Should You Reassess Scotiabank's Value After Recent Leadership and Strategy Shifts?

Reviewed by Bailey Pemberton

- Wondering if Bank of Nova Scotia's stock still offers good value? You're not alone. Let's dig into whether now could be an opportunity or a moment to pause.

- The price has climbed 1.3% in the past week and is up a solid 6.1% over the last month, while the year-to-date return stands at an impressive 22.7%.

- Recent news headlines have spotlighted Bank of Nova Scotia's strategic shifts in international markets and ongoing leadership changes, giving investors even more to consider. These moves have been seen as catalysts for the strong stock momentum and provide new context for the recent uptick.

- According to our valuation checks, Bank of Nova Scotia scores 2 out of 6, so there are compelling debates about how to judge its true worth. We’ll explore the common valuation approaches next, but stick around if you want to find out a smarter way to view value at the end of this article.

Bank of Nova Scotia scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Bank of Nova Scotia Excess Returns Analysis

The Excess Returns model focuses on how much value a company creates for shareholders above its cost of capital. In other words, it measures whether Bank of Nova Scotia is generating strong returns from its investments compared to what it costs to fund those investments.

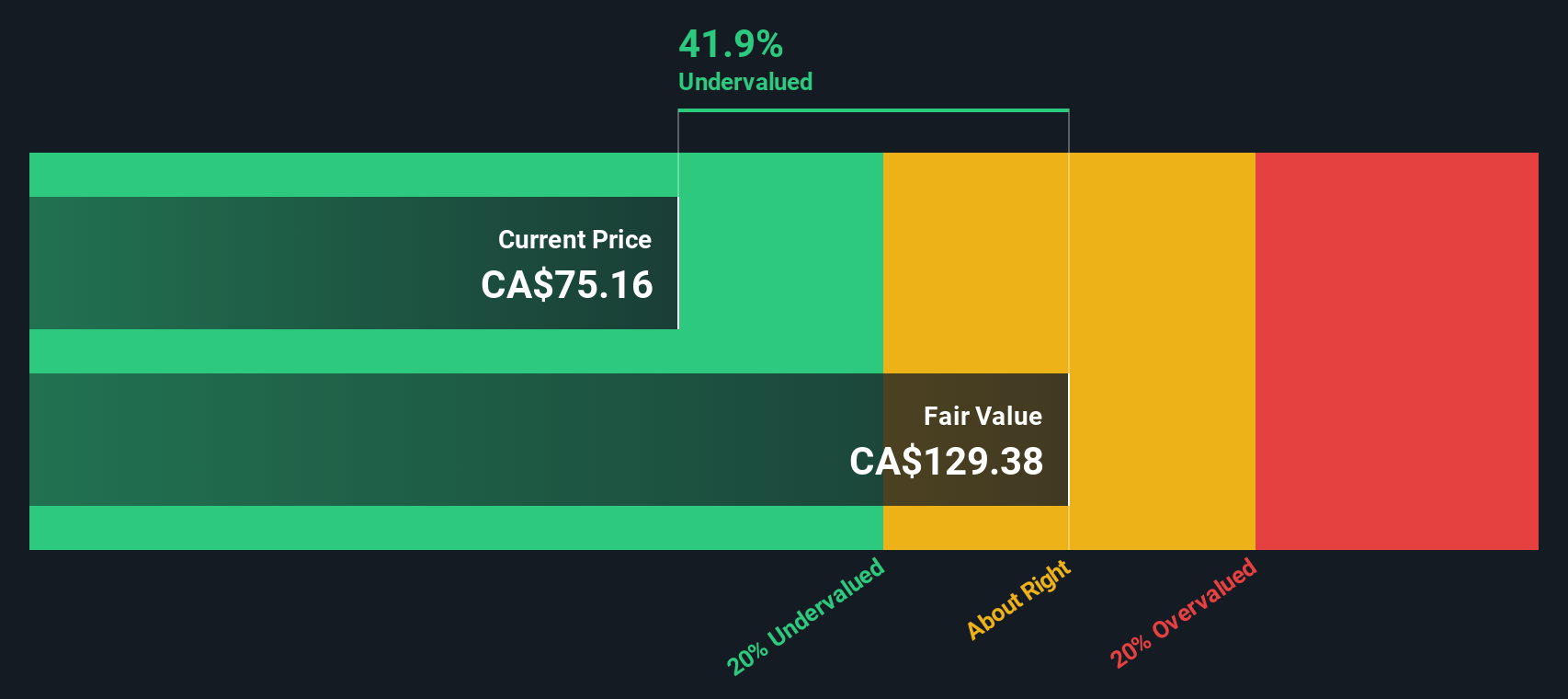

For Bank of Nova Scotia, the model uses several key inputs. The book value stands at CA$67.45 per share, while the stable earnings per share (EPS) are CA$8.66, based on weighted future Return on Equity (ROE) estimates from 8 analysts. The calculated cost of equity is CA$5.43 per share, giving an excess return of CA$3.22 per share. The average ROE over the projection period is 13.11%. The stable book value is estimated at CA$66.03 per share, sourced from 7 analysts.

Based on these figures, the Excess Returns model estimates the intrinsic value of Bank of Nova Scotia stock at CA$124.85 per share. This is around 24.1% higher than the current trading price. According to this method, the stock appears significantly undervalued.

Result: UNDERVALUED

Our Excess Returns analysis suggests Bank of Nova Scotia is undervalued by 24.1%. Track this in your watchlist or portfolio, or discover 906 more undervalued stocks based on cash flows.

Approach 2: Bank of Nova Scotia Price vs Earnings

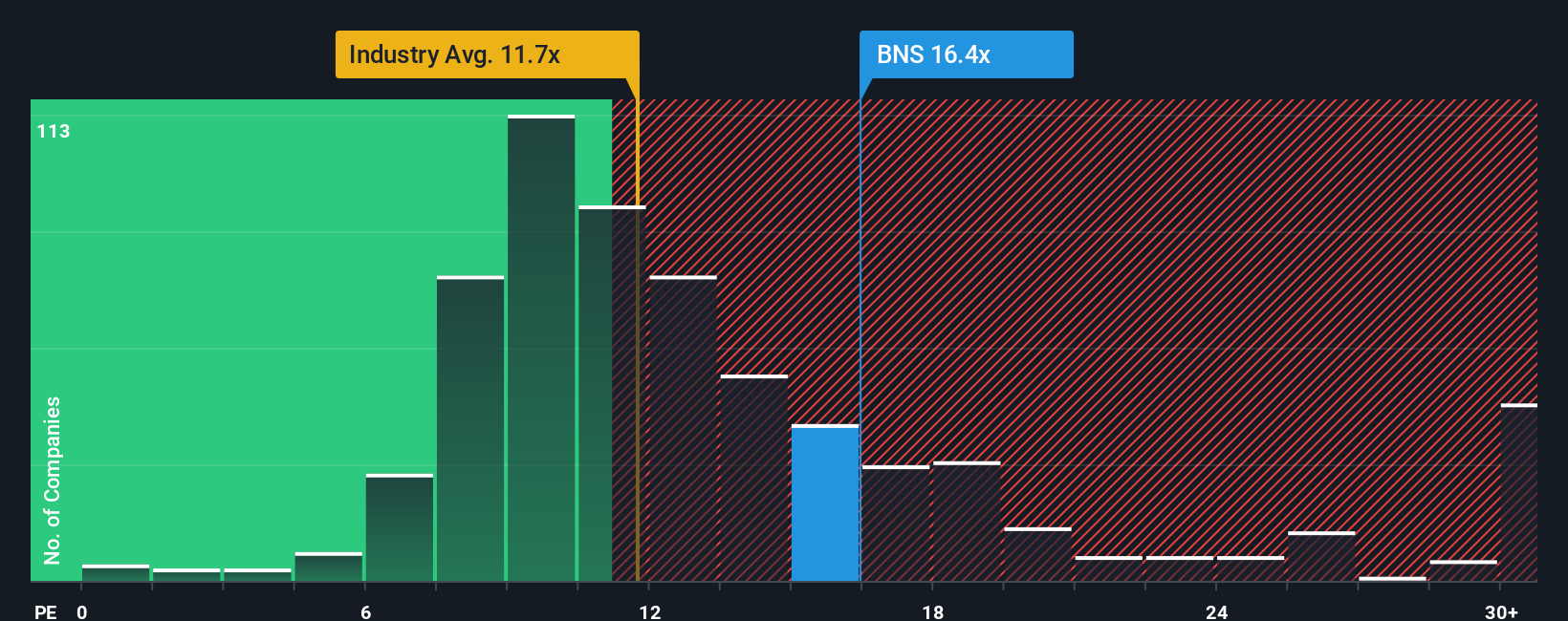

The Price-to-Earnings (PE) ratio is the preferred valuation metric for Bank of Nova Scotia because it directly relates the company’s stock price to its earnings, making it especially useful for profitable, mature firms like major banks. Investors favor this multiple when evaluating well-established companies that consistently generate positive earnings, as it provides a straightforward comparison to peers and sector norms.

While a company’s PE ratio tells us how much the market is willing to pay for each dollar of earnings, its interpretation should always consider growth prospects and risk exposure. Companies expected to grow earnings rapidly or with lower risk typically justify higher PE ratios. More mature or riskier firms might deserve lower multiples.

Currently, Bank of Nova Scotia trades at a PE of 17.6x, above both the Canadian banking industry average of 10.1x and its peer average of 13.9x. However, Simply Wall St’s proprietary Fair Ratio for Bank of Nova Scotia is 14.8x. The Fair Ratio is designed to reflect a more nuanced “fair value” by blending the company’s growth outlook, profit margins, market cap, and broader risk profile. This approach provides a more tailored benchmark than peer or sector comparisons, ensuring a more relevant analysis when the business has different prospects or risk characteristics versus the rest of the industry.

With Bank of Nova Scotia’s current PE ratio moderately higher than its Fair Ratio, the stock appears somewhat overvalued on this measure.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1421 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bank of Nova Scotia Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your own interpretation of a company’s story. All the facts, future forecasts, and financials fit together to shape your view of what the business is worth. Narratives allow you to connect the dots between what’s happening at Bank of Nova Scotia, your assumptions about its future revenue, earnings, and profit margins, and the fair value you believe is appropriate.

On Simply Wall St’s Community page, Narratives are an accessible and easy-to-use tool trusted by millions of investors. They help you link your unique perspective directly to a price target, making decisions about when to buy or sell feel less like guesswork and more like a simple comparison. If the fair value from your Narrative is above the current share price, it might be a buy. If it’s below, it might be time to wait or sell.

What makes Narratives powerful is that they update automatically as fresh news, earnings releases, or regulatory changes come in, so your investment thesis evolves with the facts. For example, some investors see Bank of Nova Scotia’s international growth and digital strategy justifying a price as high as CA$94.00. Others, focused on risks like housing exposure or regulatory headwinds, set fair value closer to CA$78.00. This shows how every Narrative tells a slightly different story.

Do you think there's more to the story for Bank of Nova Scotia? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Nova Scotia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BNS

Bank of Nova Scotia

Provides various banking products and services in Canada, the United States, Mexico, Peru, Chile, Colombia, the Caribbean and Central America, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives