- Brazil

- /

- Electronic Equipment and Components

- /

- BOVESPA:ALLD3

Here's Why Allied Tecnologia (BVMF:ALLD3) Has Caught The Eye Of Investors

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Allied Tecnologia (BVMF:ALLD3). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

How Fast Is Allied Tecnologia Growing Its Earnings Per Share?

In the last three years Allied Tecnologia's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. As a result, we'll zoom in on growth over the last year, instead. Outstandingly, Allied Tecnologia's EPS shot from R$1.67 to R$3.72, over the last year. It's a rarity to see 123% year-on-year growth like that.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. We note that while EBIT margins have improved from 4.0% to 9.3%, the company has actually reported a fall in revenue by 3.1%. While not disastrous, these figures could be better.

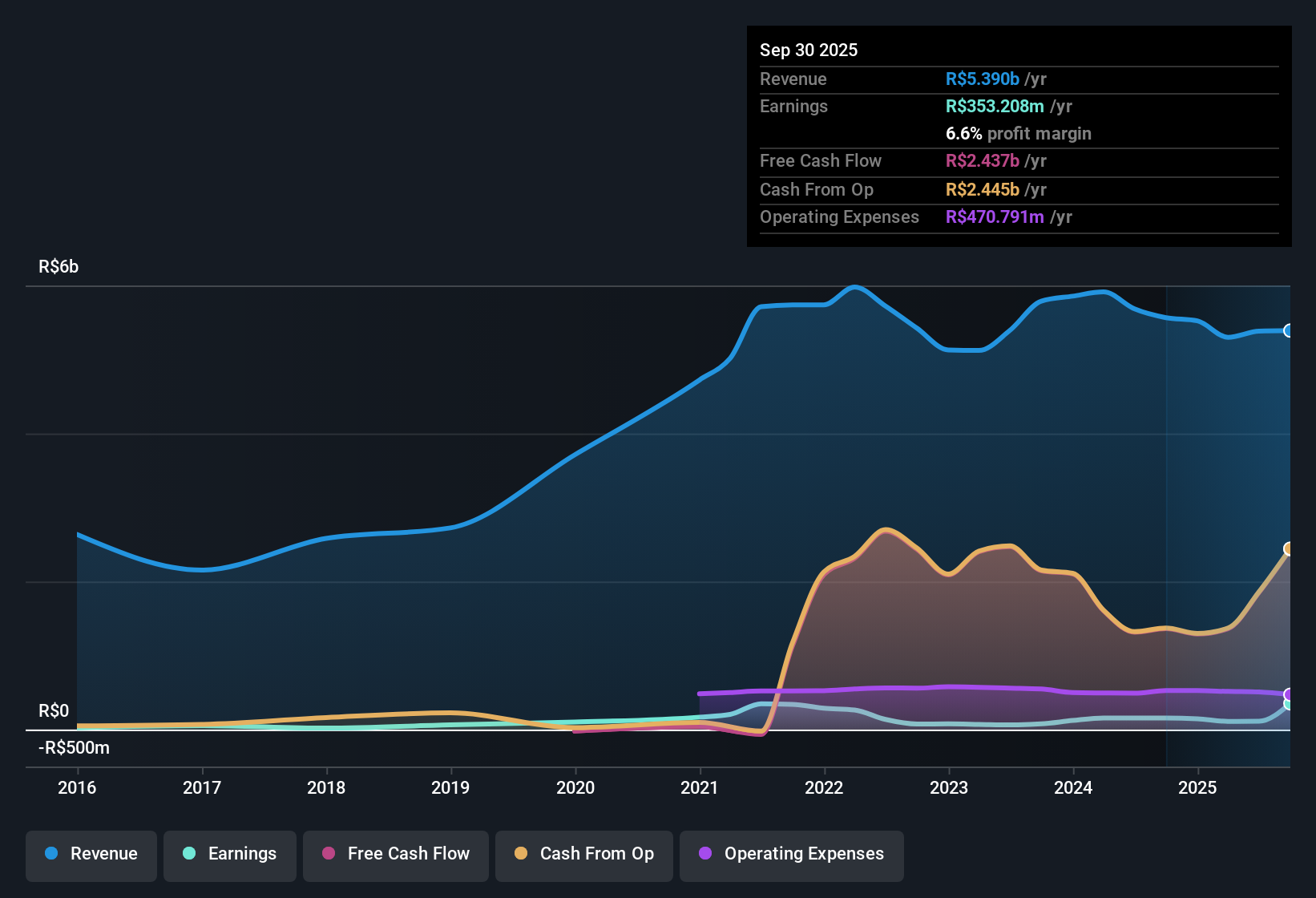

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

See our latest analysis for Allied Tecnologia

Since Allied Tecnologia is no giant, with a market capitalisation of R$722m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Allied Tecnologia Insiders Aligned With All Shareholders?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. Allied Tecnologia followers will find comfort in knowing that insiders have a significant amount of capital that aligns their best interests with the wider shareholder group. As a matter of fact, their holding is valued at R$111m. That shows significant buy-in, and may indicate conviction in the business strategy. As a percentage, this totals to 15% of the shares on issue for the business, an appreciable amount considering the market cap.

Does Allied Tecnologia Deserve A Spot On Your Watchlist?

Allied Tecnologia's earnings have taken off in quite an impressive fashion. That EPS growth certainly is attention grabbing, and the large insider ownership only serves to further stoke our interest. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. Based on the sum of its parts, we definitely think its worth watching Allied Tecnologia very closely. We don't want to rain on the parade too much, but we did also find 3 warning signs for Allied Tecnologia (1 is concerning!) that you need to be mindful of.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Brazilian companies which have demonstrated growth backed by significant insider holdings.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:ALLD3

Allied Tecnologia

Manufactures and distributes technology products in Brazil and Latin America.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives