- Brazil

- /

- Food and Staples Retail

- /

- BOVESPA:CRFB3

Atacadão S.A.'s (BVMF:CRFB3) Stock's On An Uptrend: Are Strong Financials Guiding The Market?

Atacadão's (BVMF:CRFB3) stock is up by a considerable 6.4% over the past month. Given the company's impressive performance, we decided to study its financial indicators more closely as a company's financial health over the long-term usually dictates market outcomes. In this article, we decided to focus on Atacadão's ROE.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. Put another way, it reveals the company's success at turning shareholder investments into profits.

See our latest analysis for Atacadão

How To Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Atacadão is:

17% = R$2.8b ÷ R$17b (Based on the trailing twelve months to December 2020).

The 'return' is the amount earned after tax over the last twelve months. That means that for every R$1 worth of shareholders' equity, the company generated R$0.17 in profit.

What Is The Relationship Between ROE And Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

A Side By Side comparison of Atacadão's Earnings Growth And 17% ROE

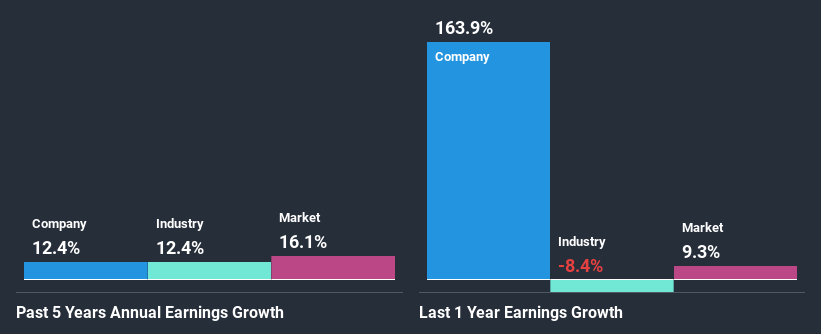

When you first look at it, Atacadão's ROE doesn't look that attractive. Although a closer study shows that the company's ROE is higher than the industry average of 7.8% which we definitely can't overlook. Consequently, this likely laid the ground for the decent growth of 12% seen over the past five years by Atacadão. That being said, the company does have a slightly low ROE to begin with, just that it is higher than the industry average. Hence there might be some other aspects that are causing earnings to grow. E.g the company has a low payout ratio or could belong to a high growth industry.

We then performed a comparison between Atacadão's net income growth with the industry, which revealed that the company's growth is similar to the average industry growth of 12% in the same period.

Earnings growth is a huge factor in stock valuation. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. What is CRFB3 worth today? The intrinsic value infographic in our free research report helps visualize whether CRFB3 is currently mispriced by the market.

Is Atacadão Efficiently Re-investing Its Profits?

Atacadão's three-year median payout ratio to shareholders is 20% (implying that it retains 80% of its income), which is on the lower side, so it seems like the management is reinvesting profits heavily to grow its business.

Additionally, Atacadão has paid dividends over a period of three years which means that the company is pretty serious about sharing its profits with shareholders. Looking at the current analyst consensus data, we can see that the company's future payout ratio is expected to rise to 25% over the next three years. However, the company's ROE is not expected to change by much despite the higher expected payout ratio.

Conclusion

Overall, we are quite pleased with Atacadão's performance. In particular, it's great to see that the company has seen significant growth in its earnings backed by a respectable ROE and a high reinvestment rate. That being so, a study of the latest analyst forecasts show that the company is expected to see a slowdown in its future earnings growth. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

If you decide to trade Atacadão, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BOVESPA:CRFB3

Atacadão

Engages in the wholesale and retail of food, clothing, home appliances, electronics, and other products in Brazil.

Fair value with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026