- Spain

- /

- Real Estate

- /

- BME:AEDAS

3 European Dividend Stocks Yielding Up To 13.3%

Reviewed by Simply Wall St

Amid renewed concerns about inflated AI stock valuations, the European markets have seen a downturn, with major indices like the STOXX Europe 600 Index and Germany's DAX experiencing notable declines. Despite this challenging environment, dividend stocks remain an attractive option for investors seeking steady income streams, as they can provide a buffer against market volatility.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.44% | ★★★★★★ |

| Sulzer (SWX:SUN) | 3.22% | ★★★★★☆ |

| Sonae SGPS (ENXTLS:SON) | 4.03% | ★★★★★☆ |

| Holcim (SWX:HOLN) | 4.29% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.99% | ★★★★★★ |

| freenet (XTRA:FNTN) | 6.71% | ★★★★★☆ |

| Evolution (OM:EVO) | 4.83% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.25% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.68% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.66% | ★★★★★★ |

Click here to see the full list of 222 stocks from our Top European Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

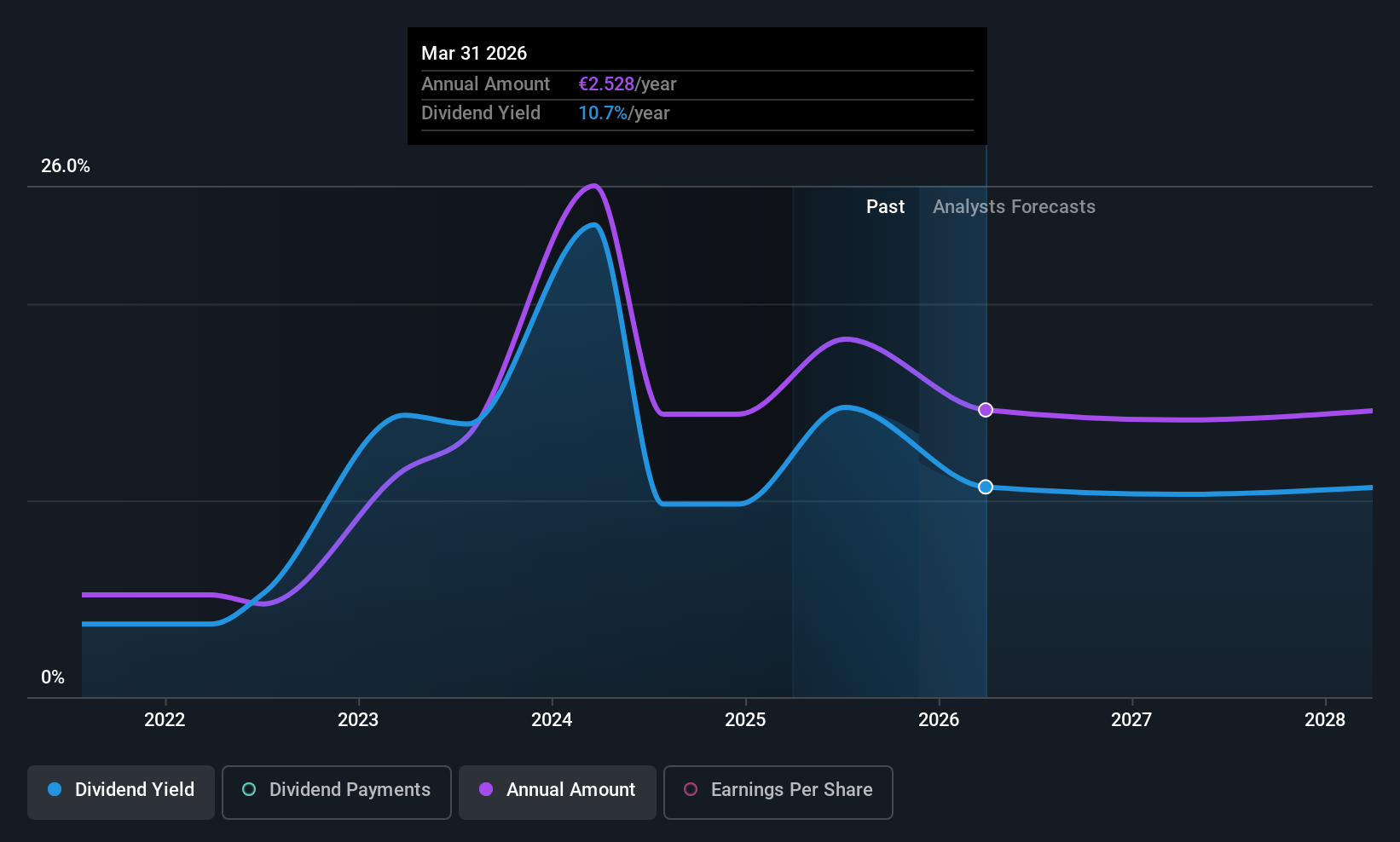

Aedas Homes (BME:AEDAS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aedas Homes, S.A. is involved in the development of residential properties in Spain and has a market cap of approximately €1.02 billion.

Operations: Aedas Homes, S.A. generates its revenue primarily from property development, amounting to €1.16 billion.

Dividend Yield: 13.3%

Aedas Homes offers a high dividend yield of 13.32%, placing it in the top 25% of Spanish dividend payers, but its payments have been volatile over the past four years. While dividends are covered by earnings and cash flows with payout ratios of 74.5% and 78%, respectively, future earnings are expected to decline by an average of 7.2% annually over the next three years, posing potential risks to sustainability.

- Click here to discover the nuances of Aedas Homes with our detailed analytical dividend report.

- Our valuation report unveils the possibility Aedas Homes' shares may be trading at a discount.

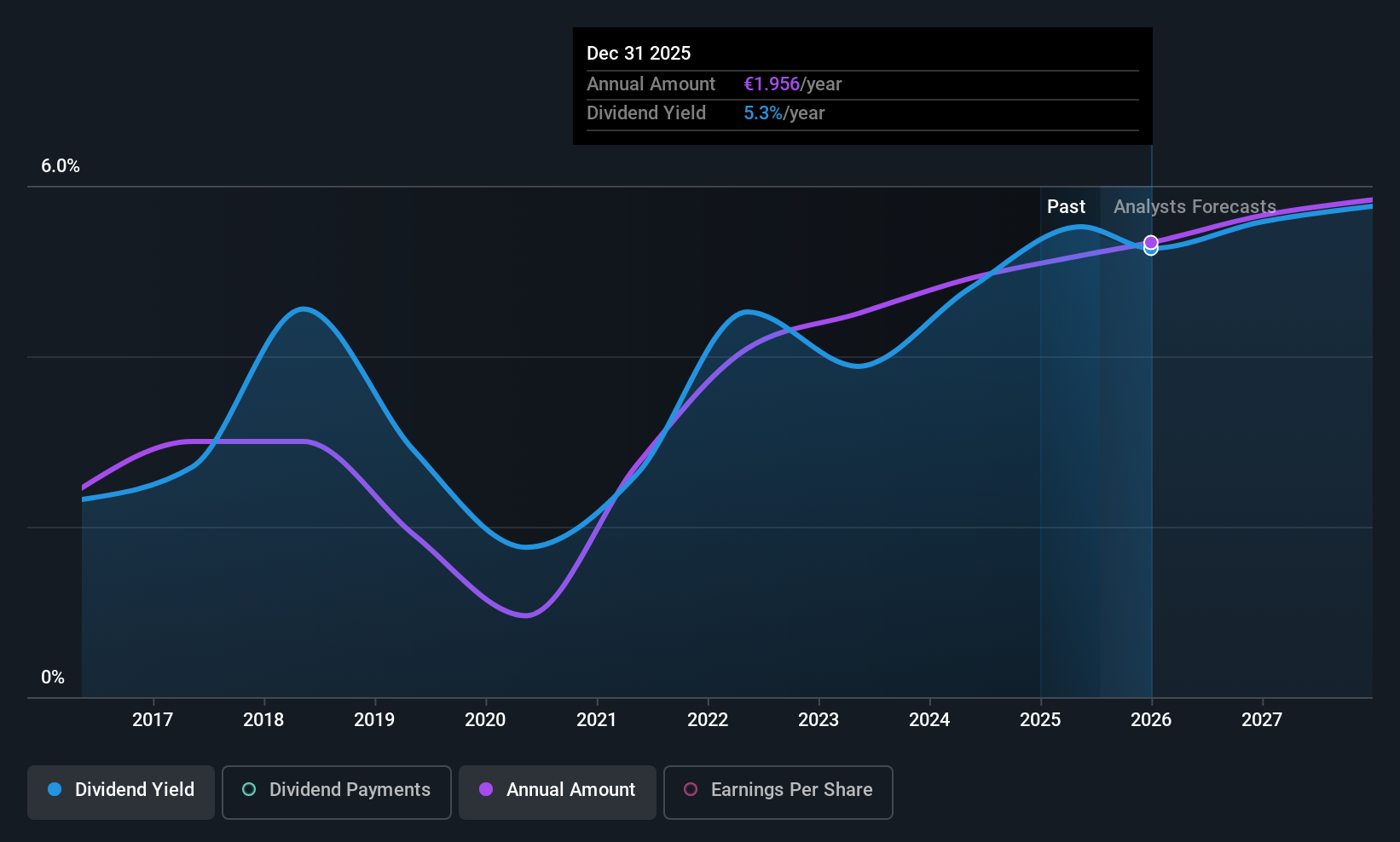

NV Bekaert (ENXTBR:BEKB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NV Bekaert SA operates globally, specializing in steel wire transformation and coating technologies, with a market cap of €1.86 billion.

Operations: NV Bekaert SA's revenue is primarily derived from its Rubber Reinforcement segment at €1.68 billion, Steel Wire Solutions at €1.08 billion, Specialty Businesses at €584.04 million, and Bridon-Bekaert Ropes Group at €561.23 million.

Dividend Yield: 5.1%

NV Bekaert's dividend payments are covered by earnings and cash flows, with payout ratios of 56.7% and 39%, respectively. Despite a history of volatility and unreliability in its dividends, the company has increased its payouts over the past decade. Trading at good value compared to peers, Bekaert is also trading below estimated fair value. Recent guidance suggests sales around €3.7 billion for FY2025, reflecting potential growth opportunities amidst its inclusion in the Euronext 150 Index.

- Click to explore a detailed breakdown of our findings in NV Bekaert's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of NV Bekaert shares in the market.

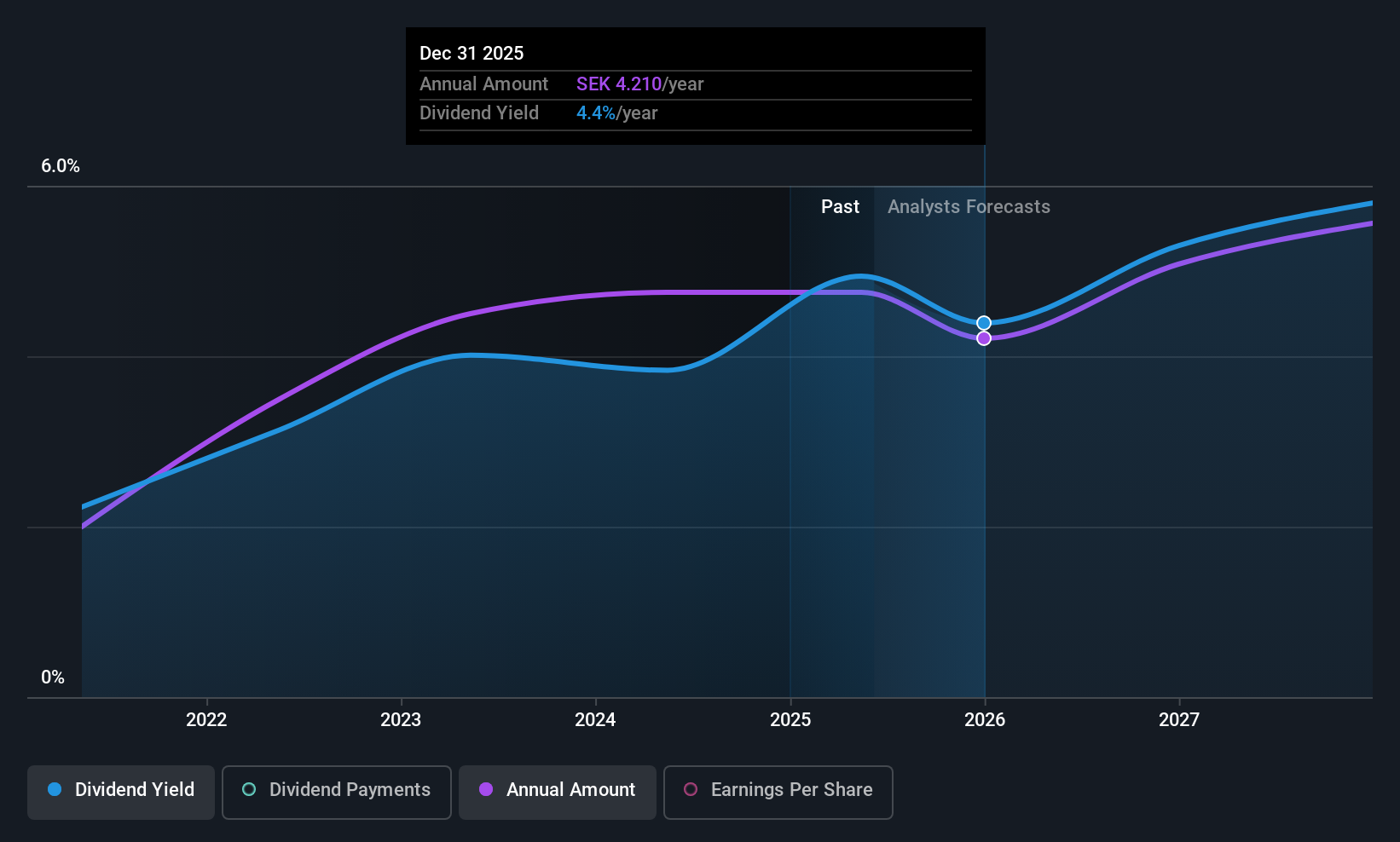

Prevas (OM:PREV B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Prevas AB offers technical solutions across Sweden, Denmark, Finland, and internationally, with a market cap of SEK1.07 billion.

Operations: Prevas AB generates revenue primarily from Sweden (SEK1.22 billion), followed by Finland (SEK198.86 million) and Denmark (SEK156.89 million).

Dividend Yield: 5.7%

Prevas AB's dividend payments are well-supported by earnings and cash flows, with payout ratios of 84.3% and 41.5%, respectively. Although dividends have been reliable, the company has only a five-year history of payouts. Recent Q3 results showed improved net income at SEK 17.24 million, up from SEK 9.63 million a year ago, suggesting financial stability despite high debt levels. Prevas trades significantly below its estimated fair value, offering potential value for investors seeking top-tier yields in Sweden's market.

- Dive into the specifics of Prevas here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Prevas is trading behind its estimated value.

Make It Happen

- Dive into all 222 of the Top European Dividend Stocks we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:AEDAS

Aedas Homes

Engages in the development of residential properties in Spain.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success