- Brazil

- /

- Infrastructure

- /

- BOVESPA:TPIS3

How Much Did Triunfo Participações e Investimentos'(BVMF:TPIS3) Shareholders Earn From Share Price Movements Over The Last Five Years?

While not a mind-blowing move, it is good to see that the Triunfo Participações e Investimentos S.A. (BVMF:TPIS3) share price has gained 12% in the last three months. But over the last half decade, the stock has not performed well. In fact, the share price is down 59%, which falls well short of the return you could get by buying an index fund.

See our latest analysis for Triunfo Participações e Investimentos

Triunfo Participações e Investimentos wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over half a decade Triunfo Participações e Investimentos reduced its trailing twelve month revenue by 19% for each year. That puts it in an unattractive cohort, to put it mildly. Arguably, the market has responded appropriately to this business performance by sending the share price down 10% (annualized) in the same time period. It's fair to say most investors don't like to invest in loss making companies with falling revenue. You'd want to research this company pretty thoroughly before buying, it looks a bit too risky for us.

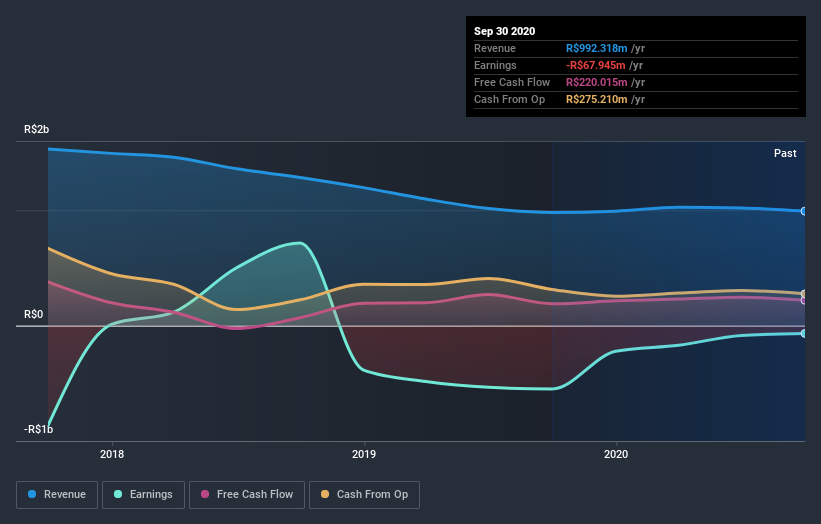

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Triunfo Participações e Investimentos' balance sheet strength is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Triunfo Participações e Investimentos' total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Its history of dividend payouts mean that Triunfo Participações e Investimentos' TSR, which was a 48% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

Triunfo Participações e Investimentos provided a TSR of 0.6% over the last twelve months. Unfortunately this falls short of the market return. But at least that's still a gain! Over five years the TSR has been a reduction of 8% per year, over five years. It could well be that the business is stabilizing. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Triunfo Participações e Investimentos , and understanding them should be part of your investment process.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on BR exchanges.

If you’re looking to trade Triunfo Participações e Investimentos, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Triunfo Participações e Investimentos might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BOVESPA:TPIS3

Triunfo Participações e Investimentos

Triunfo Participações e Investimentos S.A.

Good value with mediocre balance sheet.

Market Insights

Community Narratives