- Brazil

- /

- Electronic Equipment and Components

- /

- BOVESPA:ALLD3

Investors Can Find Comfort In Allied Tecnologia's (BVMF:ALLD3) Earnings Quality

Soft earnings didn't appear to concern Allied Tecnologia S.A.'s (BVMF:ALLD3) shareholders over the last week. We did some digging, and we believe the earnings are stronger than they seem.

Our free stock report includes 2 warning signs investors should be aware of before investing in Allied Tecnologia. Read for free now.

A Closer Look At Allied Tecnologia's Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. The ratio shows us how much a company's profit exceeds its FCF.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

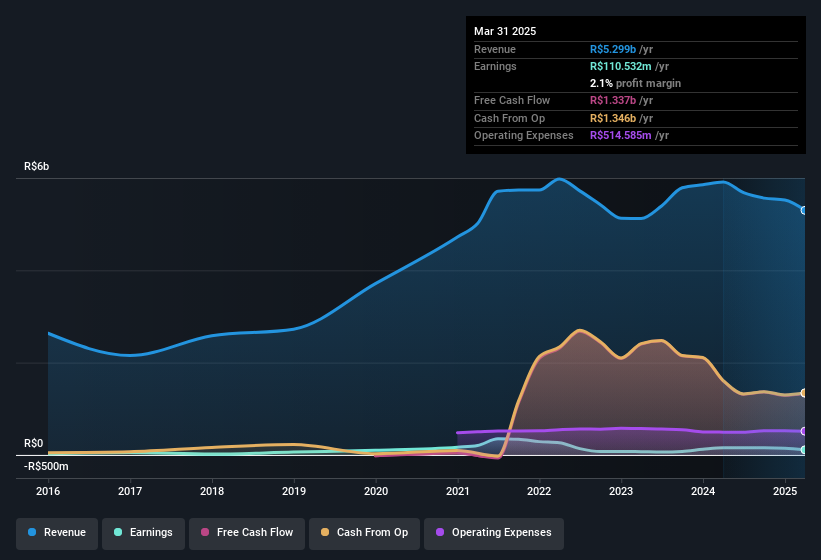

Allied Tecnologia has an accrual ratio of -0.70 for the year to March 2025. Therefore, its statutory earnings were very significantly less than its free cashflow. To wit, it produced free cash flow of R$1.3b during the period, dwarfing its reported profit of R$110.5m. Allied Tecnologia did see its free cash flow drop year on year, which is less than ideal, like a Simpson's episode without Groundskeeper Willie. Importantly, we note an unusual tax situation, which we discuss below, has impacted the accruals ratio.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Allied Tecnologia.

An Unusual Tax Situation

In addition to the notable accrual ratio, we can see that Allied Tecnologia received a tax benefit of R$22m. This is meaningful because companies usually pay tax rather than receive tax benefits. Of course, prima facie it's great to receive a tax benefit. However, the devil in the detail is that these kind of benefits only impact in the year they are booked, and are often one-off in nature. In the likely event the tax benefit is not repeated, we'd expect to see its statutory profit levels drop, at least in the absence of strong growth. So while we think it's great to receive a tax benefit, it does tend to imply an increased risk that the statutory profit overstates the sustainable earnings power of the business.

Our Take On Allied Tecnologia's Profit Performance

While Allied Tecnologia's accrual ratio stands testament to its strong cashflow, and indicates good quality earnings, the fact that it received a tax benefit suggests that this year's profit may not be a great guide to its sustainable profit run-rate. Considering all the aforementioned, we'd venture that Allied Tecnologia's profit result is a pretty good guide to its true profitability, albeit a bit on the conservative side. So while earnings quality is important, it's equally important to consider the risks facing Allied Tecnologia at this point in time. For example, we've found that Allied Tecnologia has 2 warning signs (1 can't be ignored!) that deserve your attention before going any further with your analysis.

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:ALLD3

Allied Tecnologia

Manufactures and distributes technology products in Brazil and Latin America.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.