Stock Analysis

- Brazil

- /

- Consumer Durables

- /

- BOVESPA:GFSA3

Even after rising 16% this past week, Gafisa (BVMF:GFSA3) shareholders are still down 86% over the past five years

Gafisa S.A. (BVMF:GFSA3) shareholders will doubtless be very grateful to see the share price up 48% in the last quarter. But spare a thought for the long term holders, who have held the stock as it bled value over the last five years. Five years have seen the share price descend precipitously, down a full 89%. The recent bounce might mean the long decline is over, but we are not confident. The fundamental business performance will ultimately determine if the turnaround can be sustained. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

While the last five years has been tough for Gafisa shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

View our latest analysis for Gafisa

Gafisa isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last half decade, Gafisa saw its revenue increase by 13% per year. That's a fairly respectable growth rate. So it is unexpected to see the stock down 14% per year in the last five years. The market can be a harsh master when your company is losing money and revenue growth disappoints.

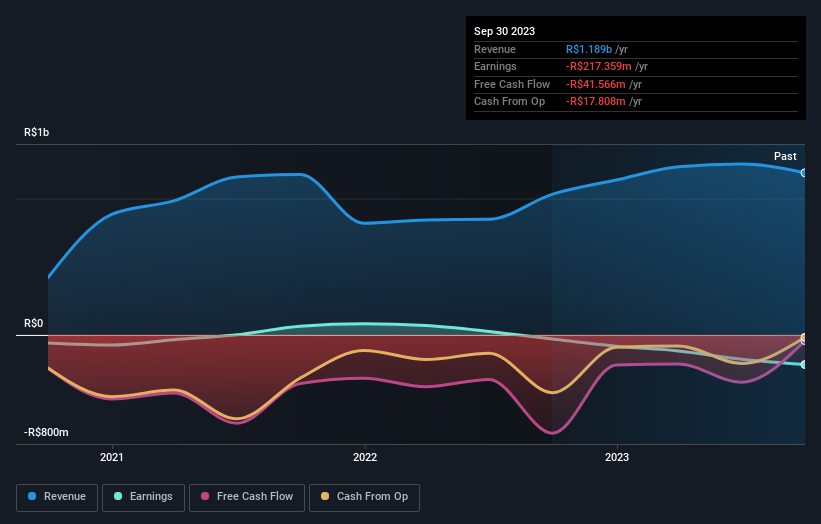

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling Gafisa stock, you should check out this FREE detailed report on its balance sheet.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Gafisa's total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Dividends have been really beneficial for Gafisa shareholders, and that cash payout explains why its total shareholder loss of 86%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

Gafisa shareholders gained a total return of 21% during the year. But that was short of the market average. But at least that's still a gain! Over five years the TSR has been a reduction of 13% per year, over five years. So this might be a sign the business has turned its fortunes around. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 3 warning signs for Gafisa you should be aware of, and 2 of them can't be ignored.

Of course Gafisa may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Brazilian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:GFSA3

Gafisa

Operates as a development and construction company under the Gafisa brand name in Brazil.

Excellent balance sheet and good value.