Is Solvay's Share Price Attractive After Recent Restructuring and 27.9% Decline?

Reviewed by Bailey Pemberton

- If you have ever wondered whether Solvay’s current share price offers genuine value or just more volatility, you are not alone. This is the right place for answers.

- The stock has slipped by 3.5% over the past week and is now down 27.9% over the past year. However, it still shows 52% returns over three years and 79.2% over the past five years.

- Recent headlines have focused on Solvay’s major restructuring and its shift of strategic priorities after splitting into two companies, which has caught investor attention. These moves have fueled both optimism for future growth and concerns about transition risks.

- When we crunch the numbers, Solvay earns a valuation score of 3 out of 6. There is room for improvement, but also signals of potential opportunity, depending on which valuation lens you use. We will break down those methods next, and at the end, share a smarter way to cut through the noise and really understand what this score means.

Find out why Solvay's -27.9% return over the last year is lagging behind its peers.

Approach 1: Solvay Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them back to today’s value. For Solvay, this means looking ahead at how much cash the business is expected to generate and translating those numbers into a present-day valuation in euros.

Solvay’s latest twelve-month Free Cash Flow (FCF) stands at -€193.85 million, reflecting recent financial headwinds. Analysts expect this to bounce back to €310 million by 2028, with year-on-year projections showing steady improvement. Notably, specialist forecasts are only available for the next five years. Beyond that, cash flows are extrapolated by Simply Wall St, but the upward trajectory continues, reaching €337.63 million by 2035 based on these longer-range assumptions.

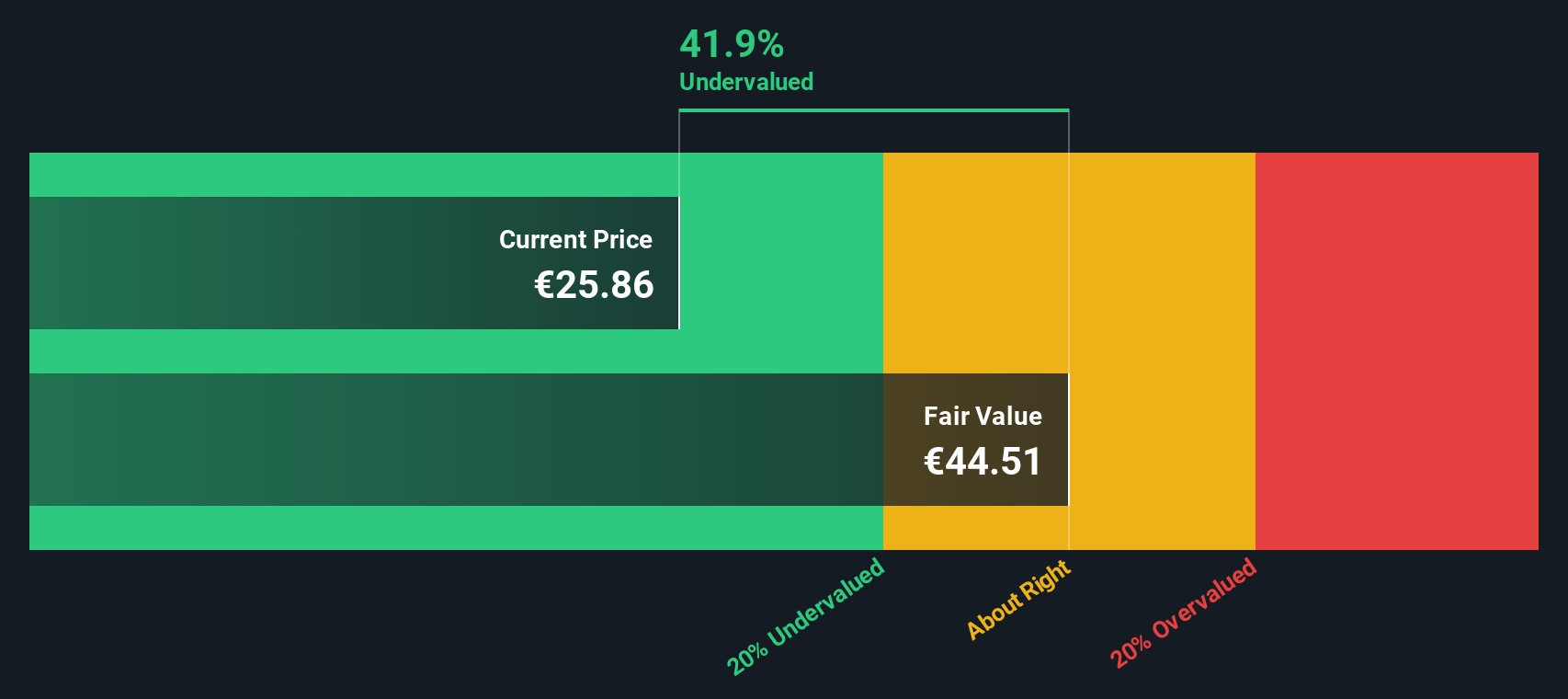

After plugging these cash flow projections into the 2 Stage Free Cash Flow to Equity model, the resulting intrinsic value is €44.51 per share. With Solvay currently trading at a significant discount to this estimate, specifically 41.9% below, this suggests the stock is undervalued according to its projected cash generation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Solvay is undervalued by 41.9%. Track this in your watchlist or portfolio, or discover 843 more undervalued stocks based on cash flows.

Approach 2: Solvay Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely recognized yardstick for valuing profitable companies like Solvay. It essentially tells investors how much they are paying for each euro of earnings. For established businesses generating consistent profits, the PE ratio helps gauge whether a stock is cheap, expensive, or roughly fair in light of its growth prospects and risk profile.

What is considered a “fair” PE ratio isn’t set in stone, as it shifts alongside expectations for future earnings growth, competitive strengths, and industry risks. Higher growth and lower risk usually justify a higher PE, while slower growth or greater uncertainty tend to pull it down.

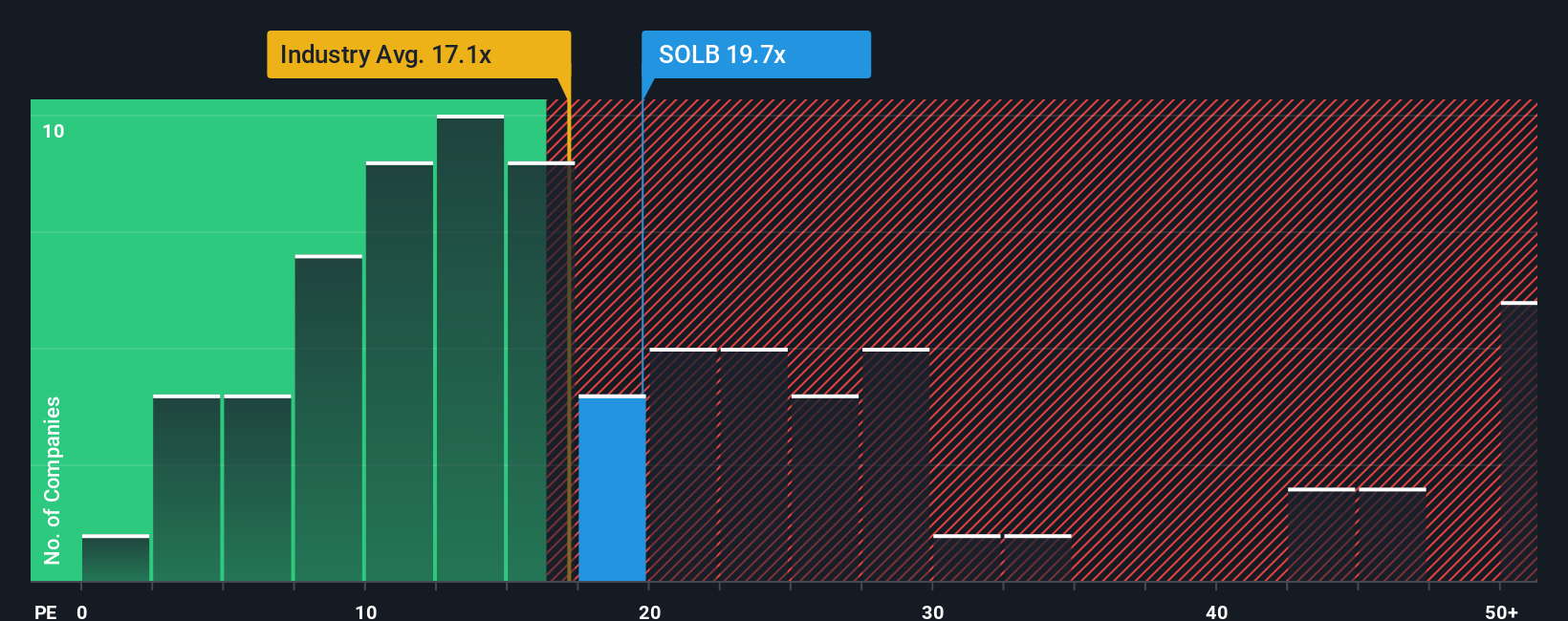

Currently, Solvay trades at a PE ratio of 19.4x. To put that in context, peers in the chemicals sector average 16.2x. The industry as a whole sits even higher at 22x. These statistics offer a point of reference but do not fully account for Solvay’s unique circumstances.

This is where Simply Wall St’s “Fair Ratio” comes in. The Fair Ratio is a proprietary benchmark that we calculate by considering a company’s growth outlook, profit margins, industry role, market cap, and its risk factors. It aims to answer the question, “What multiple should this business trade at, given its specific fundamentals?” As of now, Solvay's Fair Ratio clocks in at 20.4x. This nuanced approach provides a much clearer picture than comparisons to blunt industry or peer averages alone.

Comparing Solvay’s actual PE (19.4x) with its Fair Ratio (20.4x), the difference is less than 1x. This means the stock is valued about right relative to what its core fundamentals suggest it deserves.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Solvay Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives.

A Narrative puts your own story behind Solvay’s numbers. It is your perspective on estimated fair value and future performance, backed up by the revenue, earnings, and profit margin assumptions that matter most to you. Narratives connect what you believe about the company’s direction to a projected financial forecast and then to a fair value, turning complex analysis into one clear story.

On Simply Wall St’s Community page, Narratives are an accessible tool used by millions of investors to see, compare, and discuss diverse investment perspectives. They help you act confidently by making it easy to judge if Solvay is a buy or sell. You simply compare your preferred Narrative’s fair value to the current price and see how the gap changes as new news, earnings, or updates are released.

For example, one Solvay Narrative might assume the highest analyst price target of €37.0, seeing international growth and margin wins ahead, while another takes the most cautious view with a €24.0 target, concerned about global pricing pressure and environmental risks. Narratives let you weigh those stories side by side and pick the one that fits your outlook best.

Do you think there's more to the story for Solvay? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:SOLB

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives