As global markets experience a surge, with U.S. stocks reaching new heights amid optimism over trade policies and AI advancements, growth stocks have notably outperformed their value counterparts, highlighting investor enthusiasm for innovation-driven sectors. In this dynamic environment, identifying high-growth tech stocks involves evaluating companies that can leverage technological advancements and strategic partnerships to capitalize on emerging market opportunities.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

Click here to see the full list of 1231 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

argenx (ENXTBR:ARGX)

Simply Wall St Growth Rating: ★★★★★☆

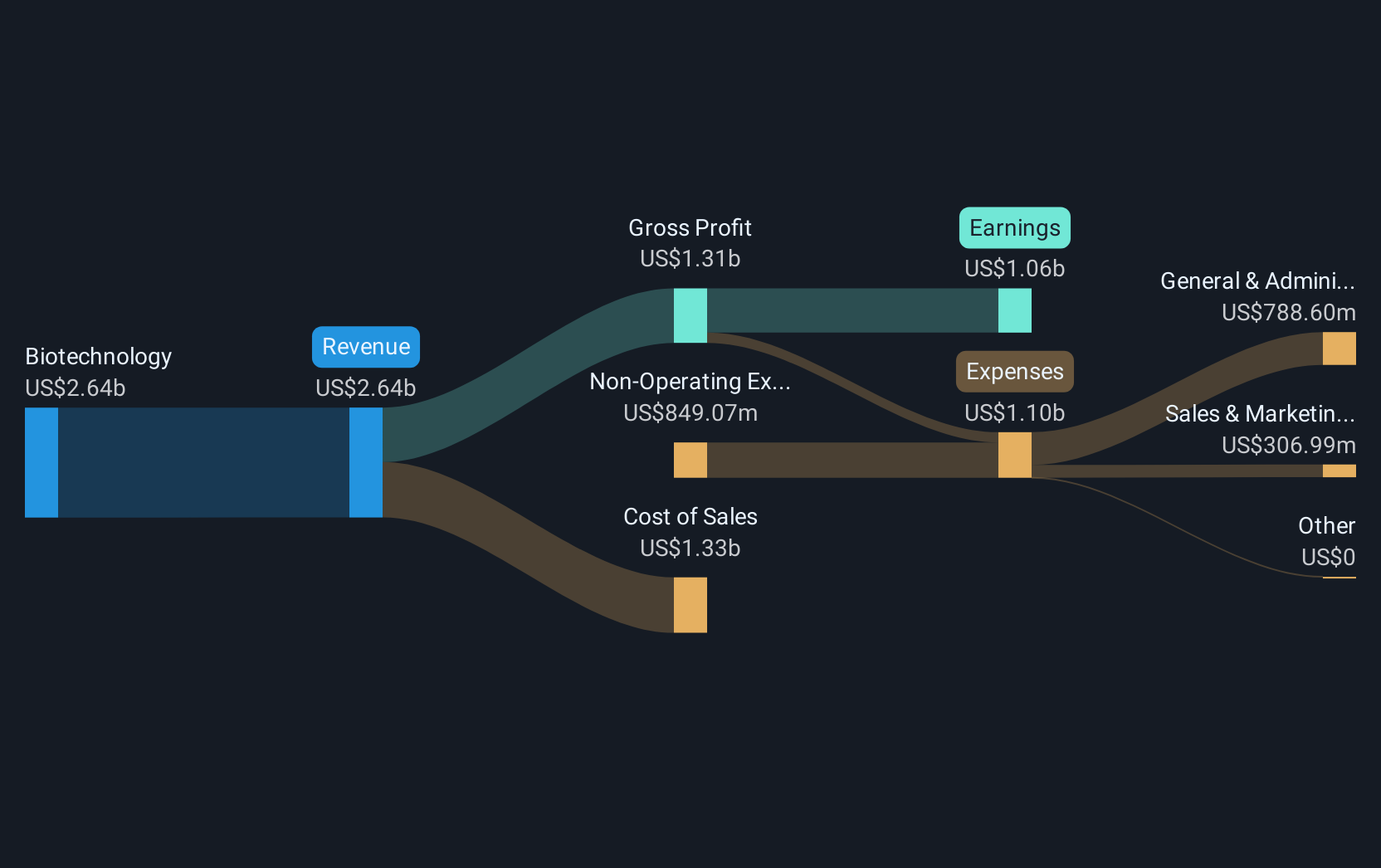

Overview: argenx SE is a biotechnology company focused on developing therapies for autoimmune diseases across the United States, Japan, Europe, the Middle East, Africa, and China with a market cap of €37.89 billion.

Operations: The company generates revenue primarily from its biotechnology segment, amounting to $1.91 billion. It is engaged in the development of therapies targeting autoimmune diseases across multiple regions globally.

Argenx's recent approval of VYVDURA in Japan for CIDP, a rare neuromuscular disorder, underscores its strategic focus on addressing unmet medical needs through innovative treatments. This follows their positive earnings report for Q3 2024, where revenue surged to $588.88 million from $339.84 million year-over-year and net income flipped to $91.41 million from a previous loss of $72.64 million. These developments highlight Argenx's robust R&D commitment and its potential ripple effect in enhancing patient care globally while boosting its financial health and market position in specialized pharmaceuticals.

- Take a closer look at argenx's potential here in our health report.

Examine argenx's past performance report to understand how it has performed in the past.

SM Entertainment (KOSDAQ:A041510)

Simply Wall St Growth Rating: ★★★★☆☆

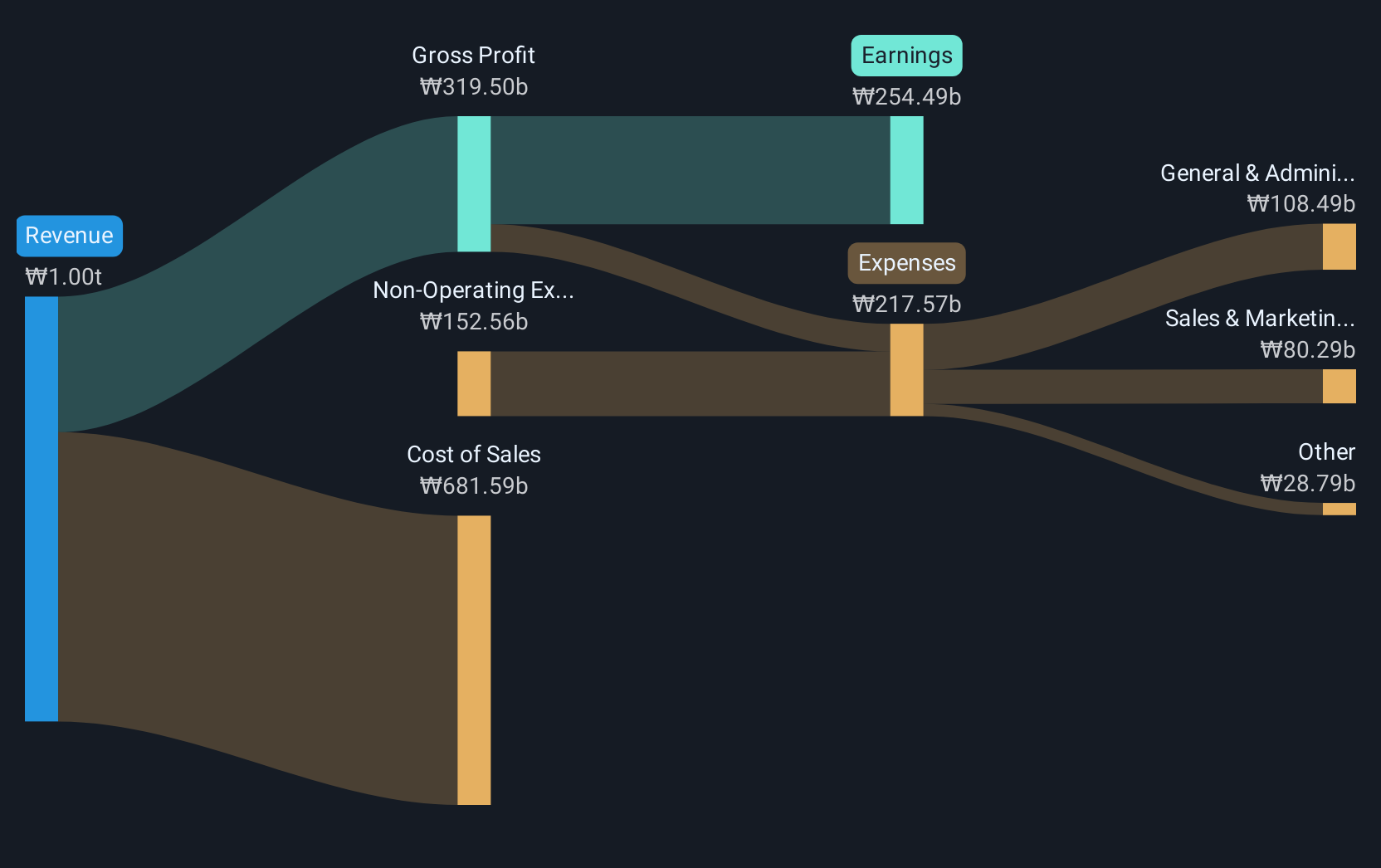

Overview: SM Entertainment Co., Ltd. is a South Korean company involved in music and sound production, talent management, and music/audio content publication globally, with a market cap of ₩1.92 trillion.

Operations: SM Entertainment generates revenue primarily through its entertainment segment, excluding advertising agency activities, which accounts for ₩871.42 billion. The company also earns from its advertising agency operations, contributing ₩80.94 billion to its revenue stream.

SM Entertainment, poised to become profitable within three years, demonstrates a promising trajectory with expected earnings growth of 75.7% annually. This growth is supported by a robust annual revenue increase of 11.3%, surpassing South Korea's market average of 9.2%. Despite current unprofitability which complicates direct industry comparisons, the company's strategic initiatives are yielding tangible results, as evidenced by its recent regular cash dividend announcement in November 2024. With a forecasted low return on equity at 13.6% in three years and challenges in matching the rapid pace of some industry peers, SM Entertainment must continue innovating and leveraging its unique position in the entertainment sector to enhance future profitability and shareholder value.

Doushen (Beijing) Education & Technology (SZSE:300010)

Simply Wall St Growth Rating: ★★★★☆☆

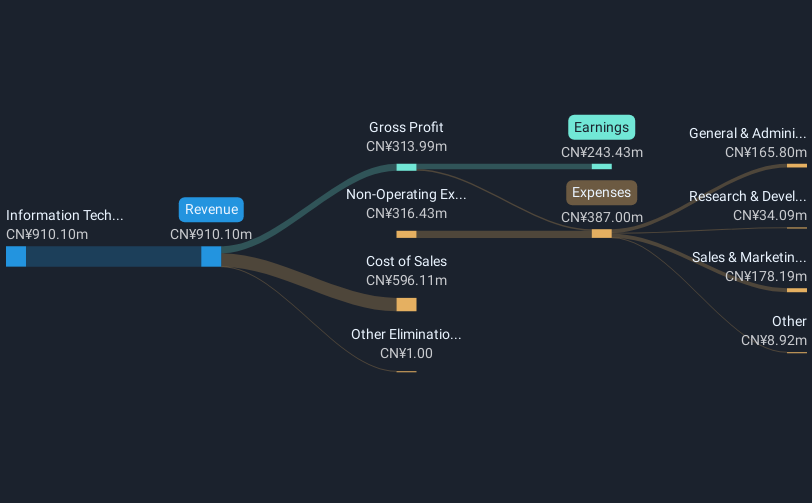

Overview: Doushen (Beijing) Education & Technology INC. focuses on providing educational and technological services, with a market capitalization of CN¥16.08 billion.

Operations: The company's primary revenue stream is from Information Technology Services, generating CN¥910.10 million.

Doushen (Beijing) Education & Technology has recently transitioned into profitability, a notable achievement that aligns with its impressive revenue growth of 38.4% annually. This growth rate significantly outpaces the broader CN market's average of 13.3%. The company's commitment to innovation is evident in its R&D spending, which has been strategically increased to enhance product offerings and market competitiveness. Despite a forecast of earnings growth at 23.8% per year, slightly below the CN market expectation of 25%, Doushen is making significant strides in securing a robust position within the tech education sector. Its recent profitability and aggressive investment in R&D are pivotal for sustaining long-term growth and adapting to evolving educational technology demands.

Taking Advantage

- Click this link to deep-dive into the 1231 companies within our High Growth Tech and AI Stocks screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300010

Doushen (Beijing) Education & Technology

Doushen (Beijing) Education & Technology INC.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives