- Bulgaria

- /

- Electric Utilities

- /

- BUL:TPLR

The Market Lifts Toplofikatsia-Ruse AD (BUL:TPLR) Shares 60% But It Can Do More

The Toplofikatsia-Ruse AD (BUL:TPLR) share price has done very well over the last month, posting an excellent gain of 60%. The last 30 days bring the annual gain to a very sharp 56%.

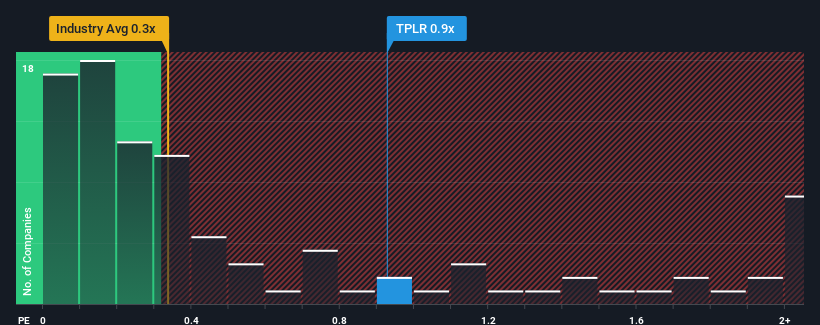

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Toplofikatsia-Ruse AD's P/S ratio of 0.9x, since the median price-to-sales (or "P/S") ratio for the Electric Utilities industry in Bulgaria is also close to 0.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Toplofikatsia-Ruse AD

How Toplofikatsia-Ruse AD Has Been Performing

With revenue growth that's exceedingly strong of late, Toplofikatsia-Ruse AD has been doing very well. It might be that many expect the strong revenue performance to wane, which has kept the share price, and thus the P/S ratio, from rising. Those who are bullish on Toplofikatsia-Ruse AD will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Toplofikatsia-Ruse AD will help you shine a light on its historical performance.How Is Toplofikatsia-Ruse AD's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Toplofikatsia-Ruse AD's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company grew revenue by an impressive 62% last year. The latest three year period has also seen an excellent 112% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to decline by 6.6% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

With this in mind, we find it intriguing that Toplofikatsia-Ruse AD's P/S matches its industry peers. It looks like most investors are not convinced the company can maintain its recent positive growth rate in the face of a shrinking broader industry.

The Final Word

Toplofikatsia-Ruse AD appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Toplofikatsia-Ruse AD revealed its growing revenue over the medium-term hasn't helped elevate its P/S above that of the industry, which is surprising given the industry is set to shrink. When we see a history of positive growth in a struggling industry, but only an average P/S, we assume potential risks are what might be placing pressure on the P/S ratio. One major risk is whether its revenue trajectory can keep outperforming under these tough industry conditions. The fact that the company's relative performance has not provided a kick to the share price suggests that some investors are anticipating revenue instability.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Toplofikatsia-Ruse AD (2 can't be ignored!) that you need to be mindful of.

If you're unsure about the strength of Toplofikatsia-Ruse AD's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Toplofikatsia-Ruse AD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BUL:TPLR

Toplofikatsia-Ruse AD

Produces and sells electricity and thermal energy in Bulgaria.

Good value with adequate balance sheet.

Market Insights

Community Narratives