- Canada

- /

- Aerospace & Defense

- /

- TSX:BBD.B

Did Early Redemption of 2027 Debt Just Shift Bombardier's (TSX:BBD.B) Investment Narrative?

Reviewed by Sasha Jovanovic

- On November 3, 2025, Bombardier Inc. announced it had issued a notice of redemption for all of its outstanding 7.875% Senior Notes due 2027, totaling US$99.43 million in principal, with redemption taking place on December 3, 2025 at 100% of principal plus accrued interest.

- This early debt redemption marks a decisive step in Bombardier's ongoing efforts to strengthen its balance sheet and improve its financial flexibility.

- We'll assess how Bombardier's targeted debt repayment could influence its investment narrative and outlook for financial resilience.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Bombardier Investment Narrative Recap

To be a Bombardier shareholder, you need confidence in the durability of business jet demand and faith that ongoing deleveraging will translate to stronger earnings stability. The early redemption of US$99.43 million in senior notes could modestly improve financial flexibility, but the near-term investment story still revolves around execution in the business jet segment and managing persistent supply chain headwinds. This redemption does not materially alter the most important short-term catalyst, continued order momentum and aftermarket growth, or ease the sector's primary risk of cyclicality.

A recent announcement that stands out alongside this debt repayment is Bombardier’s upcoming service center opening in Fort Wayne, Indiana, part of its U.S. expansion. Service facility growth aligns closely with the current catalyst of rising high-margin aftermarket revenue, which should support cash flow, a critical offset as backlogs stretch out and near-term deliveries remain key to financial performance.

By contrast, the greatest risk that investors should be aware of is the potential for...

Read the full narrative on Bombardier (it's free!)

Bombardier's outlook anticipates $10.2 billion in revenue and $980.5 million in earnings by 2028. This assumes a 5.4% annual revenue growth rate and a $531.5 million increase in earnings from the current $449.0 million.

Uncover how Bombardier's forecasts yield a CA$199.52 fair value, in line with its current price.

Exploring Other Perspectives

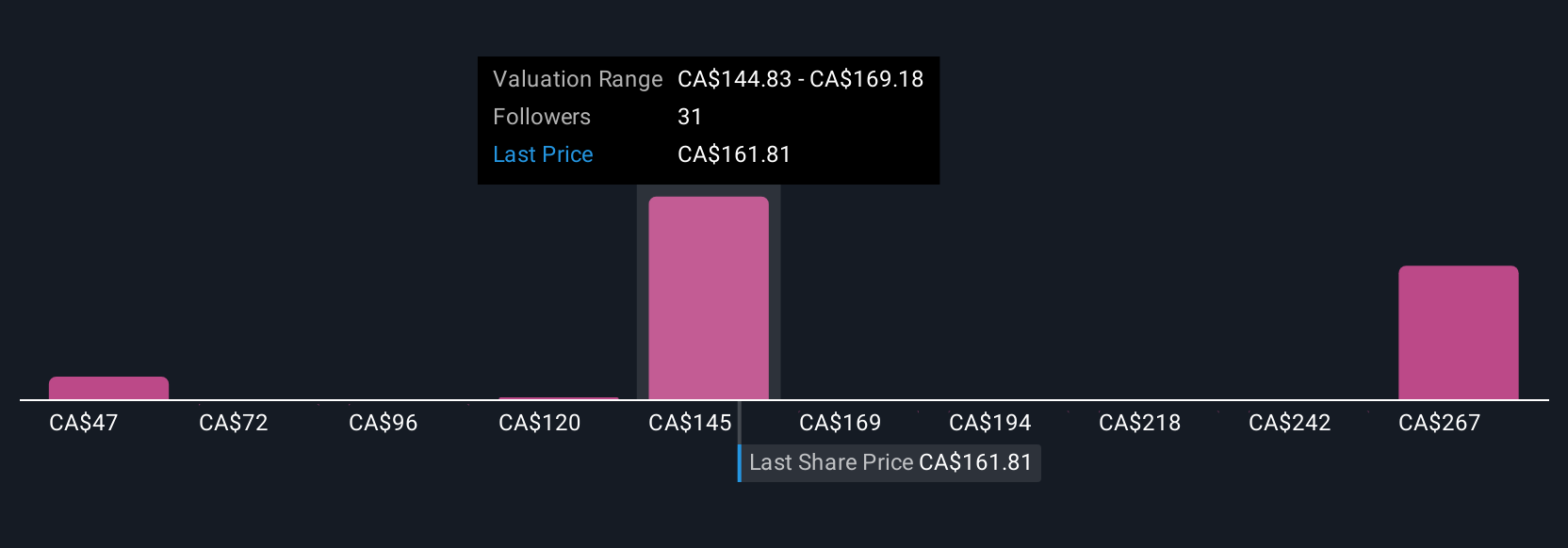

Fair value estimates from 10 Simply Wall St Community members range widely, from CA$47.40 to CA$303.76. With execution against supply chain risks still in focus, explore how these varied views can influence your perspective.

Explore 10 other fair value estimates on Bombardier - why the stock might be worth less than half the current price!

Build Your Own Bombardier Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bombardier research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Bombardier research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bombardier's overall financial health at a glance.

No Opportunity In Bombardier?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bombardier might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BBD.B

Bombardier

Engages in the design, manufacture, and sale of business aircraft and aircraft structural components worldwide.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives