- Brazil

- /

- Trade Distributors

- /

- BOVESPA:MILS3

Mills Locação Serviços e Logística (BVMF:MILS3) Seems To Use Debt Rather Sparingly

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Mills Locação, Serviços e Logística S.A. (BVMF:MILS3) makes use of debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Mills Locação Serviços e Logística

What Is Mills Locação Serviços e Logística's Net Debt?

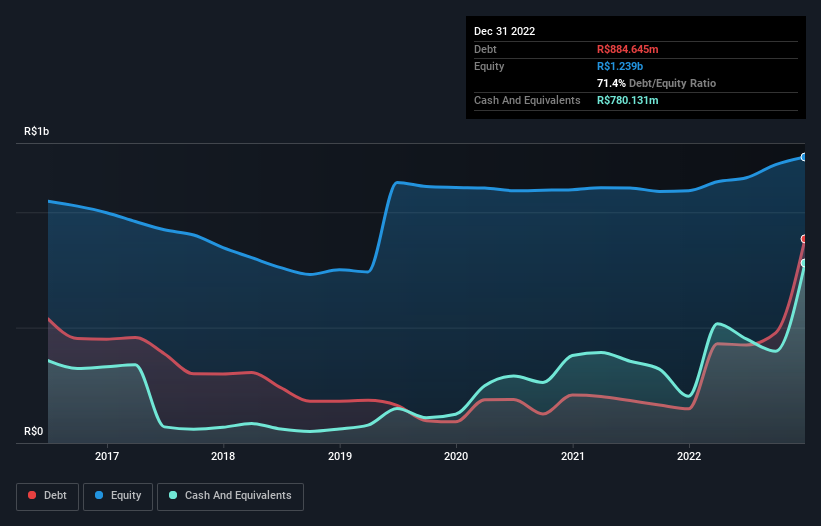

You can click the graphic below for the historical numbers, but it shows that as of December 2022 Mills Locação Serviços e Logística had R$884.6m of debt, an increase on R$148.3m, over one year. However, because it has a cash reserve of R$780.1m, its net debt is less, at about R$104.5m.

How Strong Is Mills Locação Serviços e Logística's Balance Sheet?

The latest balance sheet data shows that Mills Locação Serviços e Logística had liabilities of R$416.9m due within a year, and liabilities of R$932.1m falling due after that. Offsetting this, it had R$780.1m in cash and R$261.1m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by R$307.8m.

Since publicly traded Mills Locação Serviços e Logística shares are worth a total of R$2.12b, it seems unlikely that this level of liabilities would be a major threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Mills Locação Serviços e Logística has a low net debt to EBITDA ratio of only 0.22. And its EBIT easily covers its interest expense, being 54.6 times the size. So we're pretty relaxed about its super-conservative use of debt. Better yet, Mills Locação Serviços e Logística grew its EBIT by 115% last year, which is an impressive improvement. If maintained that growth will make the debt even more manageable in the years ahead. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Mills Locação Serviços e Logística can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last three years, Mills Locação Serviços e Logística produced sturdy free cash flow equating to 64% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

The good news is that Mills Locação Serviços e Logística's demonstrated ability to cover its interest expense with its EBIT delights us like a fluffy puppy does a toddler. And that's just the beginning of the good news since its EBIT growth rate is also very heartening. Considering this range of factors, it seems to us that Mills Locação Serviços e Logística is quite prudent with its debt, and the risks seem well managed. So we're not worried about the use of a little leverage on the balance sheet. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Mills Locação Serviços e Logística is showing 1 warning sign in our investment analysis , you should know about...

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:MILS3

Mills Locação Serviços e Logística

Operates as a machinery and equipment rental company in Brazil.

Reasonable growth potential with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success