Guararapes Confecções S.A. (BVMF:GUAR3) Stock Catapults 28% Though Its Price And Business Still Lag The Industry

Guararapes Confecções S.A. (BVMF:GUAR3) shareholders would be excited to see that the share price has had a great month, posting a 28% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 33% in the last year.

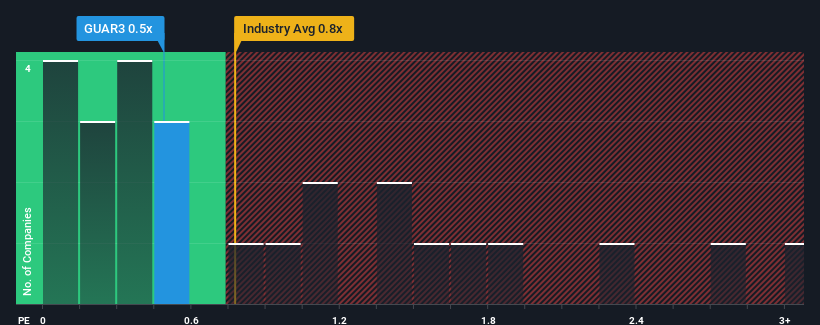

In spite of the firm bounce in price, it would still be understandable if you think Guararapes Confecções is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.5x, considering almost half the companies in Brazil's Luxury industry have P/S ratios above 1.1x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Guararapes Confecções

How Guararapes Confecções Has Been Performing

There hasn't been much to differentiate Guararapes Confecções' and the industry's revenue growth lately. One possibility is that the P/S ratio is low because investors think this modest revenue performance may begin to slide. If not, then existing shareholders have reason to be optimistic about the future direction of the share price.

Keen to find out how analysts think Guararapes Confecções' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

Guararapes Confecções' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a decent 7.1% gain to the company's revenues. The latest three year period has also seen an excellent 37% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 5.0% during the coming year according to the four analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 31%, which is noticeably more attractive.

With this in consideration, its clear as to why Guararapes Confecções' P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Despite Guararapes Confecções' share price climbing recently, its P/S still lags most other companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Guararapes Confecções' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Guararapes Confecções (1 makes us a bit uncomfortable!) that you need to be mindful of.

If these risks are making you reconsider your opinion on Guararapes Confecções, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:GUAR3

Guararapes Confecções

Engages in the manufacture, distribution, and sale of clothes, articles for personal use, and other related items in Brazil.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives