- Brazil

- /

- Aerospace & Defense

- /

- BOVESPA:EMBR3

Embraer S.A. (BVMF:EMBR3) Might Not Be As Mispriced As It Looks

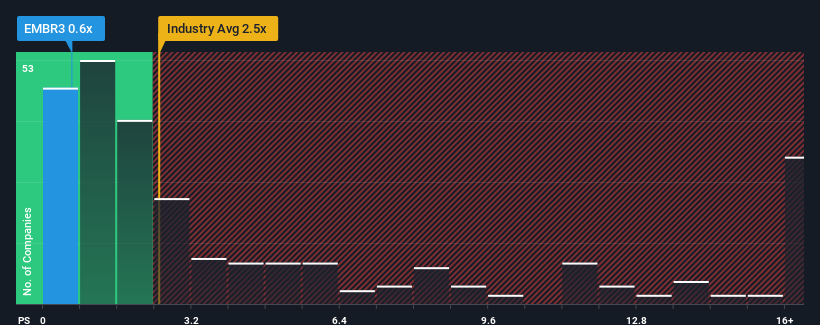

With a price-to-sales (or "P/S") ratio of 0.6x Embraer S.A. (BVMF:EMBR3) may be sending bullish signals at the moment, given that almost half of all the Aerospace & Defense companies in Brazil have P/S ratios greater than 2.5x and even P/S higher than 9x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Embraer

How Has Embraer Performed Recently?

With revenue growth that's superior to most other companies of late, Embraer has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Embraer.Is There Any Revenue Growth Forecasted For Embraer?

Embraer's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a decent 13% gain to the company's revenues. The solid recent performance means it was also able to grow revenue by 12% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 11% each year as estimated by the twelve analysts watching the company. That's shaping up to be similar to the 10% per annum growth forecast for the broader industry.

In light of this, it's peculiar that Embraer's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It looks to us like the P/S figures for Embraer remain low despite growth that is expected to be in line with other companies in the industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Embraer with six simple checks on some of these key factors.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Embraer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:EMBR3

Embraer

Designs, develops, manufactures, and sells aircraft and systems in North America, Latin America, the Asia Pacific, Brazil, Europe, and internationally.

Excellent balance sheet and slightly overvalued.