- Brazil

- /

- Professional Services

- /

- BOVESPA:IFCM3

Market Cool On Infracommerce CXaaS S.A.'s (BVMF:IFCM3) Revenues Pushing Shares 26% Lower

Unfortunately for some shareholders, the Infracommerce CXaaS S.A. (BVMF:IFCM3) share price has dived 26% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 84% loss during that time.

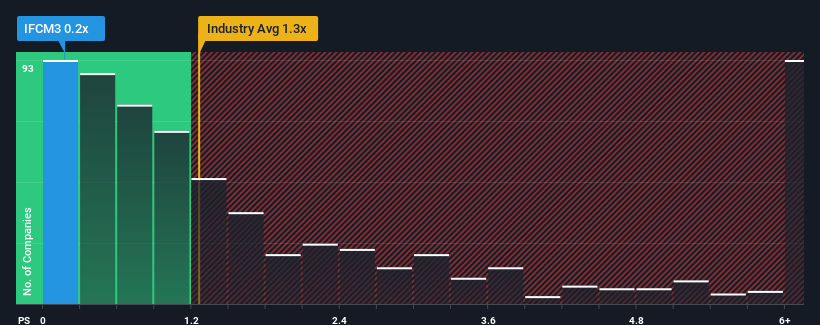

After such a large drop in price, Infracommerce CXaaS may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.2x, considering almost half of all companies in the Professional Services industry in Brazil have P/S ratios greater than 1.3x and even P/S higher than 4x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Infracommerce CXaaS

How Infracommerce CXaaS Has Been Performing

With revenue growth that's superior to most other companies of late, Infracommerce CXaaS has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Infracommerce CXaaS' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Infracommerce CXaaS' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 18% gain to the company's top line. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 22% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 6.8%, which is noticeably less attractive.

With this information, we find it odd that Infracommerce CXaaS is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What Does Infracommerce CXaaS' P/S Mean For Investors?

Infracommerce CXaaS' P/S has taken a dip along with its share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Infracommerce CXaaS' analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Having said that, be aware Infracommerce CXaaS is showing 3 warning signs in our investment analysis, and 2 of those don't sit too well with us.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:IFCM3

Infracommerce CXaaS

Provides digital solutions for various brands and industries in Brazil, Mexico, Colombia, Peru, Chile, Argentina, Uruguay, and Latin America.

Medium-low risk and fair value.

Market Insights

Community Narratives