Stock Analysis

- Brazil

- /

- Healthcare Services

- /

- BOVESPA:QUAL3

Revenues Not Telling The Story For Qualicorp Consultoria e Corretora de Seguros S.A. (BVMF:QUAL3) After Shares Rise 27%

The Qualicorp Consultoria e Corretora de Seguros S.A. (BVMF:QUAL3) share price has done very well over the last month, posting an excellent gain of 27%. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 60% share price drop in the last twelve months.

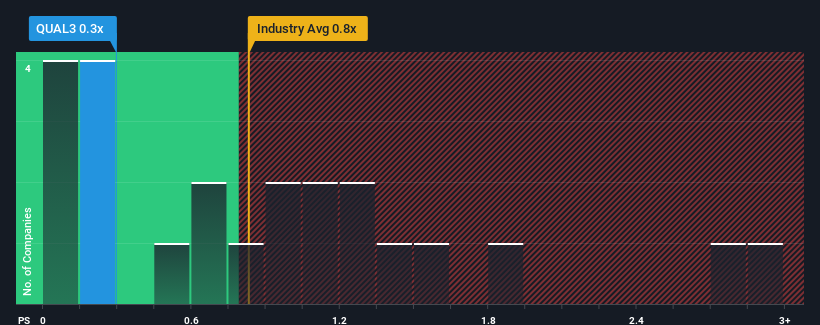

Even after such a large jump in price, it's still not a stretch to say that Qualicorp Consultoria e Corretora de Seguros' price-to-sales (or "P/S") ratio of 0.3x right now seems quite "middle-of-the-road" compared to the Healthcare industry in Brazil, where the median P/S ratio is around 0.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Qualicorp Consultoria e Corretora de Seguros

How Has Qualicorp Consultoria e Corretora de Seguros Performed Recently?

Qualicorp Consultoria e Corretora de Seguros could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think Qualicorp Consultoria e Corretora de Seguros' future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Qualicorp Consultoria e Corretora de Seguros?

Qualicorp Consultoria e Corretora de Seguros' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 11%. As a result, revenue from three years ago have also fallen 17% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 3.4% per year as estimated by the seven analysts watching the company. That's not great when the rest of the industry is expected to grow by 11% per year.

With this in consideration, we think it doesn't make sense that Qualicorp Consultoria e Corretora de Seguros' P/S is closely matching its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

The Final Word

Qualicorp Consultoria e Corretora de Seguros appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

While Qualicorp Consultoria e Corretora de Seguros' P/S isn't anything out of the ordinary for companies in the industry, we didn't expect it given forecasts of revenue decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

Before you take the next step, you should know about the 4 warning signs for Qualicorp Consultoria e Corretora de Seguros (2 shouldn't be ignored!) that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Qualicorp Consultoria e Corretora de Seguros might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BOVESPA:QUAL3

Qualicorp Consultoria e Corretora de Seguros

Qualicorp Consultoria e Corretora de Seguros S.A.

Undervalued slight.