- Canada

- /

- Construction

- /

- TSX:BDGI

Exploring 3 Undervalued Small Caps In Canada With Insider Activity

Reviewed by Simply Wall St

The Canadian market has experienced a robust 23% increase over the last 12 months, with earnings projected to grow by 15% annually. In this thriving environment, identifying stocks that combine favorable valuations with notable insider activity can offer intriguing opportunities for investors seeking potential growth.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| First National Financial | 10.4x | 3.3x | 49.98% | ★★★★★☆ |

| VersaBank | 11.7x | 4.7x | 49.91% | ★★★★★☆ |

| Trican Well Service | 7.3x | 0.9x | 18.26% | ★★★★★☆ |

| AutoCanada | NA | 0.1x | 40.70% | ★★★★★☆ |

| Nexus Industrial REIT | 3.7x | 3.6x | 18.08% | ★★★★☆☆ |

| Rogers Sugar | 15.7x | 0.6x | 47.26% | ★★★★☆☆ |

| Primaris Real Estate Investment Trust | 12.7x | 3.4x | 45.18% | ★★★★☆☆ |

| Sagicor Financial | 1.3x | 0.3x | -43.36% | ★★★★☆☆ |

| Calfrac Well Services | 2.5x | 0.2x | 17.65% | ★★★★☆☆ |

| Vermilion Energy | NA | 1.2x | -10.37% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

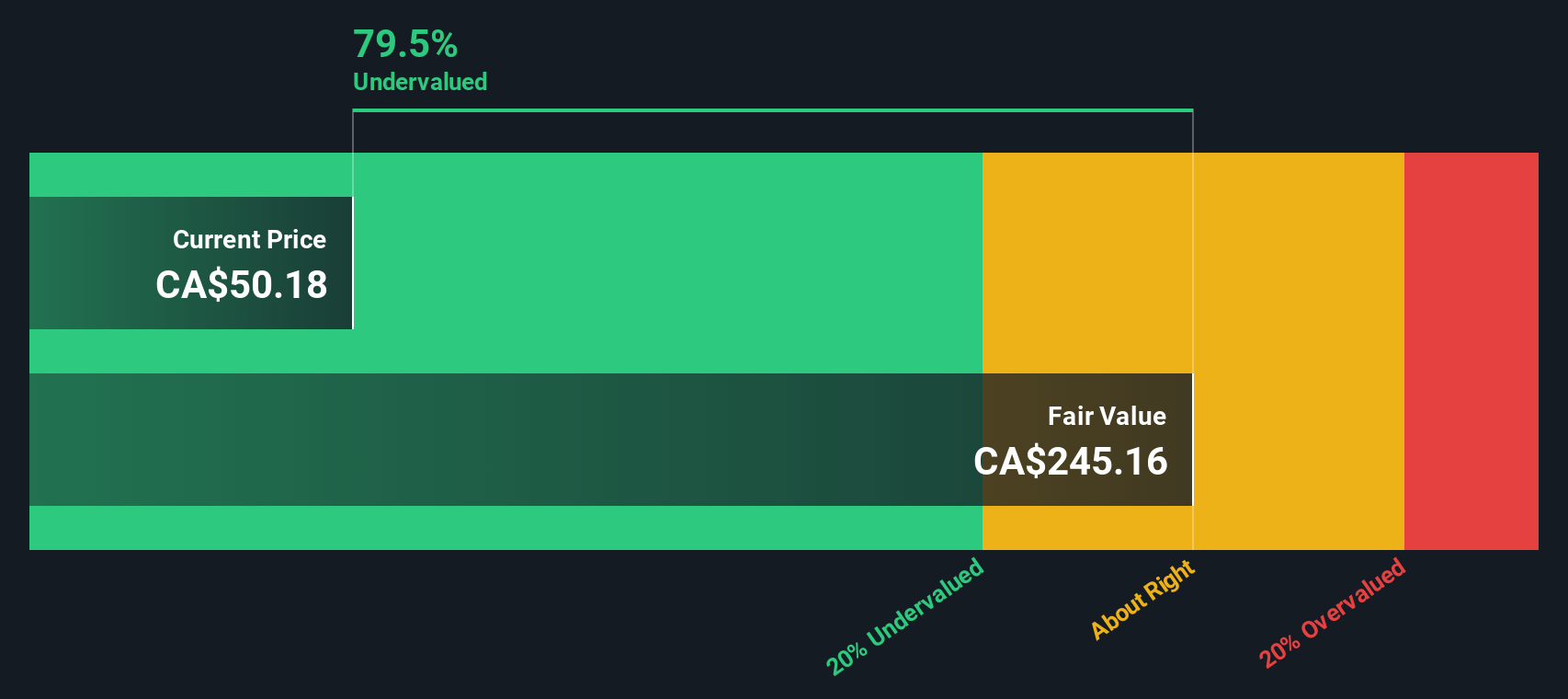

Badger Infrastructure Solutions (TSX:BDGI)

Simply Wall St Value Rating: ★★★★☆☆

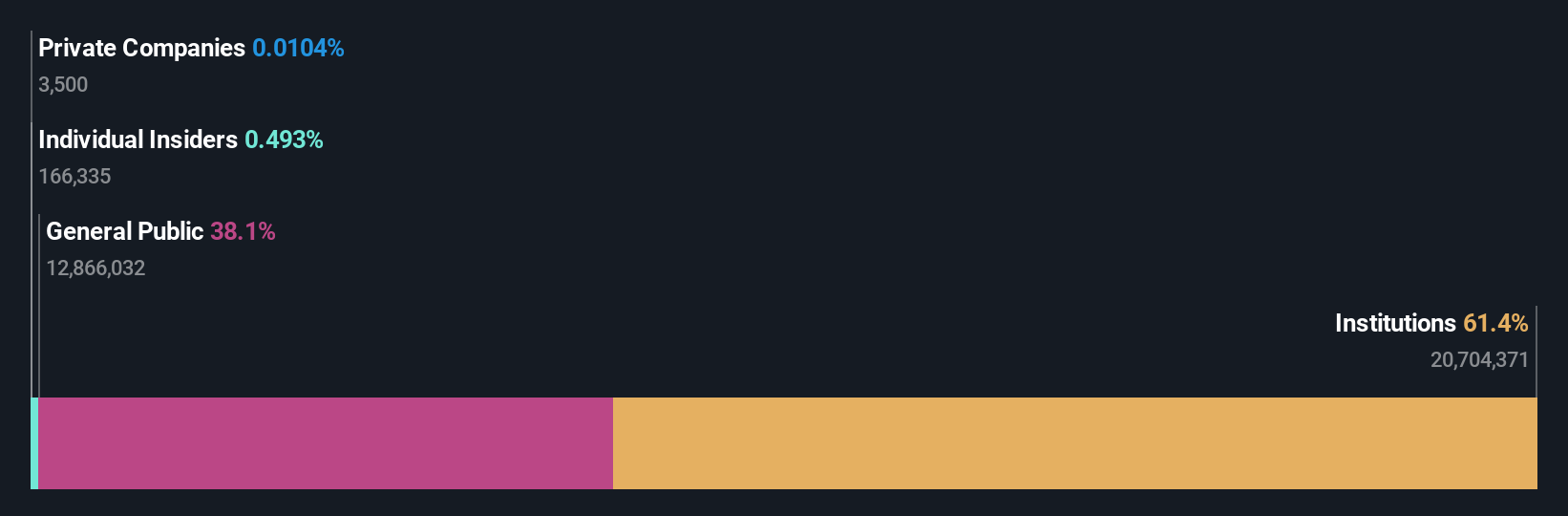

Overview: Badger Infrastructure Solutions specializes in non-destructive excavating services, with a market cap of approximately $1.31 billion CAD.

Operations: The company's primary revenue stream is from its non-destructive excavating services, generating $717.10 million. The cost of goods sold (COGS) for this period amounted to $514.27 million, resulting in a gross profit of $202.83 million and a gross profit margin of 28.29%. Operating expenses totaled $140.22 million, with depreciation and amortization (D&A) accounting for $74.88 million of this amount, while net income reached $41.68 million with a net income margin of 5.81%.

PE: 24.2x

Badger Infrastructure Solutions, a Canadian small-cap, recently reported increased sales of US$186.84 million for Q2 2024, up from US$171.89 million the previous year. Net income rose to US$11.91 million from US$11.01 million, reflecting growth potential despite its high debt levels and reliance on external borrowing for funding. Insider confidence is evident with recent share purchases by insiders in the past year, indicating belief in future prospects amidst discussions on a potential share repurchase program announced in August 2024.

Calian Group (TSX:CGY)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Calian Group operates across four main segments: IT and Cyber Solutions, Health, Learning, and Advanced Technologies, with a market cap of CA$0.83 billion.

Operations: The company generates revenue from four main segments: ITCS, Health, Learning, and Advanced Technologies. Over recent periods, the gross profit margin has shown an upward trend, reaching 33.17% as of June 2024. Operating expenses are a significant part of the cost structure, with general and administrative expenses being notably high at CA$98.70 million in June 2024.

PE: 35.6x

Calian Group, a small Canadian company, is capturing attention with its strategic partnerships and insider confidence. Recent collaborations with Walmart Canada and Microsoft highlight its innovative edge in digital health and cybersecurity. Despite a dip in net income to C$1.3 million for Q3 2024 from C$4.67 million the previous year, Calian's revenue guidance suggests growth potential between C$750 million to C$810 million for the fiscal year ending September 2024. The company's share repurchase program further underscores management's belief in its value proposition amidst evolving market opportunities.

- Navigate through the intricacies of Calian Group with our comprehensive valuation report here.

Explore historical data to track Calian Group's performance over time in our Past section.

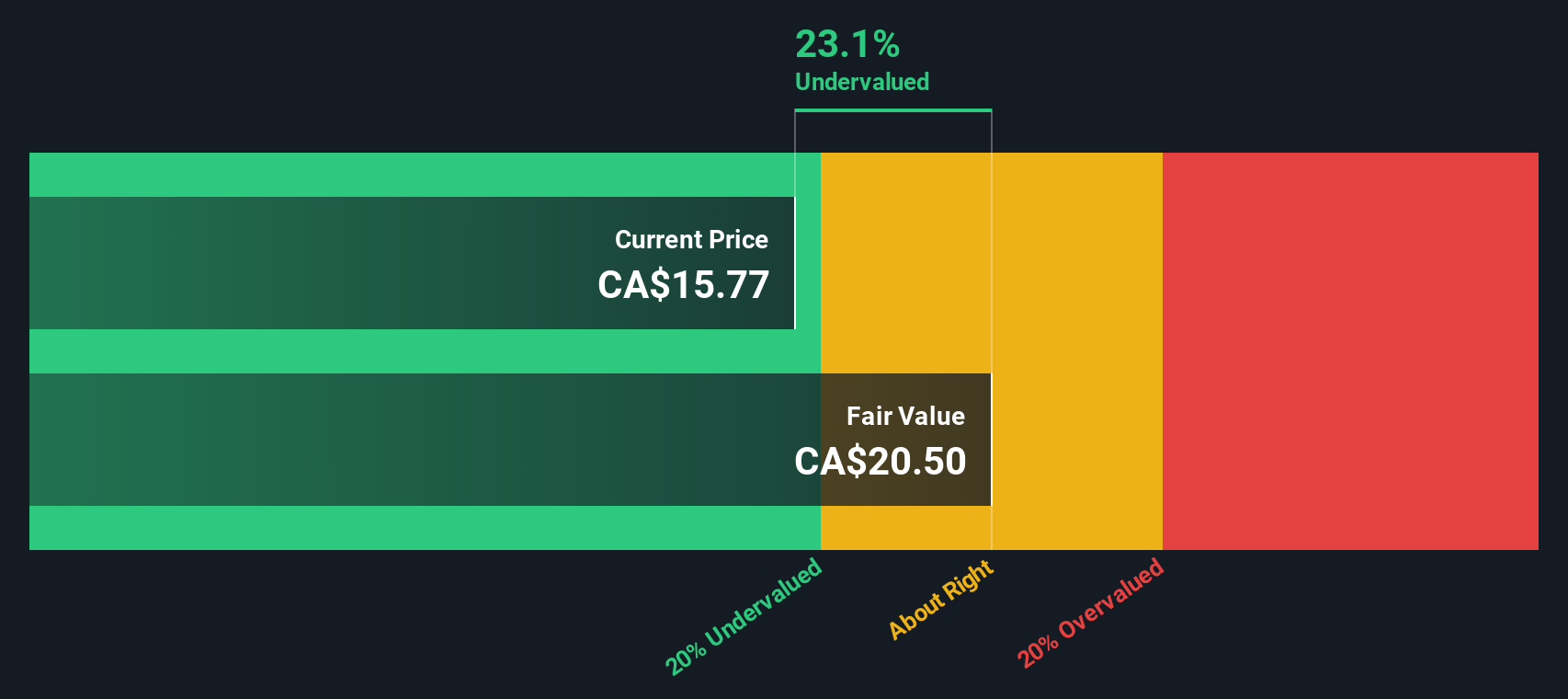

VersaBank (TSX:VBNK)

Simply Wall St Value Rating: ★★★★★☆

Overview: VersaBank operates as a digital banking institution with additional services in cybersecurity and financial technology development, and it has a market capitalization of CA$0.38 billion.

Operations: VersaBank generates revenue primarily from its Digital Banking segment, contributing CA$105.16 million, and DRTC, which adds CA$10.75 million. The company consistently achieves a gross profit margin of 100%, indicating no cost of goods sold is reported in the financials provided. Operating expenses have shown an upward trend over time, reaching CA$50.18 million in the most recent period analyzed. The net income margin has seen fluctuations but recently reached 40.17%.

PE: 11.7x

VersaBank, a Canadian financial institution, is gaining attention for its potential as an undervalued investment. With earnings projected to grow 30.36% annually, the bank presents an intriguing opportunity in its sector. Recent insider confidence was demonstrated through share purchases earlier this year, signaling trust in the company's future prospects. For Q3 2024, VersaBank reported a slight increase in net interest income at C$24.94 million and stable earnings per share of C$0.36 compared to last year. The strategic expansion into the U.S., marked by key executive appointments at their new subsidiary VersaBank USA, could further enhance growth potential and market reach moving forward.

- Dive into the specifics of VersaBank here with our thorough valuation report.

Understand VersaBank's track record by examining our Past report.

Make It Happen

- Click here to access our complete index of 21 Undervalued TSX Small Caps With Insider Buying.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Badger Infrastructure Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BDGI

Badger Infrastructure Solutions

Provides non-destructive excavating and related services in Canada and the United States.

Very undervalued with high growth potential and pays a dividend.