Are Solvac's (EBR:SOLV) Statutory Earnings A Good Reflection Of Its Earnings Potential?

Broadly speaking, profitable businesses are less risky than unprofitable ones. That said, the current statutory profit is not always a good guide to a company's underlying profitability. In this article, we'll look at how useful this year's statutory profit is, when analysing Solvac (EBR:SOLV).

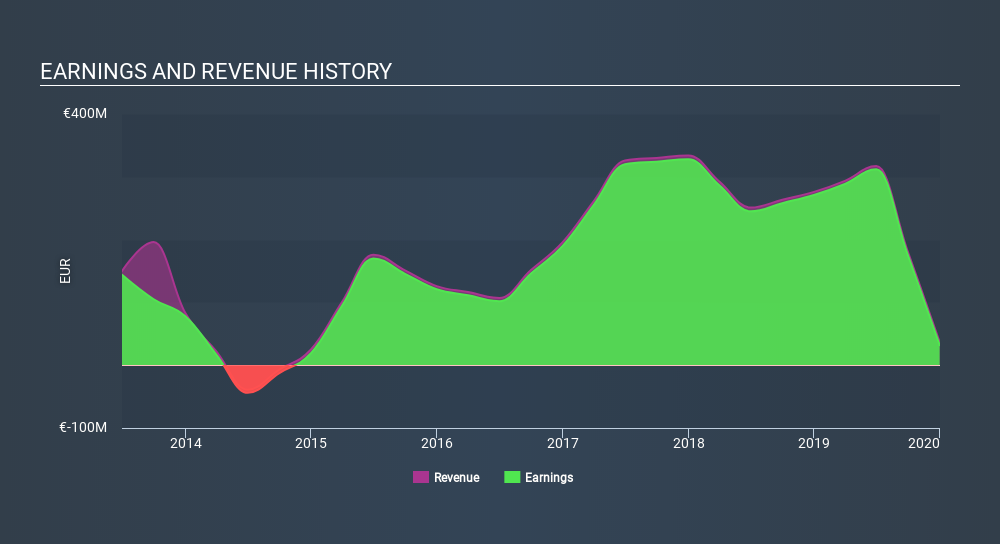

We like the fact that Solvac made a profit of €32.0m on its revenue of €37.0m, in the last year. In the last few years both its revenue and its profit have fallen, as you can see in the chart below.

Check out our latest analysis for Solvac

Of course, when it comes to statutory profit, the devil is often in the detail, and we can get a better sense for a company by diving deeper into the financial statements. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Solvac.

Our Take On Solvac's Profit Performance

Therefore, it seems possible to us that Solvac's true underlying earnings power is actually less than its statutory profit. So while earnings quality is important, it's equally important to consider the risks facing Solvac at this point in time. While conducting our analysis, we found that Solvac has 1 warning sign and it would be unwise to ignore this.

Our examination of Solvac has focussed on certain factors that can make its earnings look better than they are. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About ENXTBR:SOLV

Solvac

Operates as an advanced materials and specialty chemicals company in Belgium.

Solid track record and fair value.

Market Insights

Community Narratives