With A 30% Price Drop For Azzas 2154 S.A. (BVMF:AZZA3) You'll Still Get What You Pay For

The Azzas 2154 S.A. (BVMF:AZZA3) share price has fared very poorly over the last month, falling by a substantial 30%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 63% loss during that time.

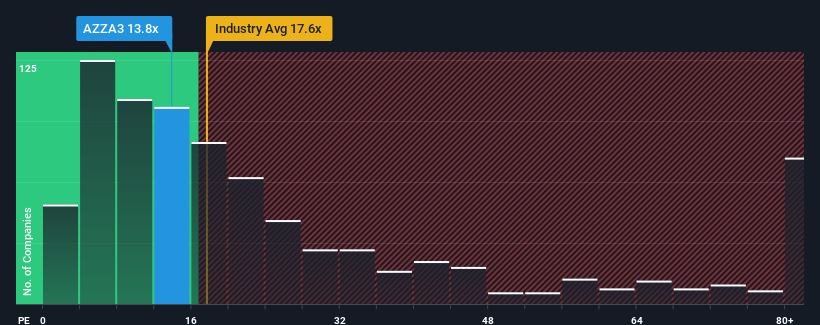

In spite of the heavy fall in price, Azzas 2154's price-to-earnings (or "P/E") ratio of 13.8x might still make it look like a strong sell right now compared to the market in Brazil, where around half of the companies have P/E ratios below 8x and even P/E's below 5x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Azzas 2154 could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Azzas 2154

Is There Enough Growth For Azzas 2154?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Azzas 2154's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 27%. The last three years don't look nice either as the company has shrunk EPS by 52% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 36% each year as estimated by the ten analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 16% each year, which is noticeably less attractive.

In light of this, it's understandable that Azzas 2154's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Azzas 2154's P/E?

Azzas 2154's shares may have retreated, but its P/E is still flying high. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Azzas 2154 maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Before you settle on your opinion, we've discovered 3 warning signs for Azzas 2154 (1 is a bit concerning!) that you should be aware of.

You might be able to find a better investment than Azzas 2154. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:AZZA3

Azzas 2154

Engages in the development and marketing of women's, men's and children's footwear, handbags, accessories, and clothing in Brazil and internationally.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives