Subdued Growth No Barrier To Realco SA (EBR:REAL) With Shares Advancing 32%

The Realco SA (EBR:REAL) share price has done very well over the last month, posting an excellent gain of 32%. The last 30 days bring the annual gain to a very sharp 42%.

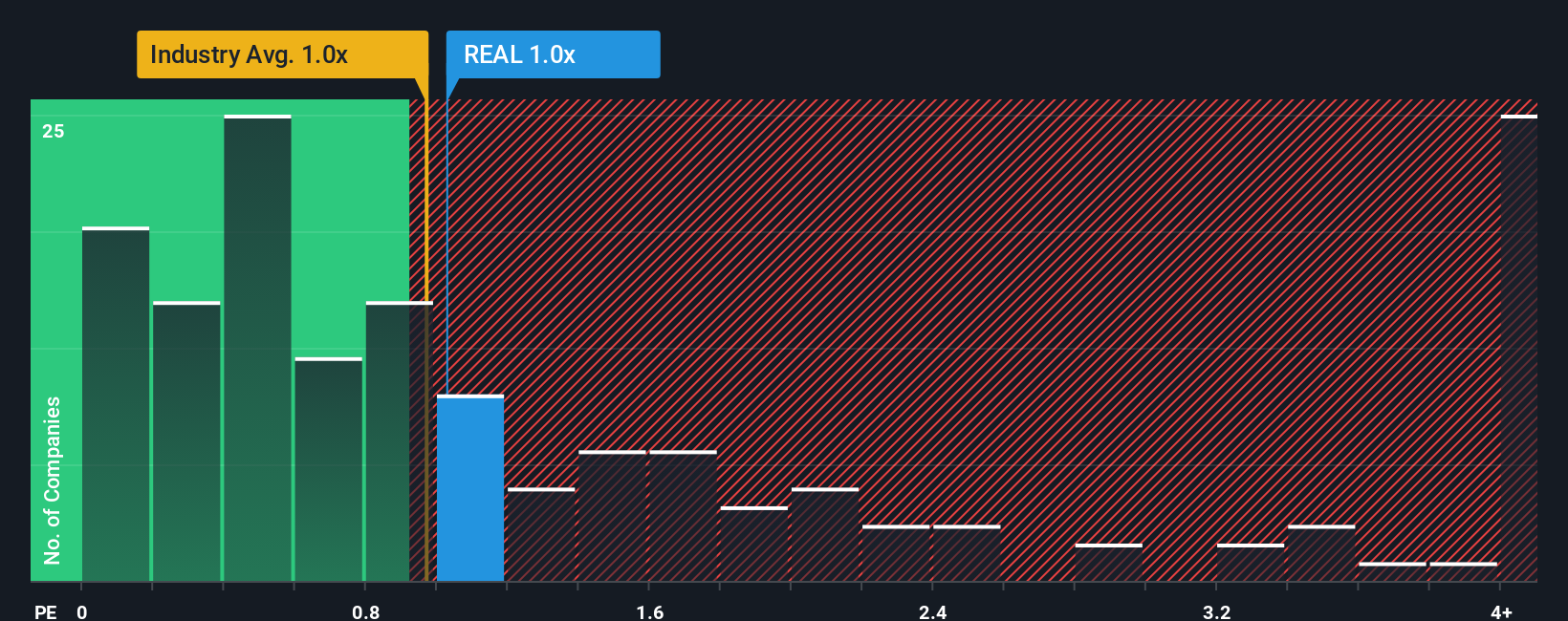

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Realco's P/S ratio of 1x, since the median price-to-sales (or "P/S") ratio for the Chemicals industry in Belgium is also close to 0.8x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Realco

How Has Realco Performed Recently?

Revenue has risen at a steady rate over the last year for Realco, which is generally not a bad outcome. It might be that many expect the respectable revenue performance to only match most other companies over the coming period, which has kept the P/S from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Realco will help you shine a light on its historical performance.How Is Realco's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Realco's to be considered reasonable.

Retrospectively, the last year delivered a decent 6.3% gain to the company's revenues. However, this wasn't enough as the latest three year period has seen an unpleasant 8.9% overall drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to shrink 0.2% in the next 12 months, the company's downward momentum is still inferior based on recent medium-term annualised revenue results.

With this information, it's perhaps strange that Realco is trading at a fairly similar P/S in comparison. With revenue going quickly in reverse, it's not guaranteed that the P/S has found a floor yet. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

The Bottom Line On Realco's P/S

Realco's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Realco currently trades on a higher than expected P/S since its recent three-year revenues are even worse than the forecasts for a struggling industry. When we see below average revenue, we suspect the share price is at risk of declining, sending the moderate P/S lower. In addition, we would be concerned whether the company can even maintain its medium-term level of performance under these tough industry conditions. Unless the company's relative performance improves, it's challenging to accept these prices as being reasonable.

You should always think about risks. Case in point, we've spotted 5 warning signs for Realco you should be aware of, and 3 of them are concerning.

If these risks are making you reconsider your opinion on Realco, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTBR:REAL

Realco

Engages in the development, production, and sale of enzyme-based hygiene solutions and processes primarily in Belgium.

Moderate risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives