It Might Not Be A Great Idea To Buy The Bank of Nova Scotia (TSE:BNS) For Its Next Dividend

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that The Bank of Nova Scotia (TSE:BNS) is about to go ex-dividend in just four days. Ex-dividend means that investors that purchase the stock on or after the 4th of January will not receive this dividend, which will be paid on the 27th of January.

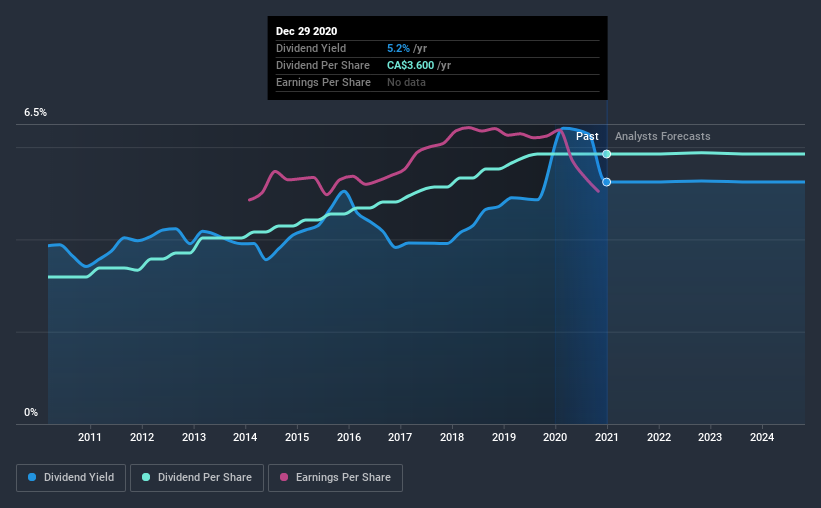

Bank of Nova Scotia's next dividend payment will be CA$0.90 per share, on the back of last year when the company paid a total of CA$3.60 to shareholders. Based on the last year's worth of payments, Bank of Nova Scotia has a trailing yield of 5.2% on the current stock price of CA$68.68. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. We need to see whether the dividend is covered by earnings and if it's growing.

Check out our latest analysis for Bank of Nova Scotia

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Bank of Nova Scotia is paying out an acceptable 66% of its profit, a common payout level among most companies.

Companies that pay out less in dividends than they earn in profits generally have more sustainable dividends. The lower the payout ratio, the more wiggle room the business has before it could be forced to cut the dividend.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies that aren't growing their earnings can still be valuable, but it is even more important to assess the sustainability of the dividend if it looks like the company will struggle to grow. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. With that in mind, we're not enthused to see that Bank of Nova Scotia's earnings per share have remained effectively flat over the past five years. We'd take that over an earnings decline any day, but in the long run, the best dividend stocks all grow their earnings per share.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. In the past 10 years, Bank of Nova Scotia has increased its dividend at approximately 6.3% a year on average.

Final Takeaway

Is Bank of Nova Scotia worth buying for its dividend? Earnings per share have not grown at all, and the company pays out a bit over half its profits to shareholders. These characteristics don't generally lead to outstanding dividend performance, and investors may not be happy with the results of owning this stock for its dividend.

Curious what other investors think of Bank of Nova Scotia? See what analysts are forecasting, with this visualisation of its historical and future estimated earnings and cash flow.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

If you decide to trade Bank of Nova Scotia, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Bank of Nova Scotia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:BNS

Bank of Nova Scotia

Provides various banking products and services in Canada, the United States, Mexico, Peru, Chile, Colombia, the Caribbean and Central America, and internationally.

Flawless balance sheet established dividend payer.