Little Excitement Around Guararapes Confecções S.A.'s (BVMF:GUAR3) Revenues As Shares Take 27% Pounding

Guararapes Confecções S.A. (BVMF:GUAR3) shareholders that were waiting for something to happen have been dealt a blow with a 27% share price drop in the last month. Longer-term shareholders would now have taken a real hit with the stock declining 5.4% in the last year.

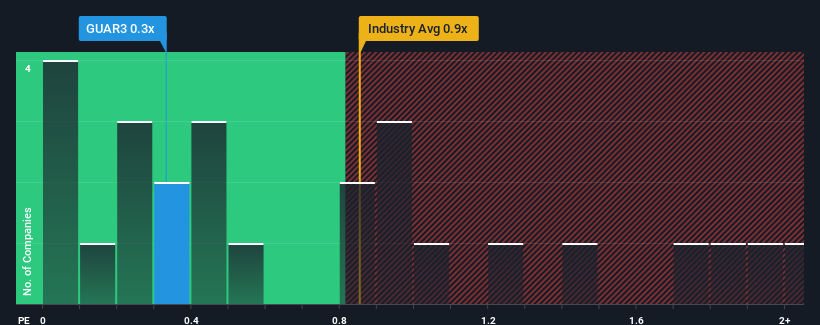

Even after such a large drop in price, it would still be understandable if you think Guararapes Confecções is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.3x, considering almost half the companies in Brazil's Luxury industry have P/S ratios above 0.9x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Guararapes Confecções

How Guararapes Confecções Has Been Performing

With revenue growth that's inferior to most other companies of late, Guararapes Confecções has been relatively sluggish. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Guararapes Confecções.Is There Any Revenue Growth Forecasted For Guararapes Confecções?

Guararapes Confecções' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 7.9%. The latest three year period has also seen an excellent 34% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 6.8% during the coming year according to the five analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 28%, which is noticeably more attractive.

With this in consideration, its clear as to why Guararapes Confecções' P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Guararapes Confecções' P/S has taken a dip along with its share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Guararapes Confecções maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You always need to take note of risks, for example - Guararapes Confecções has 1 warning sign we think you should be aware of.

If these risks are making you reconsider your opinion on Guararapes Confecções, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:GUAR3

Guararapes Confecções

Engages in the manufacture, distribution, and sale of clothes, items for personal use, and other related items in Brazil.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives