- Brazil

- /

- Hospitality

- /

- BOVESPA:AHEB3

Investors Continue Waiting On Sidelines For São Paulo Turismo S.A. (BVMF:AHEB3)

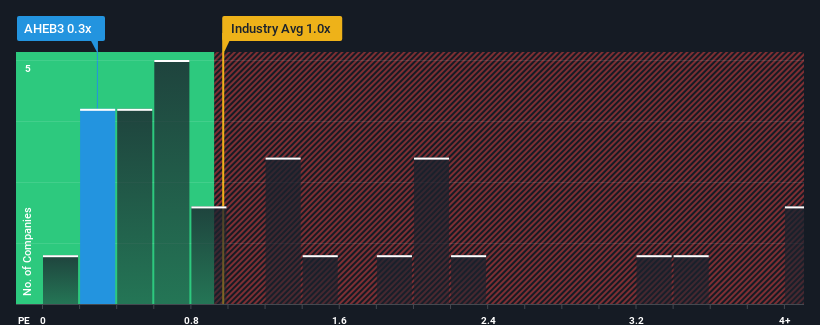

With a median price-to-sales (or "P/S") ratio of close to 0.4x in the Hospitality industry in Brazil, you could be forgiven for feeling indifferent about São Paulo Turismo S.A.'s (BVMF:AHEB3) P/S ratio of 0.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for São Paulo Turismo

What Does São Paulo Turismo's P/S Mean For Shareholders?

With revenue growth that's exceedingly strong of late, São Paulo Turismo has been doing very well. The P/S is probably moderate because investors think this strong revenue growth might not be enough to outperform the broader industry in the near future. Those who are bullish on São Paulo Turismo will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on São Paulo Turismo will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For São Paulo Turismo?

São Paulo Turismo's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 115%. The latest three year period has also seen an excellent 263% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 18% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's curious that São Paulo Turismo's P/S sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

To our surprise, São Paulo Turismo revealed its three-year revenue trends aren't contributing to its P/S as much as we would have predicted, given they look better than current industry expectations. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

It is also worth noting that we have found 2 warning signs for São Paulo Turismo (1 makes us a bit uncomfortable!) that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:AHEB3

São Paulo Turismo

Operates as a tourism and events company in Latin America.

Excellent balance sheet with slight risk.

Market Insights

Community Narratives