- Belgium

- /

- Real Estate

- /

- ENXTBR:VGP

We Believe VGP's (EBR:VGP) Earnings Are A Poor Guide For Its Profitability

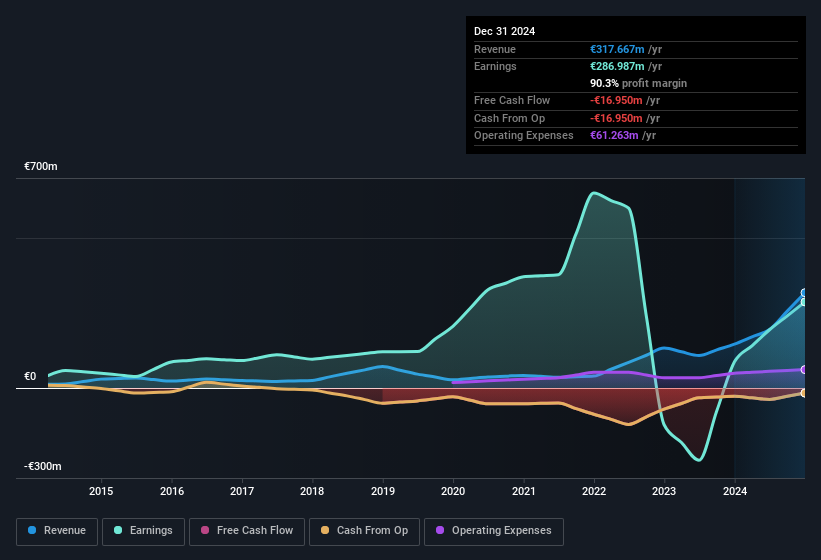

Even though VGP NV (EBR:VGP) posted strong earnings recently, the stock hasn't reacted in a large way. We looked deeper into the numbers and found that shareholders might be concerned with some underlying weaknesses.

View our latest analysis for VGP

The Power Of Non-Operating Revenue

At most companies, some revenue streams, such as government grants, are accounted for as non-operating revenue, while the core business is said to produce operating revenue. Where possible, we prefer rely on operating revenue to get a better understanding of how the business is functioning. Importantly, the non-operating revenue often comes without associated ongoing costs, so it can boost profit by letting it fall straight to the bottom line, making the operating business seem better than it really is. It's worth noting that VGP saw a big increase in non-operating revenue over the last year. Indeed, its non-operating revenue rose from €50.5m last year to €211.3m this year. If that non-operating revenue fails to manifest in the current year, then there's a real risk the bottom line profit result will be impacted negatively. Sometimes, you can get a better idea of the underlying earnings potential of a company by excluding unusual boosts to non-operating revenue.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

How Do Unusual Items Influence Profit?

As well as that spike in non-operating revenue, we should also consider the €69m boost to profit coming from unusual items, over the last year. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. Which is hardly surprising, given the name. VGP had a rather significant contribution from unusual items relative to its profit to December 2024. As a result, we can surmise that the unusual items are making its statutory profit significantly stronger than it would otherwise be.

Our Take On VGP's Profit Performance

In the last year VGP's non-operating revenue really gave it a boost, but not in a way that is necessarily going to be sustained. And on top of that, it also saw an unusual item boost its profit, suggesting that next year might see a lower profit number, if these events are not repeated and everything else is equal. For the reasons mentioned above, we think that a perfunctory glance at VGP's statutory profits might make it look better than it really is on an underlying level. So while earnings quality is important, it's equally important to consider the risks facing VGP at this point in time. Every company has risks, and we've spotted 4 warning signs for VGP (of which 2 are a bit concerning!) you should know about.

Our examination of VGP has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTBR:VGP

VGP

Develops, owns, and manages logistics and semi-industrial real estate, and ancillary offices.

Fair value with acceptable track record.

Market Insights

Community Narratives