- Brazil

- /

- Food and Staples Retail

- /

- BOVESPA:PGMN3

Empreendimentos Pague Menos S.A. (BVMF:PGMN3) Stock Rockets 31% As Investors Are Less Pessimistic Than Expected

Empreendimentos Pague Menos S.A. (BVMF:PGMN3) shareholders have had their patience rewarded with a 31% share price jump in the last month. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 13% in the last twelve months.

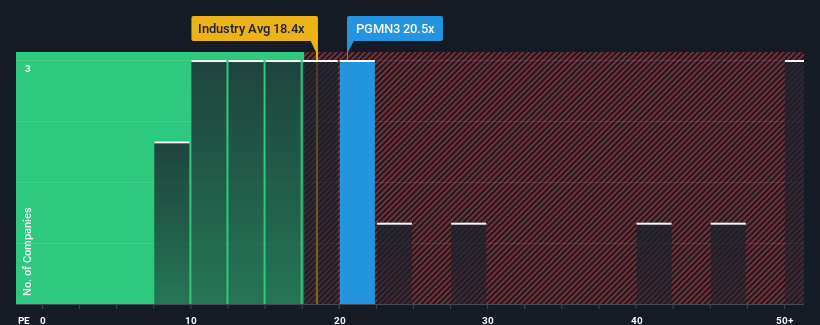

After such a large jump in price, Empreendimentos Pague Menos may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 20.5x, since almost half of all companies in Brazil have P/E ratios under 10x and even P/E's lower than 6x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Empreendimentos Pague Menos hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Empreendimentos Pague Menos

How Is Empreendimentos Pague Menos' Growth Trending?

In order to justify its P/E ratio, Empreendimentos Pague Menos would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 50%. As a result, earnings from three years ago have also fallen 63% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to slump, contracting by 3.1% per year during the coming three years according to the three analysts following the company. With the market predicted to deliver 17% growth per year, that's a disappointing outcome.

With this information, we find it concerning that Empreendimentos Pague Menos is trading at a P/E higher than the market. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock at any price. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the negative growth outlook.

The Bottom Line On Empreendimentos Pague Menos' P/E

Shares in Empreendimentos Pague Menos have built up some good momentum lately, which has really inflated its P/E. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Empreendimentos Pague Menos currently trades on a much higher than expected P/E for a company whose earnings are forecast to decline. When we see a poor outlook with earnings heading backwards, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Having said that, be aware Empreendimentos Pague Menos is showing 5 warning signs in our investment analysis, and 1 of those is a bit concerning.

You might be able to find a better investment than Empreendimentos Pague Menos. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Empreendimentos Pague Menos might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:PGMN3

Empreendimentos Pague Menos

Engages in the retail sale of medicines, perfumes, personal hygiene and beauty products in Brazil.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives