- Belgium

- /

- Metals and Mining

- /

- ENXTBR:BEKB

European Dividend Stocks To Consider In April 2025

Reviewed by Simply Wall St

As European markets show resilience with the STOXX Europe 600 Index rising by 2.77%, buoyed by easing trade tensions and positive signals from major economies, investors are increasingly looking towards dividend stocks as a stable income source amidst economic uncertainties. In this environment, selecting dividend stocks that demonstrate strong fundamentals and consistent payout histories can provide a reliable stream of income while potentially benefiting from market gains.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Julius Bär Gruppe (SWX:BAER) | 4.94% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.44% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.67% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.01% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.42% | ★★★★★★ |

| S.N. Nuclearelectrica (BVB:SNN) | 9.16% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 5.00% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.30% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.12% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.38% | ★★★★★★ |

Click here to see the full list of 237 stocks from our Top European Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

NV Bekaert (ENXTBR:BEKB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NV Bekaert SA is a global company specializing in steel wire transformation and coating technologies, with a market cap of €1.73 billion.

Operations: NV Bekaert SA's revenue is primarily derived from its Rubber Reinforcement segment at €1.73 billion, followed by Steel Wire Solutions at €1.10 billion, Specialty Businesses at €638.04 million, and the Bridon-Bekaert Ropes Group contributing €555.23 million.

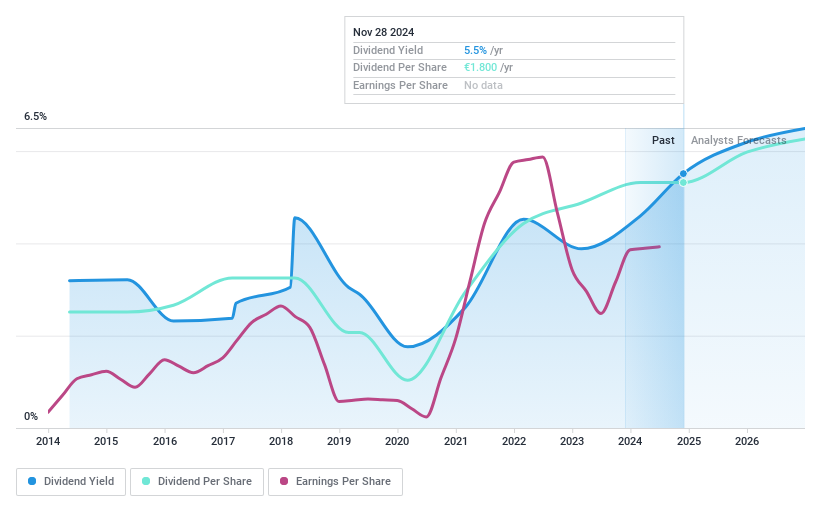

Dividend Yield: 5.6%

NV Bekaert SA has announced a proposed dividend increase of 6% to €1.90 per share, reflecting its commitment to gradually growing dividends. Despite past volatility in dividend payments, the current payout ratio of 41.7% suggests dividends are well covered by earnings, and a cash payout ratio of 63.9% indicates coverage by cash flows as well. However, the dividend yield is lower than top-tier Belgian market payers at 5.61%.

- Click here and access our complete dividend analysis report to understand the dynamics of NV Bekaert.

- Our valuation report here indicates NV Bekaert may be undervalued.

Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative (ENXTPA:CRTO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative offers a range of banking products and services in France, with a market cap of €525.85 million.

Operations: The company's revenue is primarily derived from its Proximity Bank segment, which contributes €251.71 million, and Management for Own Account and Miscellaneous segment, which adds €60.97 million.

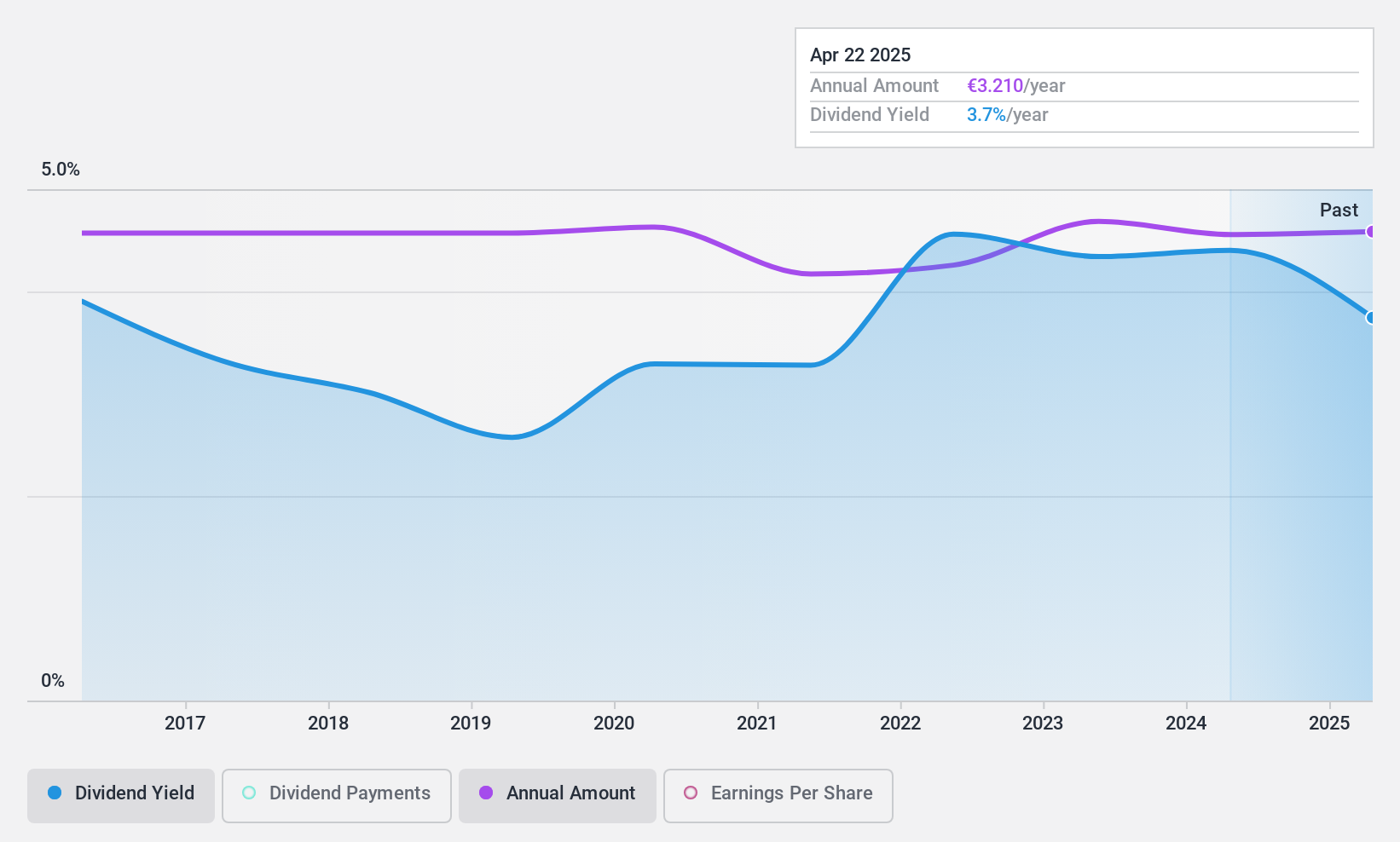

Dividend Yield: 3.8%

Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative offers a stable dividend with a reliable 10-year history and recent annual payout of €3.21 per share. Despite its net income decline to €80.55 million in 2024, the low payout ratio of 25% suggests dividends are well covered by earnings. However, its yield of 3.82% is below top-tier French market payers, yet the stock trades significantly below estimated fair value, potentially offering good investment value.

- Dive into the specifics of Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative here with our thorough dividend report.

- The valuation report we've compiled suggests that Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative's current price could be quite moderate.

Bucher Industries (SWX:BUCN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bucher Industries AG manufactures and sells machinery, systems, and hydraulic components for various industries including agriculture and public space maintenance across Asia, the United States, Europe, and internationally with a market cap of CHF3.67 billion.

Operations: Bucher Industries AG's revenue is primarily derived from its segments: Kuhn Group (CHF1.16 billion), Bucher Specials (CHF356.60 million), Bucher Municipal (CHF601.80 million), Bucher Hydraulics (CHF653.20 million), and Bucher Emhart Glass (CHF462.10 million).

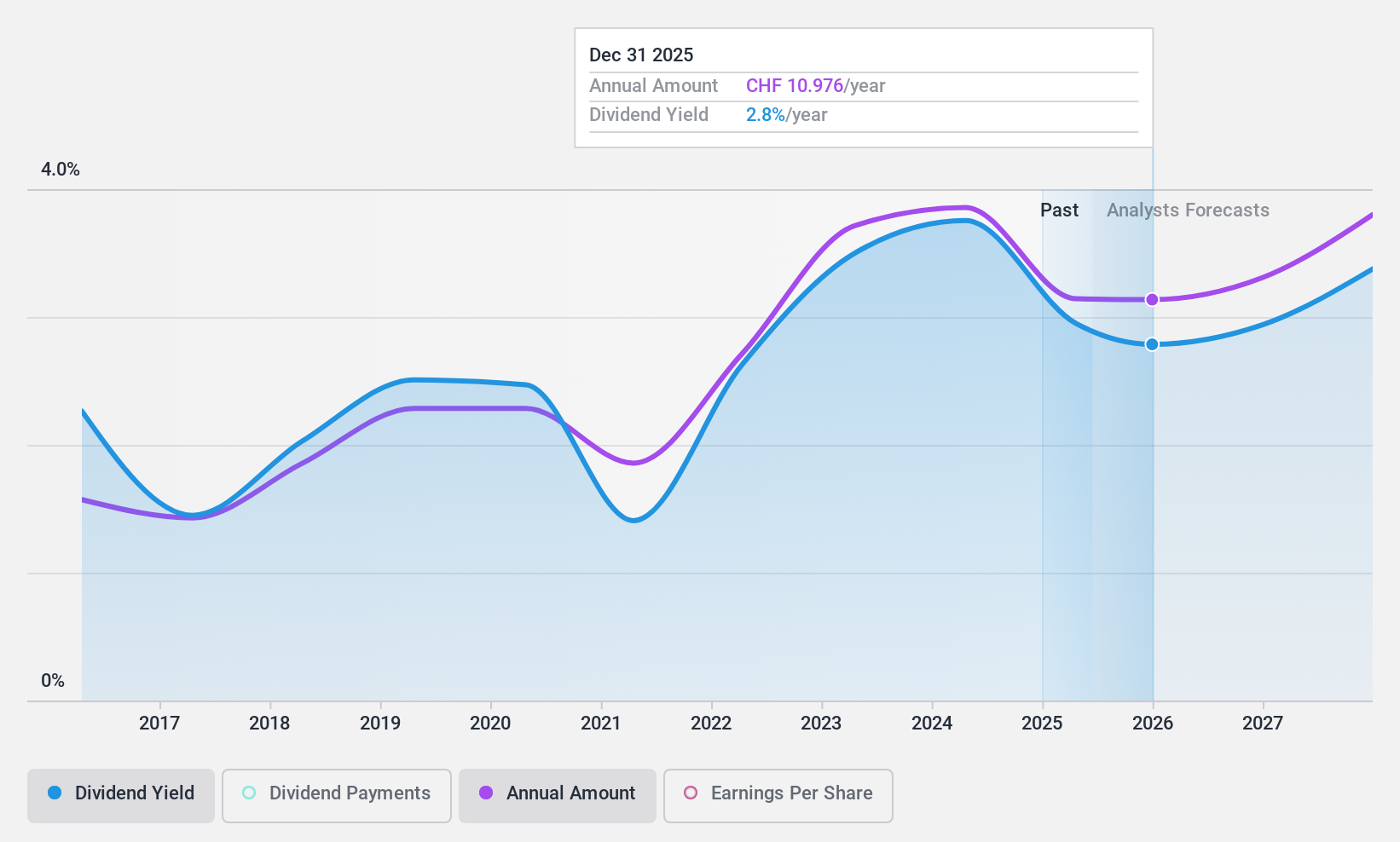

Dividend Yield: 3.1%

Bucher Industries offers a stable dividend history with reliable growth over the past decade, despite a recent decrease to CHF 11 per share. While its yield of 3.07% is below the top Swiss market payers, dividends are well covered by earnings and cash flows, with payout ratios of 49.6% and 58.5%, respectively. The stock trades at an attractive valuation, significantly below estimated fair value, amidst anticipated slight sales growth and improved operating margins for 2025.

- Take a closer look at Bucher Industries' potential here in our dividend report.

- According our valuation report, there's an indication that Bucher Industries' share price might be on the cheaper side.

Seize The Opportunity

- Unlock our comprehensive list of 237 Top European Dividend Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NV Bekaert might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:BEKB

NV Bekaert

Provides steel wire transformation and coating technologies worldwide.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives