- Canada

- /

- Construction

- /

- TSX:ARE

Aecon (TSX:ARE) Returns to Profitability, Challenging Skepticism Over Earnings Quality and Valuation

Reviewed by Simply Wall St

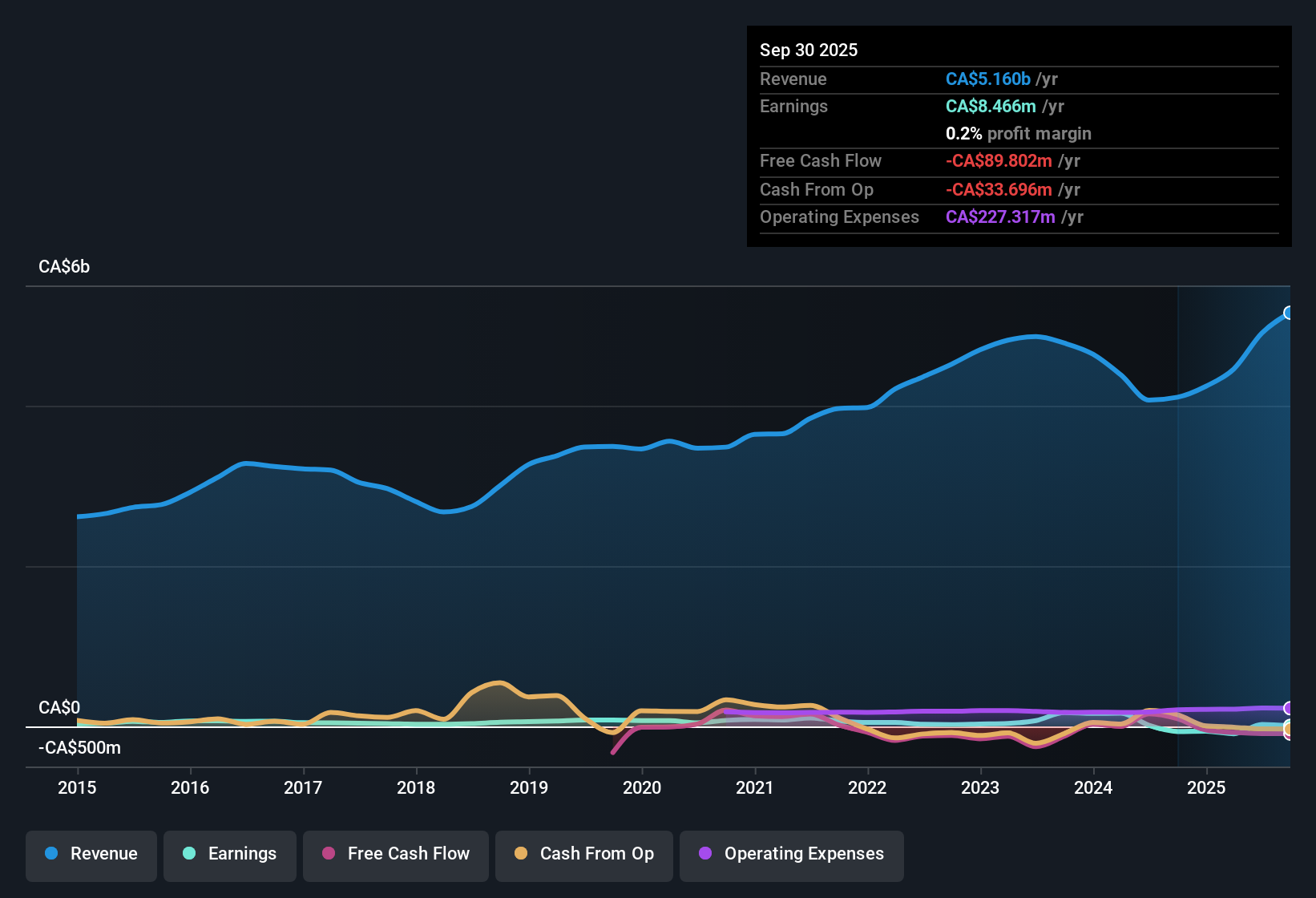

Aecon Group (TSX:ARE) is forecast to deliver standout annual earnings growth of 207.99% in the coming years, while revenue is expected to rise at 5.5% per year, outpacing the Canadian market’s 5% growth projection. The company has recently turned profitable, with net profit margins improving after posting positive results in the last year. This follows five years in which earnings fell by 26.4% per year. Investors are likely focusing on Aecon’s valuation, with shares trading at a low 0.4x Price-to-Sales Ratio and sitting well below an estimated fair value of CA$201.14 at just CA$32.18, compared with risks around dividend sustainability and the quality of one-off gains driving recent profits.

See our full analysis for Aecon Group.Next, we will see how these headline results stack up against the most widely held narratives for Aecon, highlighting where the earnings story supports the consensus and where it calls assumptions into question.

See what the community is saying about Aecon Group

Margins Slip Despite Revenue Visibility

- Construction EBITDA margin fell from 8% last year to 6.8%, and dipped again to 6.2% in the most recent quarter, even as the backlog remains at multi-year highs and revenue is projected to grow 5.5% annually.

- The analysts' consensus view is that shifting toward collaborative contracts, which now make up 76% of Aecon's backlog, has stabilized margins and reduced risk of costly write-downs. This approach trades away some potential margin upside for greater earnings reliability.

- While recurring revenue and utilities/concessions segments improve earnings quality, consensus analysts note that lower gross profitability in some areas and a strategic willingness to sacrifice margin for risk reduction may cap long-term margin expansion.

- Bears highlight ongoing net margin pressure in the context of management’s own acknowledgment that current contract structures may limit upside, creating tension between growth optimism and earnings leverage.

- Compared to prior years of declining earnings, the improved margin stability is welcome. However, the downward trend in margins could become a sticking point for investors focused on robust bottom-line growth.

- See what other investors are saying about the profit story for Aecon Group in the full consensus narrative. 📊 Read the full Aecon Group Consensus Narrative.

Reliance on Public Spending and Labour Tightness

- Aecon’s project pipeline depends heavily on public sector, utilities, and large infrastructure, making revenues and project conversion vulnerable to shifts in government funding, fiscal priorities, and regulatory changes in Canada and the U.S.

- Analysts' consensus view notes that while enhanced balance sheet strength and recurring revenue help dampen earnings volatility, sustained growth and margin improvement could be tested by:

- Persistent skilled labour shortages and higher workforce management costs, which management flags as an acute challenge for project execution as demand ramps up.

- High exposure to public sector projects, potentially leading to delays or revenue risk if fiscal austerity, policy change, or regulatory headwinds accelerate.

Shares Trade at 0.4x Sales, DCF Suggests Deep Discount

- Aecon’s Price-to-Sales Ratio of just 0.4x sits well below North American construction peer averages (1.4x to 1.8x), and the current CA$32.18 share price is materially below the DCF fair value of CA$201.14.

- According to analysts' consensus view, this steep valuation gap reflects the market’s caution, with the 2028 price target (CA$27.36) requiring investors to believe in both normalized margin expansion to 3.2% and a sustainable step-up in annual earnings to CA$184.9 million, given analysts’ use of a discount rate of 8.45%.

- Consensus analysts note that while valuation screens cheap against peers and implied fair value, actual profit delivery and risk normalization are critical for any near-term rerating.

- The deep discount exists alongside risks such as exposure to one-off gains and uncertainty around dividend sustainability, so upside may only be realized if quality of earnings sharpens and margin pressure lessens.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Aecon Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the figures? Take just a few minutes to build your own interpretation and add your voice to the story. Do it your way.

A great starting point for your Aecon Group research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Aecon’s slim margins and ongoing net profit pressure highlight the risk that earnings may not scale even as revenues rise in the coming years.

If you’d rather focus on companies showing steadier profit progression and consistent results throughout the cycle, our stable growth stocks screener (2112 results) is your quickest path to identifying those opportunities now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ARE

Aecon Group

Aecon Group Inc., together with its subsidiaries, provide construction and infrastructure development services to private and public sector clients in Canada, the United States, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives