- Brazil

- /

- Water Utilities

- /

- BOVESPA:SBSP3

Companhia de Saneamento Básico do Estado de São Paulo - SABESP (BVMF:SBSP3) Analysts Just Slashed This Year's Revenue Estimates By 18%

The analysts covering Companhia de Saneamento Básico do Estado de São Paulo - SABESP (BVMF:SBSP3) delivered a dose of negativity to shareholders today, by making a substantial revision to their statutory forecasts for this year. Revenue estimates were cut sharply as analysts signalled a weaker outlook - perhaps a sign that investors should temper their expectations as well.

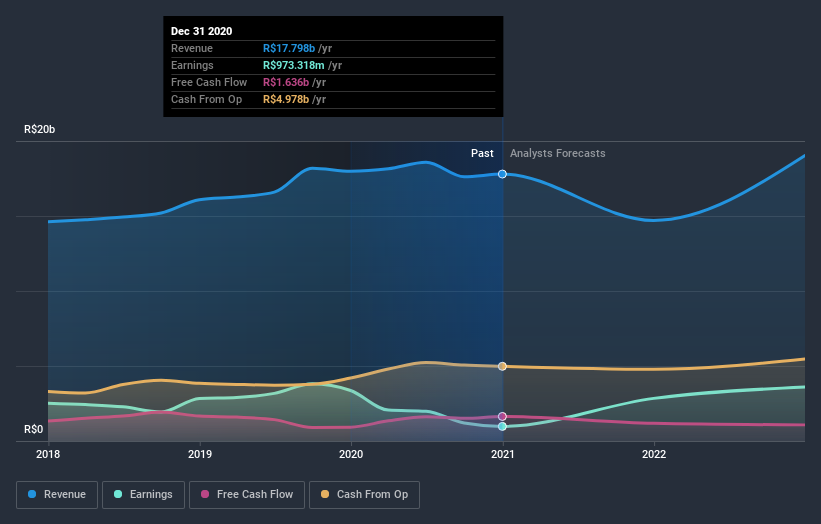

Following the latest downgrade, the ten analysts covering Companhia de Saneamento Básico do Estado de São Paulo - SABESP provided consensus estimates of R$15b revenue in 2021, which would reflect an uncomfortable 17% decline on its sales over the past 12 months. Prior to the latest estimates, the analysts were forecasting revenues of R$18b in 2021. The consensus view seems to have become more pessimistic on Companhia de Saneamento Básico do Estado de São Paulo - SABESP, noting the substantial drop in revenue estimates in this update.

See our latest analysis for Companhia de Saneamento Básico do Estado de São Paulo - SABESP

Of course, another way to look at these forecasts is to place them into context against the industry itself. We would highlight that sales are expected to reverse, with a forecast 17% annualised revenue decline to the end of 2021. That is a notable change from historical growth of 8.2% over the last five years. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 4.6% per year. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Companhia de Saneamento Básico do Estado de São Paulo - SABESP is expected to lag the wider industry.

The Bottom Line

The most important thing to take away is that analysts cut their revenue estimates for this year. They also expect company revenue to perform worse than the wider market. Often, one downgrade can set off a daisy-chain of cuts, especially if an industry is in decline. So we wouldn't be surprised if the market became a lot more cautious on Companhia de Saneamento Básico do Estado de São Paulo - SABESP after today.

Worse, Companhia de Saneamento Básico do Estado de São Paulo - SABESP is labouring under a substantial debt burden, which - if today's forecasts prove accurate - the forecast downgrade could potentially exacerbate. To see more of our financial analysis, you can click through to our free platform to learn more about its balance sheet and specific concerns we've identified.

You can also see our analysis of Companhia de Saneamento Básico do Estado de São Paulo - SABESP's Board and CEO remuneration and experience, and whether company insiders have been buying stock.

If you’re looking to trade Companhia de Saneamento Básico do Estado de São Paulo - SABESP, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BOVESPA:SBSP3

Companhia de Saneamento Básico do Estado de São Paulo - SABESP

Provides basic and environmental sanitation services in the São Paulo State, Brazil.

Outstanding track record and fair value.