- Brazil

- /

- Commercial Services

- /

- BOVESPA:PRNR3

Priner Serviços Industriais S.A. (BVMF:PRNR3) Screens Well But There Might Be A Catch

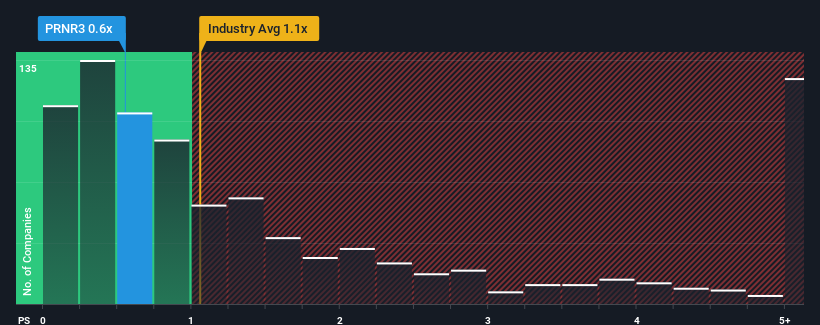

It's not a stretch to say that Priner Serviços Industriais S.A.'s (BVMF:PRNR3) price-to-sales (or "P/S") ratio of 0.6x right now seems quite "middle-of-the-road" for companies in the Commercial Services industry in Brazil, where the median P/S ratio is around 0.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Priner Serviços Industriais

How Priner Serviços Industriais Has Been Performing

Priner Serviços Industriais certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. The P/S is probably moderate because investors think this strong revenue growth might not be enough to outperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Although there are no analyst estimates available for Priner Serviços Industriais, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Priner Serviços Industriais' is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company grew revenue by an impressive 47% last year. The strong recent performance means it was also able to grow revenue by 285% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 24% shows it's noticeably more attractive.

With this information, we find it interesting that Priner Serviços Industriais is trading at a fairly similar P/S compared to the industry. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What Does Priner Serviços Industriais' P/S Mean For Investors?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We didn't quite envision Priner Serviços Industriais' P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Priner Serviços Industriais (1 doesn't sit too well with us!) that you should be aware of before investing here.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:PRNR3

Priner Serviços Industriais

Provides industrial, integrity engineering, and inspection services in the petrochemical, pulp and paper, steel, offshore, naval, mining, and infrastructure sectors in Brazil.

Solid track record with reasonable growth potential.

Market Insights

Community Narratives