A Look at Laurentian Bank (TSX:LB) Valuation After 35% Shareholder Return This Year

Reviewed by Simply Wall St

See our latest analysis for Laurentian Bank of Canada.

Laurentian Bank of Canada’s momentum has clearly been building, with a 1-day share price gain of 2.15% capping off a year where the total shareholder return reached an impressive 35%. Investors are rewarding the bank’s steady results and perceiving its growth outlook more optimistically.

If you’re interested in discovering other companies with strong momentum and trustworthy management, now is a perfect moment to explore fast growing stocks with high insider ownership

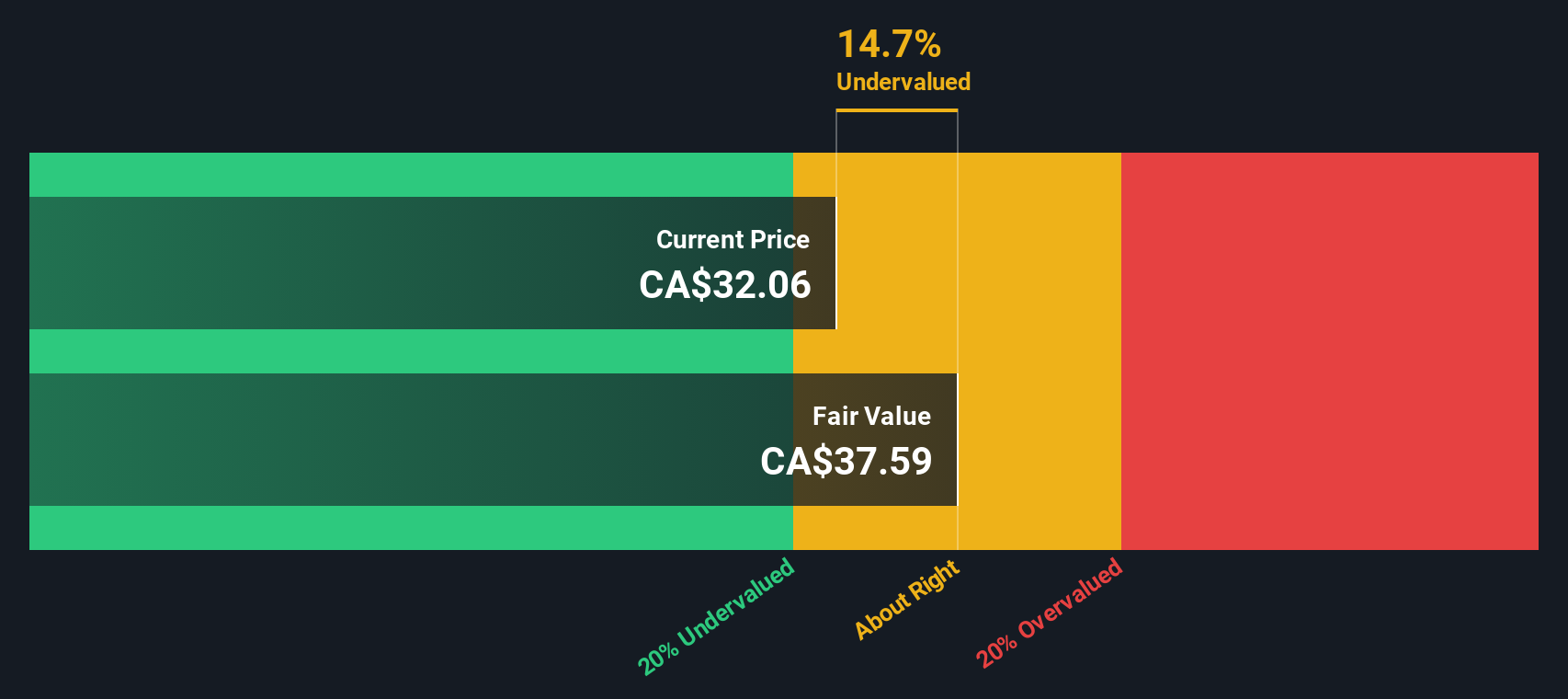

The real question for investors now is whether Laurentian Bank’s run has left the shares undervalued or if the recent rally means future growth is already priced in. Could this be another buying opportunity, or is the upside limited?

Most Popular Narrative: 11% Overvalued

According to the most widely followed narrative, Laurentian Bank’s fair value estimate sits below the latest closing price, setting the stage for a debate on whether recent gains have pushed shares beyond their fundamentals.

The bank's ongoing technology modernization, particularly migrating from on-premise to cloud systems and simplifying its tech stack, should drive significant operational efficiency and cost reductions over time. This could support higher net margins even if revenue growth remains muted in the near term.

Want to see the financial leap this narrative envisions? Analysts are betting on a shift in profit margins and future earnings that may surprise even seasoned investors. Curious how bold quantitative moves aim to justify the current premium? Don’t miss the full breakdown and the numbers driving this valuation debate.

Result: Fair Value of $29.89 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistently high digital transformation expenses, along with recent declines in revenue and net income, could undermine the optimistic scenario investors are hoping for.

Find out about the key risks to this Laurentian Bank of Canada narrative.

Another Perspective: Our DCF Model Signals Value

Taking a different approach, the SWS DCF model values Laurentian Bank more optimistically and estimates a fair value of CA$40.46 per share. This places the current price well below this mark, which could indicate a hidden value play the market may be overlooking. Is the upside as real as it seems?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Laurentian Bank of Canada for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 832 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Laurentian Bank of Canada Narrative

If you’re eager to see the story from a different angle or want to reach your own conclusion, dive into the data at your own pace and shape a unique perspective in just a few minutes, then Do it your way

A great starting point for your Laurentian Bank of Canada research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Set yourself up for investing success by checking out hand-picked opportunities with unique potential. Act now so you won’t miss tomorrow’s leaders.

- Unlock steady income possibilities by reviewing these 22 dividend stocks with yields > 3%, which delivers yields above 3% and has proven financial resilience in any market.

- Ride the next big wave in technology by checking out these 26 AI penny stocks at the frontier of artificial intelligence innovation and disruptive growth.

- Seize the chance to gain exposure to promising early-stage companies with these 3584 penny stocks with strong financials, offering strong fundamentals and future upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:LB

Laurentian Bank of Canada

Provides various financial services to personal, business, and institutional customers in Canada and the United States.

Adequate balance sheet and fair value.

Market Insights

Community Narratives