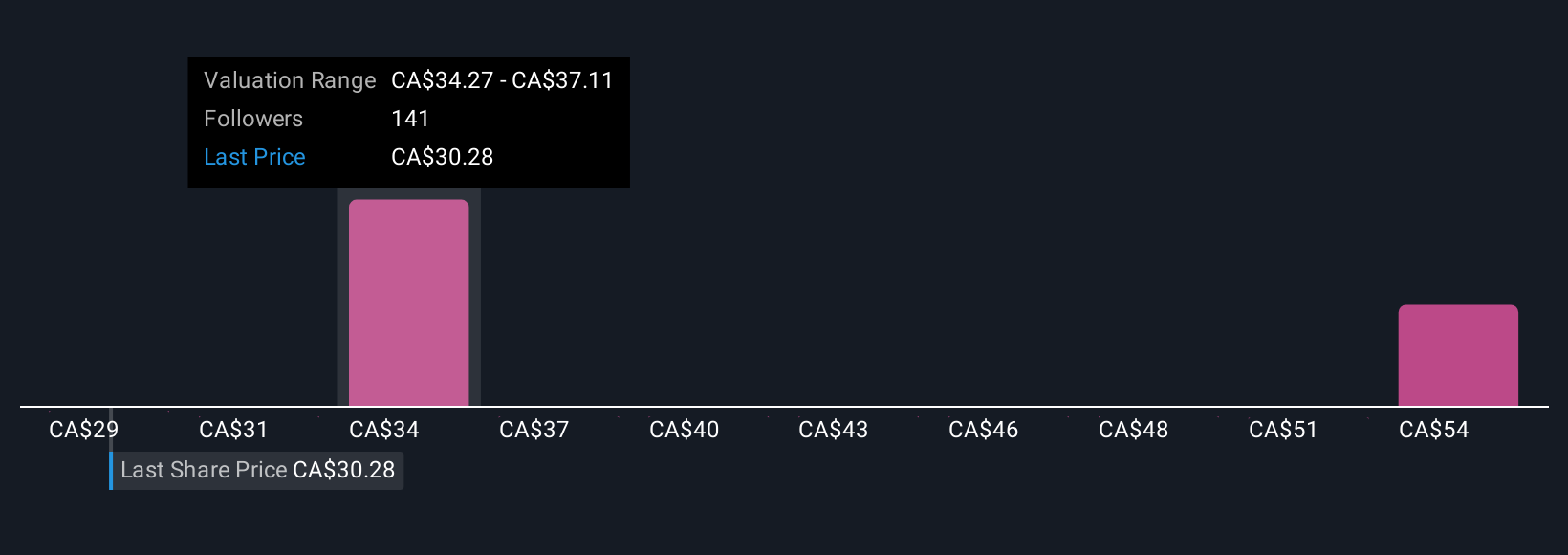

Uncover how Bird Construction's forecasts yield a CA$35.94 fair value, a 19% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community’s 14 fair value estimates for Bird Construction range widely from CA$28.60 to CA$84.44. While some see significant upside, macro-driven delays in client spending could constrain top-line growth, which means it’s crucial to examine these different assumptions for a fuller picture of possible outcomes.

Explore 14 other fair value estimates on Bird Construction - why the stock might be worth over 2x more than the current price!

Build Your Own Bird Construction Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bird Construction research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Bird Construction research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bird Construction's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bird Construction might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BDT

Very undervalued with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives