- Brazil

- /

- Water Utilities

- /

- BOVESPA:SBSP3

Companhia de Saneamento Básico do Estado de São Paulo - SABESP (BVMF:SBSP3) Takes On Some Risk With Its Use Of Debt

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Companhia de Saneamento Básico do Estado de São Paulo - SABESP (BVMF:SBSP3) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Companhia de Saneamento Básico do Estado de São Paulo - SABESP

What Is Companhia de Saneamento Básico do Estado de São Paulo - SABESP's Debt?

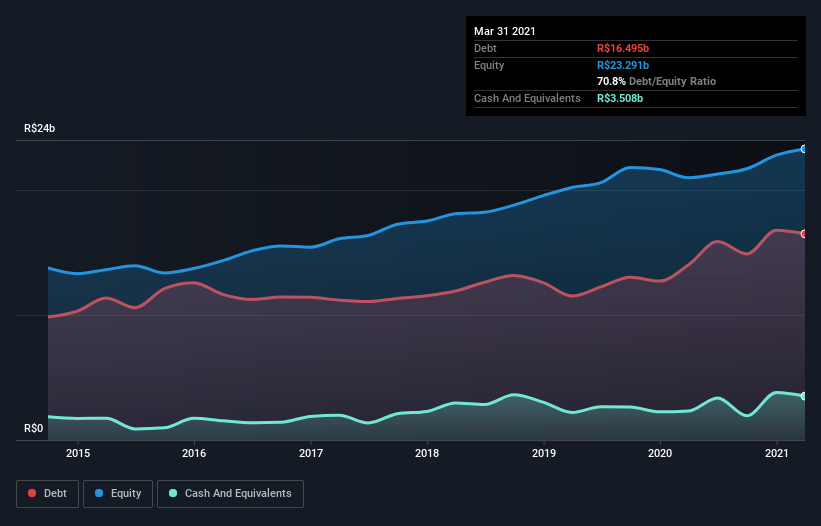

As you can see below, at the end of March 2021, Companhia de Saneamento Básico do Estado de São Paulo - SABESP had R$16.5b of debt, up from R$14.0b a year ago. Click the image for more detail. However, because it has a cash reserve of R$3.51b, its net debt is less, at about R$13.0b.

How Healthy Is Companhia de Saneamento Básico do Estado de São Paulo - SABESP's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Companhia de Saneamento Básico do Estado de São Paulo - SABESP had liabilities of R$6.20b due within 12 months and liabilities of R$21.4b due beyond that. Offsetting these obligations, it had cash of R$3.51b as well as receivables valued at R$2.41b due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by R$21.7b.

This is a mountain of leverage relative to its market capitalization of R$24.4b. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Companhia de Saneamento Básico do Estado de São Paulo - SABESP's net debt of 2.0 times EBITDA suggests graceful use of debt. And the alluring interest cover (EBIT of 8.7 times interest expense) certainly does not do anything to dispel this impression. Unfortunately, Companhia de Saneamento Básico do Estado de São Paulo - SABESP's EBIT flopped 18% over the last four quarters. If earnings continue to decline at that rate then handling the debt will be more difficult than taking three children under 5 to a fancy pants restaurant. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Companhia de Saneamento Básico do Estado de São Paulo - SABESP's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. In the last three years, Companhia de Saneamento Básico do Estado de São Paulo - SABESP's free cash flow amounted to 27% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

Mulling over Companhia de Saneamento Básico do Estado de São Paulo - SABESP's attempt at (not) growing its EBIT, we're certainly not enthusiastic. But on the bright side, its interest cover is a good sign, and makes us more optimistic. We should also note that Water Utilities industry companies like Companhia de Saneamento Básico do Estado de São Paulo - SABESP commonly do use debt without problems. Looking at the bigger picture, it seems clear to us that Companhia de Saneamento Básico do Estado de São Paulo - SABESP's use of debt is creating risks for the company. If all goes well, that should boost returns, but on the flip side, the risk of permanent capital loss is elevated by the debt. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 2 warning signs with Companhia de Saneamento Básico do Estado de São Paulo - SABESP , and understanding them should be part of your investment process.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BOVESPA:SBSP3

Companhia de Saneamento Básico do Estado de São Paulo - SABESP

Provides basic and environmental sanitation services in the São Paulo State, Brazil.

Outstanding track record and fair value.