Growth Companies With Insiders Owning Stocks Growing Earnings Up To 42%

Reviewed by Simply Wall St

In a week marked by volatility and technical factors, global markets saw modest declines, with the S&P 500 nearing correction territory and the Nasdaq Composite down significantly from its peak. Amid these fluctuations, insider ownership in growth companies remains a compelling indicator of potential stability and confidence in future earnings. High insider ownership often signals that those closest to the company believe strongly in its long-term prospects. In today's uncertain market environment, such alignment between company insiders and shareholders can be particularly reassuring for investors seeking growth opportunities.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.2% |

| People & Technology (KOSDAQ:A137400) | 16.5% | 34% |

| Gaming Innovation Group (OB:GIG) | 26.7% | 37.4% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 36.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.4% | 60.9% |

| Calliditas Therapeutics (OM:CALTX) | 12.7% | 53.7% |

| Adveritas (ASX:AV1) | 21.1% | 103.9% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| Vow (OB:VOW) | 31.7% | 97.7% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 75% |

Underneath we present a selection of stocks filtered out by our screen.

Azzas 2154 (BOVESPA:AZZA3)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Azzas 2154 S.A. designs, develops, manufactures, markets, and sells shoes, handbags, clothing, and accessories for women and men with a market cap of R$6.02 billion.

Operations: The company's revenue primarily comes from its footwear segment, generating R$4.89 billion.

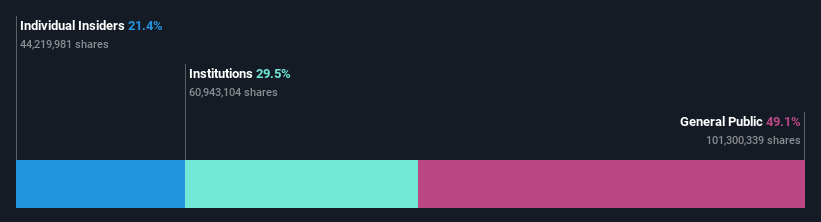

Insider Ownership: 39.9%

Earnings Growth Forecast: 27.4% p.a.

Azzas 2154, a growth company with high insider ownership, is forecast to see significant earnings growth of 27.43% annually over the next three years, outpacing the broader market. Despite trading at 67.2% below its fair value estimate and analysts predicting a 35.4% rise in stock price, its low Return on Equity (13.2%) and unsustainable dividend coverage by free cash flows present concerns for potential investors. Recent events include a special dividend payout and upcoming shareholder meetings.

- Delve into the full analysis future growth report here for a deeper understanding of Azzas 2154.

- The analysis detailed in our Azzas 2154 valuation report hints at an deflated share price compared to its estimated value.

Suzano (BOVESPA:SUZB3)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Suzano S.A. is a company that produces and sells eucalyptus pulp and paper products both in Brazil and internationally, with a market cap of R$67.47 billion.

Operations: The company generates revenue from two main segments: R$30.97 billion from pulp and R$9.30 billion from paper products.

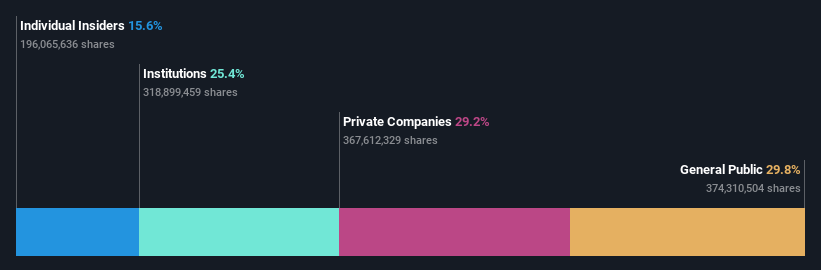

Insider Ownership: 15.8%

Earnings Growth Forecast: 37.2% p.a.

Suzano is forecast to achieve significant annual earnings growth of 37.2% over the next three years, surpassing the broader Brazilian market. Despite trading at 5.4% below its estimated fair value and analysts expecting a 27.8% rise in stock price, concerns include low return on equity (15.9%) and debt not well covered by operating cash flow. Recent events include a share buyback program and potential acquisition of International Paper, indicating strategic expansion efforts amidst financial challenges highlighted by recent net losses.

- Unlock comprehensive insights into our analysis of Suzano stock in this growth report.

- Our valuation report here indicates Suzano may be undervalued.

Kaori Heat Treatment (TWSE:8996)

Simply Wall St Growth Rating: ★★★★★★

Overview: Kaori Heat Treatment Co., Ltd. develops, manufactures, and sells heat exchanger solutions globally, with a market cap of NT$30.35 billion.

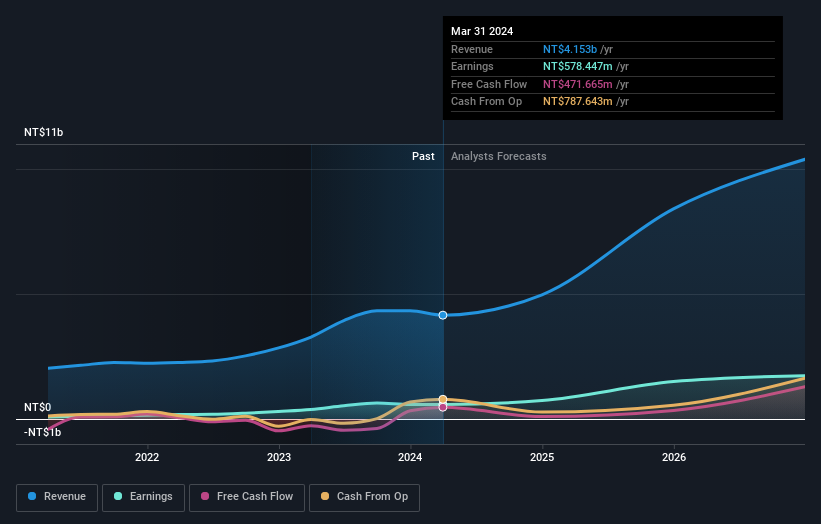

Operations: Kaori Heat Treatment's revenue segments include Plate Heat Exchanger at NT$2.23 billion and Energy Conservation Product Segment (including Metal Products and Processing) at NT$1.92 billion.

Insider Ownership: 12.5%

Earnings Growth Forecast: 42.1% p.a.

Kaori Heat Treatment is expected to see revenue growth of 33% per year, outpacing the Taiwan market's 11.7%. Earnings are forecast to grow significantly at 42.1% annually, well above the market average. Despite high volatility in its share price, analysts predict a 39.6% rise from current levels and it trades at a substantial discount to fair value (47.5%). Recent events include Q2 financial results announcement and amendments to corporate bylaws approved in June 2024.

- Dive into the specifics of Kaori Heat Treatment here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that Kaori Heat Treatment is priced lower than what may be justified by its financials.

Where To Now?

- Click through to start exploring the rest of the 1478 Fast Growing Companies With High Insider Ownership now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BOVESPA:AZZA3

Azzas 2154

Designs, develops, manufactures, markets, and sells shoes, handbags, clothing, and accessories for women and men.

High growth potential with excellent balance sheet.