- Brazil

- /

- Aerospace & Defense

- /

- BOVESPA:EMBR3

Embraer (BVMF:EMBR3) Has Debt But No Earnings; Should You Worry?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Embraer S.A. (BVMF:EMBR3) makes use of debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Embraer

What Is Embraer's Net Debt?

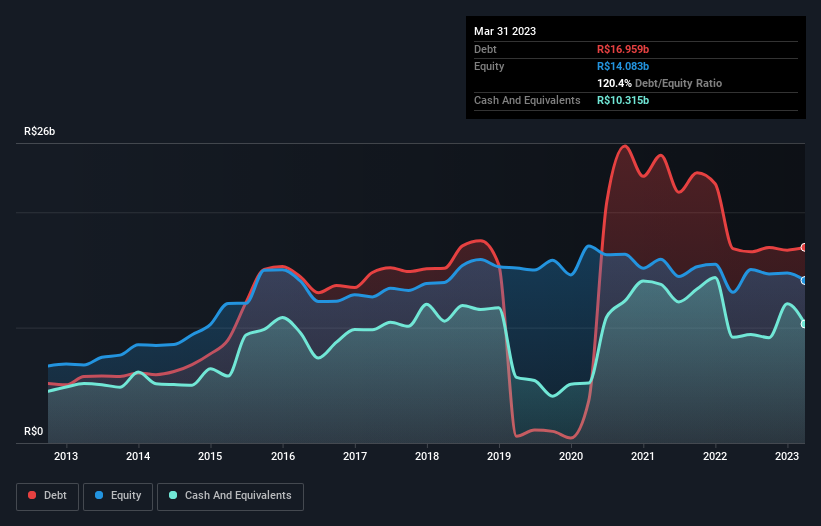

As you can see below, Embraer had R$17.0b of debt, at March 2023, which is about the same as the year before. You can click the chart for greater detail. However, because it has a cash reserve of R$10.3b, its net debt is less, at about R$6.64b.

How Healthy Is Embraer's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Embraer had liabilities of R$17.5b due within 12 months and liabilities of R$21.5b due beyond that. Offsetting this, it had R$10.3b in cash and R$5.08b in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by R$23.7b.

The deficiency here weighs heavily on the R$12.9b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. At the end of the day, Embraer would probably need a major re-capitalization if its creditors were to demand repayment. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Embraer's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, Embraer reported revenue of R$24b, which is a gain of 13%, although it did not report any earnings before interest and tax. That rate of growth is a bit slow for our taste, but it takes all types to make a world.

Caveat Emptor

Over the last twelve months Embraer produced an earnings before interest and tax (EBIT) loss. Indeed, it lost R$490m at the EBIT level. When we look at that alongside the significant liabilities, we're not particularly confident about the company. It would need to improve its operations quickly for us to be interested in it. Not least because it burned through R$143m in negative free cash flow over the last year. That means it's on the risky side of things. When we look at a riskier company, we like to check how their profits (or losses) are trending over time. Today, we're providing readers this interactive graph showing how Embraer's profit, revenue, and operating cashflow have changed over the last few years.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if Embraer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:EMBR3

Embraer

Designs, develops, manufactures, and sells aircraft and systems in North America, Latin America, the Asia Pacific, Brazil, Europe, and internationally.

Excellent balance sheet and slightly overvalued.