- Brazil

- /

- Electric Utilities

- /

- BOVESPA:ALUP11

Alupar Investimento S.A. Just Missed Earnings - But Analysts Have Updated Their Models

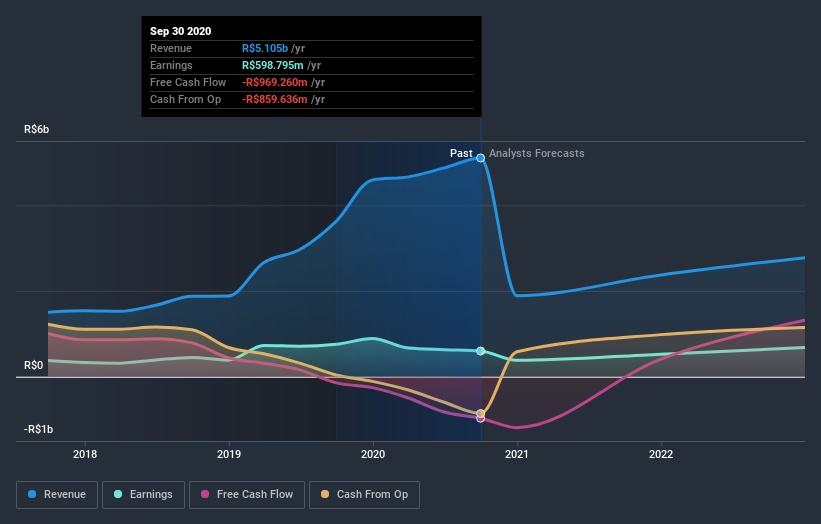

Investors in Alupar Investimento S.A. (BVMF:ALUP11) had a good week, as its shares rose 3.4% to close at R$24.91 following the release of its full-year results. Sales came in at R$5.1b, beating expectations by a remarkable 170%, while statutory earnings per share (EPS) were R$0.76, missing estimates by an equally remarkable 55%. This is an important time for investors, as they can track a company's performance in its report, look at what experts are forecasting for next year, and see if there has been any change to expectations for the business. With this in mind, we've gathered the latest statutory forecasts to see what the analysts are expecting for next year.

View our latest analysis for Alupar Investimento

Following the recent earnings report, the consensus from six analysts covering Alupar Investimento is for revenues of R$2.38b in 2021, implying a painful 53% decline in sales compared to the last 12 months. Per-share earnings are expected to step up 16% to R$2.37. In the lead-up to this report, the analysts had been modelling revenues of R$2.39b and earnings per share (EPS) of R$2.45 in 2021. The analysts seem to have become a little more negative on the business after the latest results, given the minor downgrade to their earnings per share numbers for next year.

The consensus price target held steady at R$29.96, with the analysts seemingly voting that their lower forecast earnings are not expected to lead to a lower stock price in the foreseeable future. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. There are some variant perceptions on Alupar Investimento, with the most bullish analyst valuing it at R$32.00 and the most bearish at R$28.00 per share. Still, with such a tight range of estimates, it suggeststhe analysts have a pretty good idea of what they think the company is worth.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 53% by the end of 2021. This indicates a significant reduction from annual growth of 32% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the industry are forecast to see their revenue decline 0.3% annually for the foreseeable future. So it's pretty clear that Alupar Investimento's revenues are expected to shrink faster than the wider industry.

The Bottom Line

The most important thing to take away is that the analysts downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. The consensus also reconfirmed their revenue estimates, suggesting that sales are performing in line with expectations. Plus, our data suggests that Alupar Investimento is expected to perform worse than the wider industry. The consensus price target held steady at R$29.96, with the latest estimates not enough to have an impact on their price targets.

With that in mind, we wouldn't be too quick to come to a conclusion on Alupar Investimento. Long-term earnings power is much more important than next year's profits. We have forecasts for Alupar Investimento going out to 2022, and you can see them free on our platform here.

That said, it's still necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Alupar Investimento (at least 1 which is significant) , and understanding these should be part of your investment process.

If you’re looking to trade Alupar Investimento, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BOVESPA:ALUP11

Alupar Investimento

Engages in the transmission, generation, and commercialization of energy in Brazil, Colombia, Peru, and Chile.

Proven track record with imperfect balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success