Further Upside For Minupar Participações S.A. (BVMF:MNPR3) Shares Could Introduce Price Risks After 27% Bounce

Minupar Participações S.A. (BVMF:MNPR3) shares have continued their recent momentum with a 27% gain in the last month alone. The annual gain comes to 280% following the latest surge, making investors sit up and take notice.

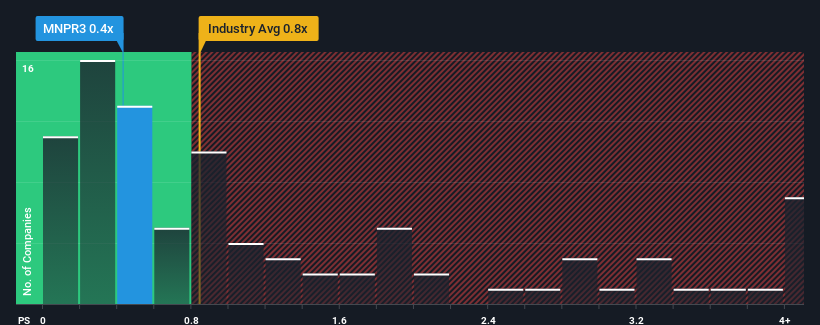

Even after such a large jump in price, given about half the companies operating in Brazil's Food industry have price-to-sales ratios (or "P/S") above 1x, you may still consider Minupar Participações as an attractive investment with its 0.4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Minupar Participações

How Has Minupar Participações Performed Recently?

Minupar Participações has been doing a decent job lately as it's been growing revenue at a reasonable pace. Perhaps the market believes the recent revenue performance might fall short of industry figures in the near future, leading to a reduced P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Minupar Participações' earnings, revenue and cash flow.How Is Minupar Participações' Revenue Growth Trending?

Minupar Participações' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a decent 4.4% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 54% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 5.2%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we find it odd that Minupar Participações is trading at a P/S lower than the industry. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Final Word

The latest share price surge wasn't enough to lift Minupar Participações' P/S close to the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We're very surprised to see Minupar Participações currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Minupar Participações (2 are a bit concerning!) that you should be aware of before investing here.

If you're unsure about the strength of Minupar Participações' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:MNPR3

Minupar Participações

Through its subsidiaries, engages in the production and slaughtering of poultry primarily in Brazil.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives