- Canada

- /

- Auto Components

- /

- TSX:LNR

Shareholders Will Probably Not Have Any Issues With Linamar Corporation's (TSE:LNR) CEO Compensation

Despite Linamar Corporation's (TSE:LNR) share price growing positively in the past few years, the per-share earnings growth has not grown to investors' expectations, suggesting that there could be other factors at play driving the share price. The upcoming AGM on 27 May 2021 may be an opportunity for shareholders to bring up any concerns they may have for the board’s attention. They will be able to influence managerial decisions through the exercise of their voting power on resolutions, such as CEO remuneration and other matters, which may influence future company prospects. From the data that we gathered, we think that shareholders should hold off on a raise on CEO compensation until performance starts to show some improvement.

See our latest analysis for Linamar

How Does Total Compensation For Linda Hasenfratz Compare With Other Companies In The Industry?

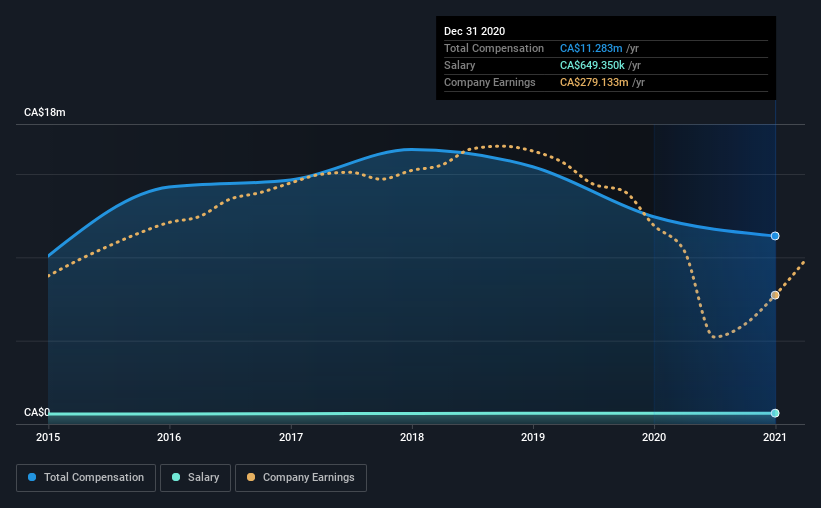

At the time of writing, our data shows that Linamar Corporation has a market capitalization of CA$4.8b, and reported total annual CEO compensation of CA$11m for the year to December 2020. We note that's a decrease of 9.3% compared to last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at CA$649k.

On examining similar-sized companies in the industry with market capitalizations between CA$2.4b and CA$7.7b, we discovered that the median CEO total compensation of that group was CA$10.0m. From this we gather that Linda Hasenfratz is paid around the median for CEOs in the industry. Moreover, Linda Hasenfratz also holds CA$341m worth of Linamar stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CA$649k | CA$649k | 6% |

| Other | CA$11m | CA$12m | 94% |

| Total Compensation | CA$11m | CA$12m | 100% |

Talking in terms of the industry, salary represented approximately 18% of total compensation out of all the companies we analyzed, while other remuneration made up 82% of the pie. Linamar sets aside a smaller share of compensation for salary, in comparison to the overall industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Linamar Corporation's Growth

Over the last three years, Linamar Corporation has shrunk its earnings per share by 14% per year. It saw its revenue drop 14% over the last year.

Few shareholders would be pleased to read that EPS have declined. This is compounded by the fact revenue is actually down on last year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Linamar Corporation Been A Good Investment?

Linamar Corporation has served shareholders reasonably well, with a total return of 13% over three years. But they would probably prefer not to see CEO compensation far in excess of the median.

To Conclude...

While it's true that shareholders have owned decent returns, it's hard to overlook the lack of earnings growth and this makes us question whether these returns will continue. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We did our research and identified 2 warning signs (and 1 which can't be ignored) in Linamar we think you should know about.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:LNR

Linamar

Manufactures and sells engineered products in Canada, Europe, the Asia Pacific, and rest of North America.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives