- Brazil

- /

- Specialty Stores

- /

- BOVESPA:PETZ3

Pet Center Comércio e Participações S.A. (BVMF:PETZ3) Stocks Shoot Up 30% But Its P/E Still Looks Reasonable

Those holding Pet Center Comércio e Participações S.A. (BVMF:PETZ3) shares would be relieved that the share price has rebounded 30% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 34% over that time.

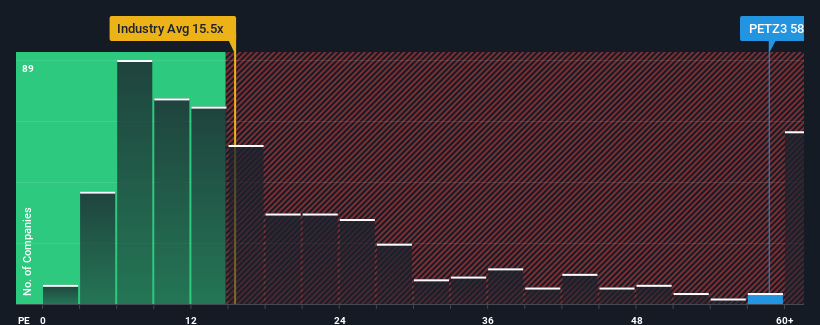

Following the firm bounce in price, Pet Center Comércio e Participações may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 58.7x, since almost half of all companies in Brazil have P/E ratios under 10x and even P/E's lower than 7x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

While the market has experienced earnings growth lately, Pet Center Comércio e Participações' earnings have gone into reverse gear, which is not great. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Pet Center Comércio e Participações

Is There Enough Growth For Pet Center Comércio e Participações?

The only time you'd be truly comfortable seeing a P/E as steep as Pet Center Comércio e Participações' is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered a frustrating 48% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 48% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 140% during the coming year according to the eleven analysts following the company. With the market only predicted to deliver 23%, the company is positioned for a stronger earnings result.

With this information, we can see why Pet Center Comércio e Participações is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Pet Center Comércio e Participações' P/E

Pet Center Comércio e Participações' P/E is flying high just like its stock has during the last month. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Pet Center Comércio e Participações' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Pet Center Comércio e Participações, and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on Pet Center Comércio e Participações, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:PETZ3

Pet Center Comércio e Participações

Operates physical and digital stores that sells products and services for pets in Brazil.

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026