- Canada

- /

- Construction

- /

- TSX:ATRL

We Think AtkinsRéalis Group Inc.'s (TSE:ATRL) CEO Compensation Looks Fair

Key Insights

- AtkinsRéalis Group to hold its Annual General Meeting on 15th of May

- Total pay for CEO Ian Edwards includes CA$1.44m salary

- Total compensation is similar to the industry average

- AtkinsRéalis Group's total shareholder return over the past three years was 208% while its EPS grew by 42% over the past three years

The performance at AtkinsRéalis Group Inc. (TSE:ATRL) has been quite strong recently and CEO Ian Edwards has played a role in it. The pleasing results would be something shareholders would keep in mind at the upcoming AGM on 15th of May. The focus will probably be on the future company strategy as shareholders cast their votes on resolutions such as executive remuneration and other matters. In light of the great performance, we discuss the case why we think CEO compensation is not excessive.

See our latest analysis for AtkinsRéalis Group

How Does Total Compensation For Ian Edwards Compare With Other Companies In The Industry?

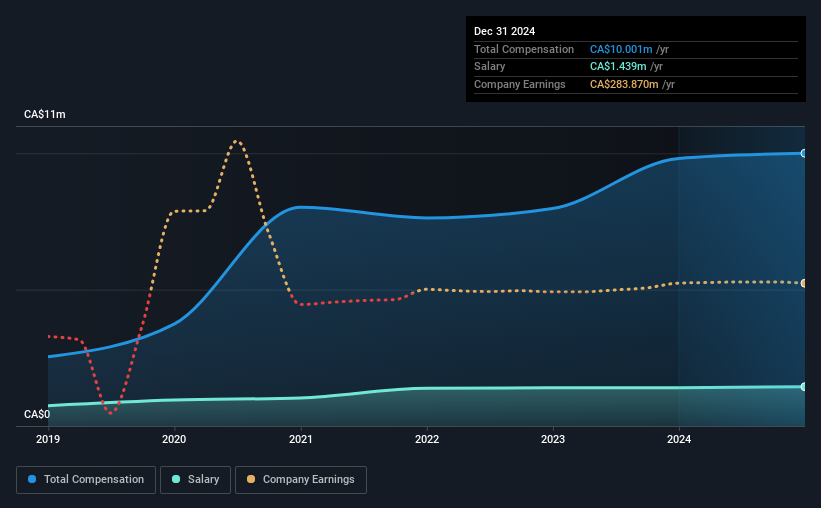

According to our data, AtkinsRéalis Group Inc. has a market capitalization of CA$13b, and paid its CEO total annual compensation worth CA$10m over the year to December 2024. This means that the compensation hasn't changed much from last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at CA$1.4m.

On comparing similar companies from the Canadian Construction industry with market caps ranging from CA$5.6b to CA$17b, we found that the median CEO total compensation was CA$9.4m. From this we gather that Ian Edwards is paid around the median for CEOs in the industry. Moreover, Ian Edwards also holds CA$14m worth of AtkinsRéalis Group stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | CA$1.4m | CA$1.4m | 14% |

| Other | CA$8.6m | CA$8.4m | 86% |

| Total Compensation | CA$10m | CA$9.8m | 100% |

Talking in terms of the industry, salary represented approximately 19% of total compensation out of all the companies we analyzed, while other remuneration made up 81% of the pie. AtkinsRéalis Group pays a modest slice of remuneration through salary, as compared to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

AtkinsRéalis Group Inc.'s Growth

AtkinsRéalis Group Inc. has seen its earnings per share (EPS) increase by 42% a year over the past three years. In the last year, its revenue is up 12%.

This demonstrates that the company has been improving recently and is good news for the shareholders. This sort of respectable year-on-year revenue growth is often seen at a healthy, growing business. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has AtkinsRéalis Group Inc. Been A Good Investment?

Boasting a total shareholder return of 208% over three years, AtkinsRéalis Group Inc. has done well by shareholders. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

The company's solid performance might have made most shareholders happy, possibly making CEO remuneration the least of the matters to be discussed in the AGM. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

If you think CEO compensation levels are interesting you will probably really like this free visualization of insider trading at AtkinsRéalis Group.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:ATRL

AtkinsRéalis Group

Provides professional services and project management, and capital investment services in United Kingdom, Canada, the United States, Saudi Arabia, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026