Investors in argenx (EBR:ARGX) have seen strong returns of 259% over the past five years

It hasn't been the best quarter for argenx SE (EBR:ARGX) shareholders, since the share price has fallen 24% in that time. But that doesn't change the fact that the returns over the last five years have been very strong. In fact, the share price is 259% higher today. So while it's never fun to see a share price fall, it's important to look at a longer time horizon. Of course, that doesn't necessarily mean it's cheap now.

Now it's worth having a look at the company's fundamentals too, because that will help us determine if the long term shareholder return has matched the performance of the underlying business.

Check out our latest analysis for argenx

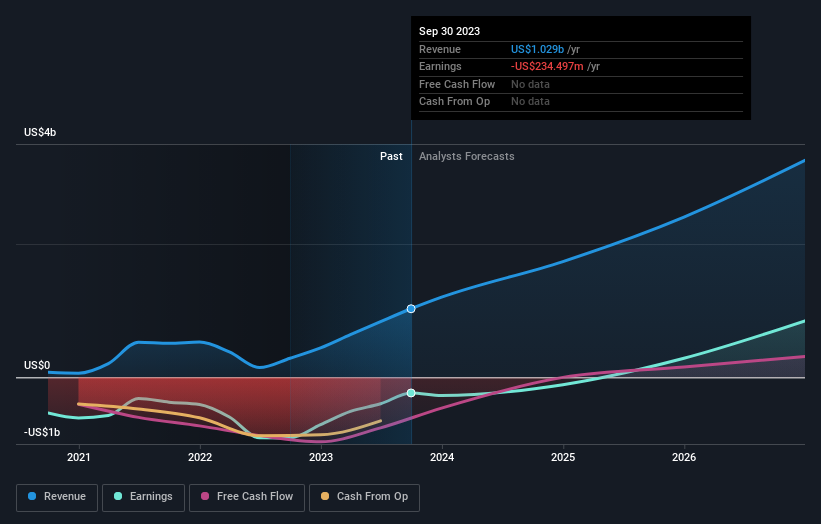

Because argenx made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last 5 years argenx saw its revenue grow at 52% per year. Even measured against other revenue-focussed companies, that's a good result. Meanwhile, its share price performance certainly reflects the strong growth, given the share price grew at 29% per year, compound, during the period. This suggests the market has well and truly recognized the progress the business has made. To our minds that makes argenx worth investigating - it may have its best days ahead.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

argenx is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. You can see what analysts are predicting for argenx in this interactive graph of future profit estimates.

A Different Perspective

It's nice to see that argenx shareholders have received a total shareholder return of 2.1% over the last year. Having said that, the five-year TSR of 29% a year, is even better. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for argenx (of which 1 doesn't sit too well with us!) you should know about.

We will like argenx better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Belgian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTBR:ARGX

argenx

A biotechnology company, engages in the developing of various therapies for the treatment of autoimmune diseases in the United States, Japan, Europe, Middle East, Africa, and China.

Exceptional growth potential with excellent balance sheet.