ATS (TSX:ATS) Approaches Profitability With 19.8% Forecasted Annual Earnings Growth Heading Into Results

Reviewed by Simply Wall St

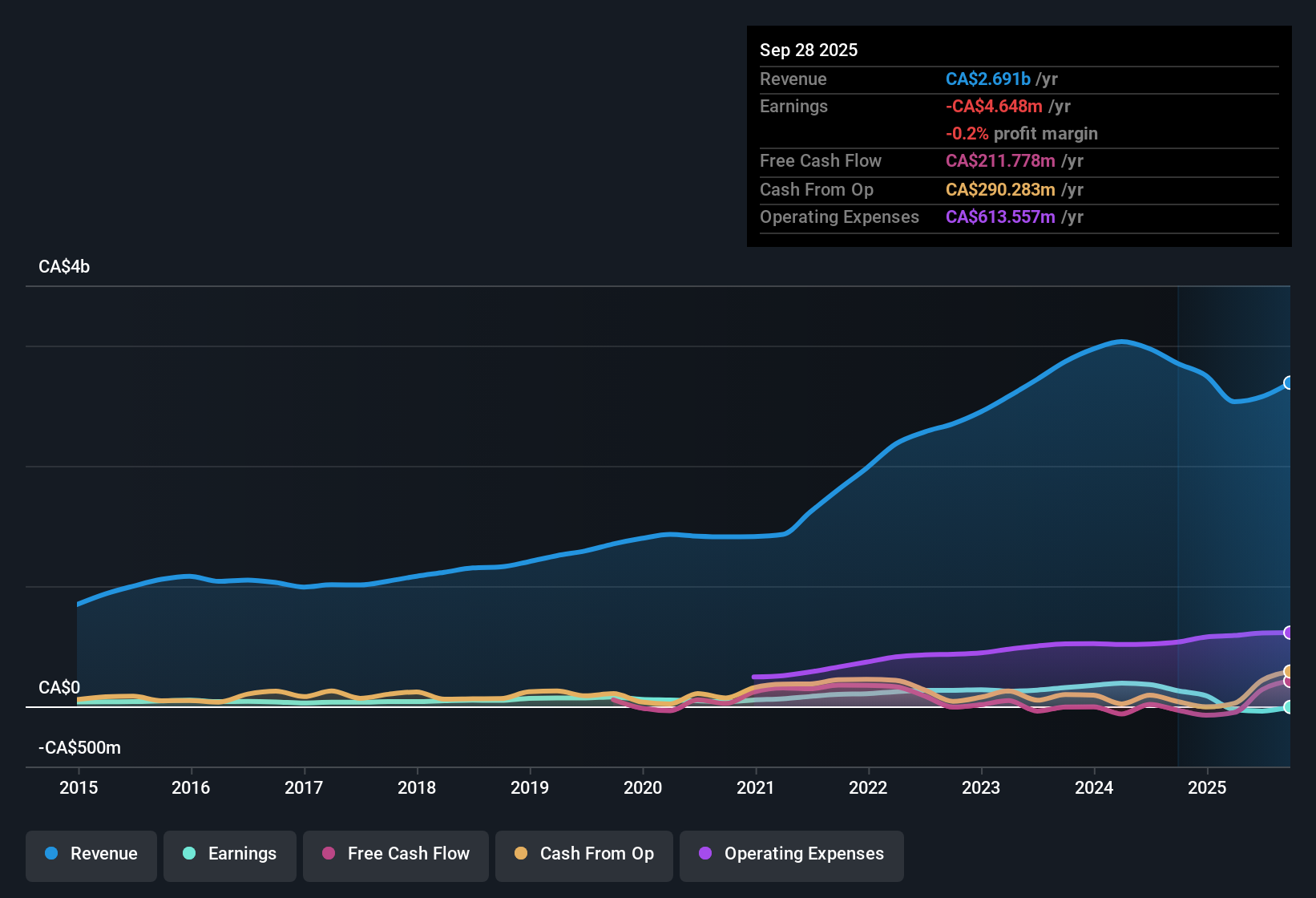

ATS (TSX:ATS) remains unprofitable, but has managed to shrink its losses by an average of 0.9% per year over the past five years. Looking forward, earnings are forecast to jump 19.79% annually, and the company is expected to cross into profitability within three years, while revenue is set to grow at 5.3% per year, just ahead of the broader Canadian market. This growth backdrop puts investor focus squarely on ATS’s trajectory toward profitability and how the current valuation matches up with those expectations.

See our full analysis for ATS.Now let’s see how these headline figures line up with the key narratives and market expectations. Some long-held views might be confirmed while others could be due for a re-think.

See what the community is saying about ATS

Margins Expected to Climb Sharply

- Profit margins are projected to rise from -1.5% currently to 16.7% over the next three years, reflecting expectations for significant improvements in cost control and operational efficiency.

- According to analysts' consensus view, this margin expansion is heavily backed by recurring revenue streams and enhanced cash flows as ATS increases its focus on automation, digital services, and cross-selling from strategic acquisitions.

- Analysts argue that recurring digital and lifecycle services could drive margin improvement, as these areas provide steady, higher-quality revenue.

- Consensus also notes that combining these new offerings with acquisition synergies and supply chain efficiencies is expected to support both gross and net margin growth going forward.

- Sharp gross margin increases would support much greater earnings leverage than the market is currently pricing in, according to the consensus narrative. 📊 Read the full ATS Consensus Narrative.

Order Bookdown and Volatility Risks

- The company's order bookings fell 15% year-over-year, pointing to some near-term uncertainty around demand pipelines and raising questions about future revenue visibility.

- Bears contend that this drop challenges bullish assumptions around stable top-line growth, as order book concentration and ongoing client delays in segments like transportation create the risk that revenue volatility could persist.

- What stands out is that even though backlogs grew previously, the latest period's decline exposes ATS to disruptions if the macro environment worsens or large projects are delayed.

- Critics highlight that a large chunk of the backlog is linked to specific Life Sciences projects, increasing the chance for lumpy revenue and margin swings if demand in that sector weakens.

Shares Trade Above DCF Fair Value

- ATS shares last traded at CA$41.69, which is about 56% higher than the DCF fair value estimate of CA$26.67, and also above at least one peer group average as measured by the 1.6x price-to-sales ratio (industry average: 1.8x, peers: 1.7x).

- Analysts' consensus narrative points out that while valuation multiples appear moderate versus industry, the premium to fair value means investors are betting on both a quick road to profitability and the realization of forecast margin gains.

- What’s worth noting is that the analyst average price target sits at CA$48.49, putting upside at about 16% from current levels, assuming all margin and revenue forecasts are met as expected.

- Despite justified optimism around future growth, consensus cautions that failure to hit these aggressive profitability and margin expansion targets could leave the share price vulnerable to a correction, especially given the fair value gap.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for ATS on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got a new angle on the figures? Share your insight and shape your own narrative in just a few minutes. Do it your way

A great starting point for your ATS research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While ATS is striving for higher margins and consistent growth, its premium valuation exposes investors to risk if profitability targets are not met.

If you’re looking for investments trading closer to fair value and less exposed to downside, check out these 836 undervalued stocks based on cash flows that could offer a better margin of safety right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ATS

Reasonable growth potential and slightly overvalued.

Market Insights

Community Narratives