There's No Escaping Guararapes Confecções S.A.'s (BVMF:GUAR3) Muted Revenues Despite A 28% Share Price Rise

Guararapes Confecções S.A. (BVMF:GUAR3) shareholders would be excited to see that the share price has had a great month, posting a 28% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 79% in the last year.

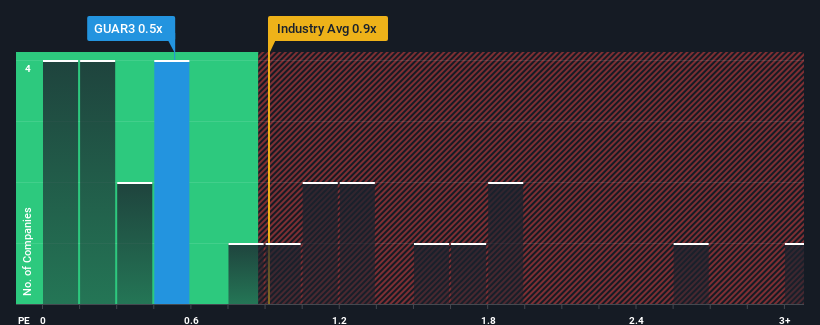

In spite of the firm bounce in price, it would still be understandable if you think Guararapes Confecções is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.5x, considering almost half the companies in Brazil's Luxury industry have P/S ratios above 1.1x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Guararapes Confecções

What Does Guararapes Confecções' Recent Performance Look Like?

There hasn't been much to differentiate Guararapes Confecções' and the industry's revenue growth lately. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. Those who are bullish on Guararapes Confecções will be hoping that this isn't the case.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Guararapes Confecções.Is There Any Revenue Growth Forecasted For Guararapes Confecções?

The only time you'd be truly comfortable seeing a P/S as low as Guararapes Confecções' is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a decent 7.1% gain to the company's revenues. Pleasingly, revenue has also lifted 37% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 6.4% as estimated by the five analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 41%, which is noticeably more attractive.

With this in consideration, its clear as to why Guararapes Confecções' P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From Guararapes Confecções' P/S?

Despite Guararapes Confecções' share price climbing recently, its P/S still lags most other companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Guararapes Confecções' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Guararapes Confecções (of which 1 is a bit unpleasant!) you should know about.

If these risks are making you reconsider your opinion on Guararapes Confecções, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:GUAR3

Guararapes Confecções

Engages in the manufacture, distribution, and sale of clothes, articles for personal use, and other related items in Brazil.

Excellent balance sheet and fair value.

Market Insights

Community Narratives