- Brazil

- /

- Consumer Durables

- /

- BOVESPA:PLPL3

After Leaping 27% Plano & Plano Desenvolvimento Imobiliário S.A. (BVMF:PLPL3) Shares Are Not Flying Under The Radar

Plano & Plano Desenvolvimento Imobiliário S.A. (BVMF:PLPL3) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. The annual gain comes to 241% following the latest surge, making investors sit up and take notice.

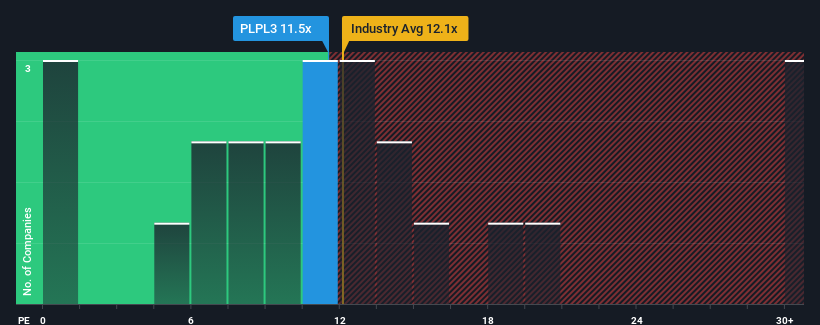

Although its price has surged higher, there still wouldn't be many who think Plano & Plano Desenvolvimento Imobiliário's price-to-earnings (or "P/E") ratio of 11.5x is worth a mention when the median P/E in Brazil is similar at about 10x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Plano & Plano Desenvolvimento Imobiliário certainly has been doing a good job lately as it's been growing earnings more than most other companies. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Plano & Plano Desenvolvimento Imobiliário

Does Growth Match The P/E?

Plano & Plano Desenvolvimento Imobiliário's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 138% last year. The latest three year period has also seen an excellent 108% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 24% as estimated by the six analysts watching the company. With the market predicted to deliver 23% growth , the company is positioned for a comparable earnings result.

With this information, we can see why Plano & Plano Desenvolvimento Imobiliário is trading at a fairly similar P/E to the market. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Key Takeaway

Its shares have lifted substantially and now Plano & Plano Desenvolvimento Imobiliário's P/E is also back up to the market median. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Plano & Plano Desenvolvimento Imobiliário's analyst forecasts revealed that its market-matching earnings outlook is contributing to its current P/E. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. Unless these conditions change, they will continue to support the share price at these levels.

You should always think about risks. Case in point, we've spotted 3 warning signs for Plano & Plano Desenvolvimento Imobiliário you should be aware of.

Of course, you might also be able to find a better stock than Plano & Plano Desenvolvimento Imobiliário. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:PLPL3

Plano & Plano Desenvolvimento Imobiliário

Through its subsidiaries develops, constructs, and sells real estate projects in the São Paulo Metropolitan Region.

Undervalued with high growth potential.

Market Insights

Community Narratives