- Canada

- /

- Aerospace & Defense

- /

- TSX:BBD.B

A Fresh Look at Bombardier (TSX:BBD.B) Valuation After Strong Q3 Growth and Expanding Backlog

Reviewed by Simply Wall St

Bombardier (TSX:BBD.B) just reported its third-quarter results, showing an 11% jump in revenue along with growth in aircraft deliveries and services. The company’s order backlog now stands at $16.6 billion.

See our latest analysis for Bombardier.

Bombardier’s string of upbeat developments, including new aircraft certifications and a steady M&A push, has caught investor attention, and that enthusiasm is showing in the numbers. The stock’s recent momentum is evident, with a 5% share price return over the past month and a remarkable year-to-date share price return of nearly 107%. Over the longer term, shareholders have enjoyed a total return of more than 1,000% over five years, which signals that the company has consistently delivered for investors even as it reshapes its business for the future.

If Bombardier’s surge has you wondering what other industrial names could be on the move, this is a great time to discover See the full list for free.

With the stock’s stellar run and a hefty backlog now in place, investors have to ask if Bombardier shares still offer room for upside or if all that future growth is already reflected in the current price.

Most Popular Narrative: 70% Undervalued

Bombardier’s most-followed narrative places fair value well above the latest closing price, highlighting just how far consensus estimates stretch beyond current market levels. With such a significant gap, this perspective deserves extra attention.

Robust growth in Bombardier's services and aftermarket business, including expanded service facilities and high utilization rates across a growing fleet, points to a durable, high-margin recurring revenue stream that should support long-term improvements in earnings stability and free cash flow.

Curious what kind of growth outlook leads analysts to this aggressive fair value? The underlying factors center on a mix of recurring revenue and margin expansion assumptions, painting a picture most investors may not see unless they examine the details. Unlock the full forecast behind these high targets and discover what numbers could make Bombardier a heavyweight for years to come.

Result: Fair Value of $201.35 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Bombardier’s heavy reliance on business jets and persistent supply chain constraints could challenge its momentum and test investor confidence moving forward.

Find out about the key risks to this Bombardier narrative.

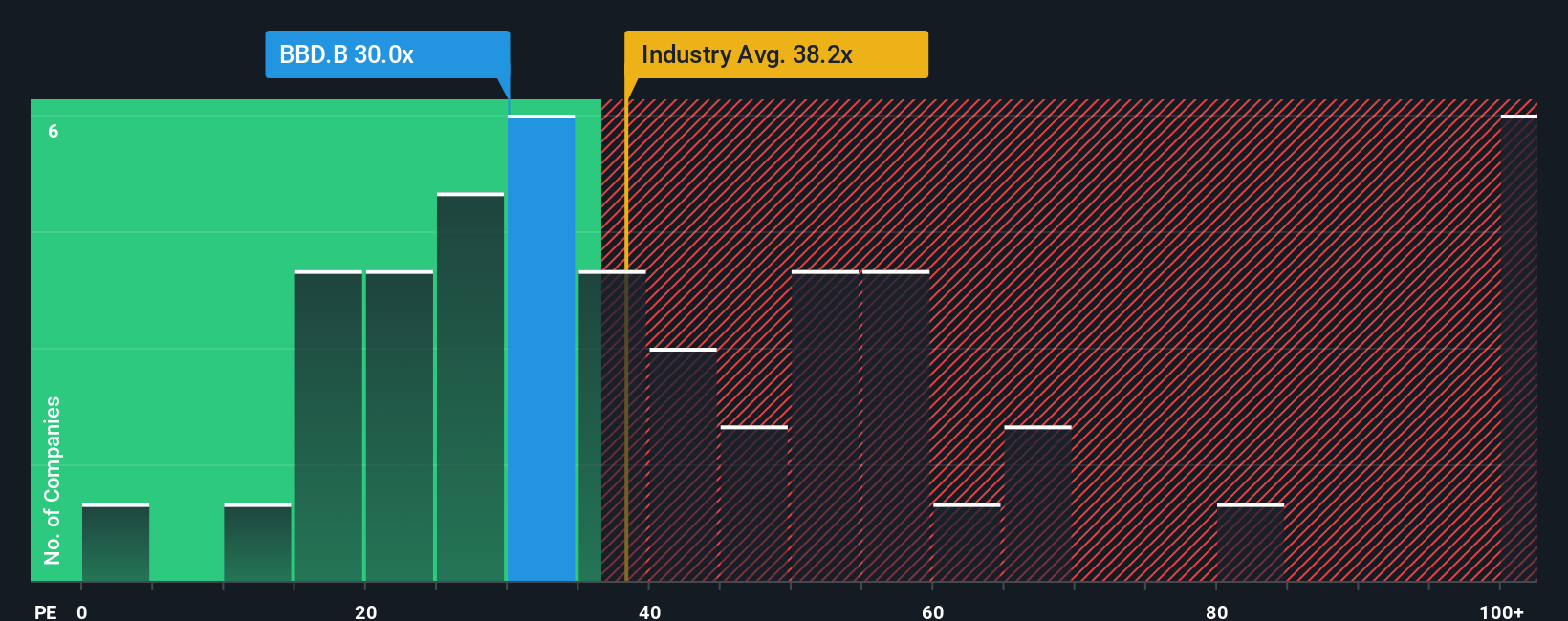

Another View: The Multiples Perspective

Looking at Bombardier through the lens of its price-to-earnings ratio, the stock trades at 34x, which is a notch above the peer average of 29.9x but sits comfortably below the industry average of 37.1x. Interestingly, the market’s fair ratio for Bombardier could be as high as 40.8x. This pricing suggests investors may be balancing growth potential against current risks. If sentiment shifts or results surprise, the stock’s valuation multiples could adjust to match the fair ratio or industry norms.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bombardier Narrative

If you see things differently or want to dig into the numbers on your own terms, you can build a custom narrative with fresh insights in just a few minutes. Do it your way

A great starting point for your Bombardier research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Stay ahead of the curve and maximize your portfolio's potential by acting on opportunities others may overlook. Don’t wait for the crowd to catch up; take advantage now.

- Target higher yields and consistent returns when you evaluate these 16 dividend stocks with yields > 3% with payouts above 3% for your income strategy.

- Jump on emerging trends and uncover innovation leaders by reviewing these 24 AI penny stocks that are driving the rapid evolution of technology and automation.

- Catch tomorrow’s potential winners early by analyzing these 3572 penny stocks with strong financials that combine strong fundamentals with explosive upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bombardier might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BBD.B

Bombardier

Engages in the design, manufacture, and sale of business aircraft and aircraft structural components worldwide.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives