- Brazil

- /

- Electric Utilities

- /

- BOVESPA:EQPA3

Did You Participate In Any Of Equatorial Pará Distribuidora de Energia's (BVMF:EQPA3) Fantastic 118% Return ?

One simple way to benefit from the stock market is to buy an index fund. But if you choose individual stocks with prowess, you can make superior returns. Just take a look at Equatorial Pará Distribuidora de Energia S.A. (BVMF:EQPA3), which is up 85%, over three years, soundly beating the market return of 29% (not including dividends).

Check out our latest analysis for Equatorial Pará Distribuidora de Energia

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

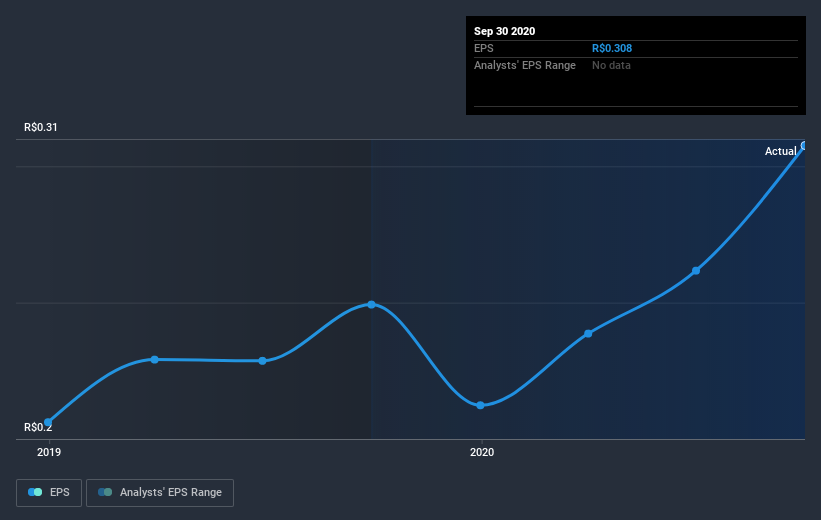

During three years of share price growth, Equatorial Pará Distribuidora de Energia achieved compound earnings per share growth of 23% per year. This EPS growth is remarkably close to the 23% average annual increase in the share price. That suggests that the market sentiment around the company hasn't changed much over that time. Rather, the share price has approximately tracked EPS growth.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Equatorial Pará Distribuidora de Energia's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that Equatorial Pará Distribuidora de Energia's TSR of 118% over the last 3 years is better than the share price return.

A Different Perspective

Equatorial Pará Distribuidora de Energia shareholders are down 6.6% for the year, but the market itself is up 19%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 16% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Equatorial Pará Distribuidora de Energia you should know about.

Of course Equatorial Pará Distribuidora de Energia may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on BR exchanges.

When trading Equatorial Pará Distribuidora de Energia or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Equatorial Pará Distribuidora de Energia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BOVESPA:EQPA3

Equatorial Pará Distribuidora de Energia

Equatorial Pará Distribuidora de Energia S.A.

Fair value second-rate dividend payer.

Market Insights

Community Narratives