- Finland

- /

- Specialty Stores

- /

- HLSE:KAMUX

November 2025's European Penny Stocks Worth Watching

Reviewed by Simply Wall St

As the European markets experience mixed movements, with major indexes showing varied performances and the ECB maintaining a steady interest rate policy, investors are keenly observing smaller opportunities. Penny stocks, often associated with smaller or newer companies, might seem like a term from past market eras but remain relevant due to their potential for growth and affordability. In this article, we explore several penny stocks that stand out for their financial strength and potential to offer significant returns without many of the typical risks associated with this segment.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Lucisano Media Group (BIT:LMG) | €1.08 | €16.04M | ✅ 4 ⚠️ 5 View Analysis > |

| Maps (BIT:MAPS) | €3.29 | €43.7M | ✅ 4 ⚠️ 1 View Analysis > |

| DigiTouch (BIT:DGT) | €2.03 | €28.05M | ✅ 3 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €222.71M | ✅ 2 ⚠️ 2 View Analysis > |

| Nurminen Logistics Oyj (HLSE:NLG1V) | €0.941 | €75.93M | ✅ 2 ⚠️ 4 View Analysis > |

| High (ENXTPA:HCO) | €4.07 | €79.62M | ✅ 1 ⚠️ 5 View Analysis > |

| Faes Farma (BME:FAE) | €4.47 | €1.39B | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.025 | €279.9M | ✅ 4 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.90 | €30.14M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 282 stocks from our European Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Nyxoah (ENXTBR:NYXH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Nyxoah SA is a medical technology company that develops and commercializes solutions for treating obstructive sleep apnea (OSA), with a market cap of €166.21 million.

Operations: The company generates revenue of €4.93 million from its medical products segment.

Market Cap: €166.21M

Nyxoah, a medical technology company focused on treating obstructive sleep apnea, has been expanding its commercial presence in the Middle East following successful Genio® implants. Despite FDA approval for its innovative Genio system and positive clinical trial results, Nyxoah remains unprofitable with increasing losses over the past five years. Its short-term assets exceed both short- and long-term liabilities, but it faces a cash runway of less than one year. The company's share price is highly volatile and trades significantly below estimated fair value. Management's lack of experience may pose additional challenges in achieving profitability amid forecasted revenue growth.

- Click to explore a detailed breakdown of our findings in Nyxoah's financial health report.

- Evaluate Nyxoah's prospects by accessing our earnings growth report.

Nightingale Health Oyj (HLSE:HEALTH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nightingale Health Oyj is a health technology company that provides advanced health checks to detect disease risks across Finland, the United Kingdom, Europe, the United States, and internationally with a market cap of €139.85 million.

Operations: The company's revenue is generated from its Medical Labs & Research segment, totaling €4.69 million.

Market Cap: €139.85M

Nightingale Health Oyj, with a market cap of €139.85 million, is navigating the penny stock landscape by leveraging its innovative health technology offerings. The company recently launched a patent-pending risk detection tool for lipoprotein (a), aiming to reduce cardiovascular disease costs significantly. Despite reporting €4.69 million in revenue for the year ending June 2025, Nightingale remains unprofitable with a net loss of €18.46 million. However, it maintains strong liquidity, as short-term assets cover both short- and long-term liabilities comfortably. A recent contract with Aalborg University highlights its potential to expand revenue streams through strategic partnerships in medical research.

- Click here to discover the nuances of Nightingale Health Oyj with our detailed analytical financial health report.

- Explore Nightingale Health Oyj's analyst forecasts in our growth report.

Kamux Oyj (HLSE:KAMUX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Kamux Oyj, with a market cap of €78.55 million, operates in the wholesale and retail sectors by selling used cars across Finland, Sweden, and Germany.

Operations: The company generates €954.9 million in revenue from its retail segment focused on gasoline and auto dealerships.

Market Cap: €78.55M

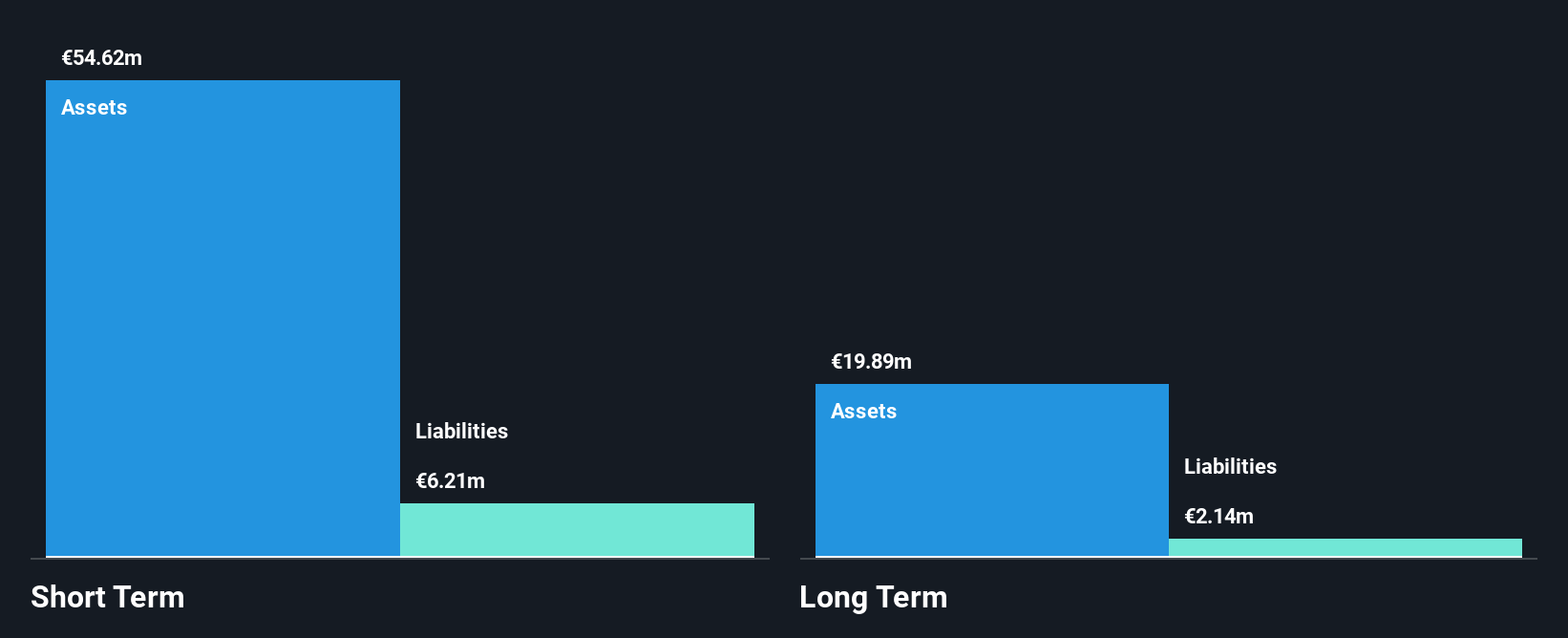

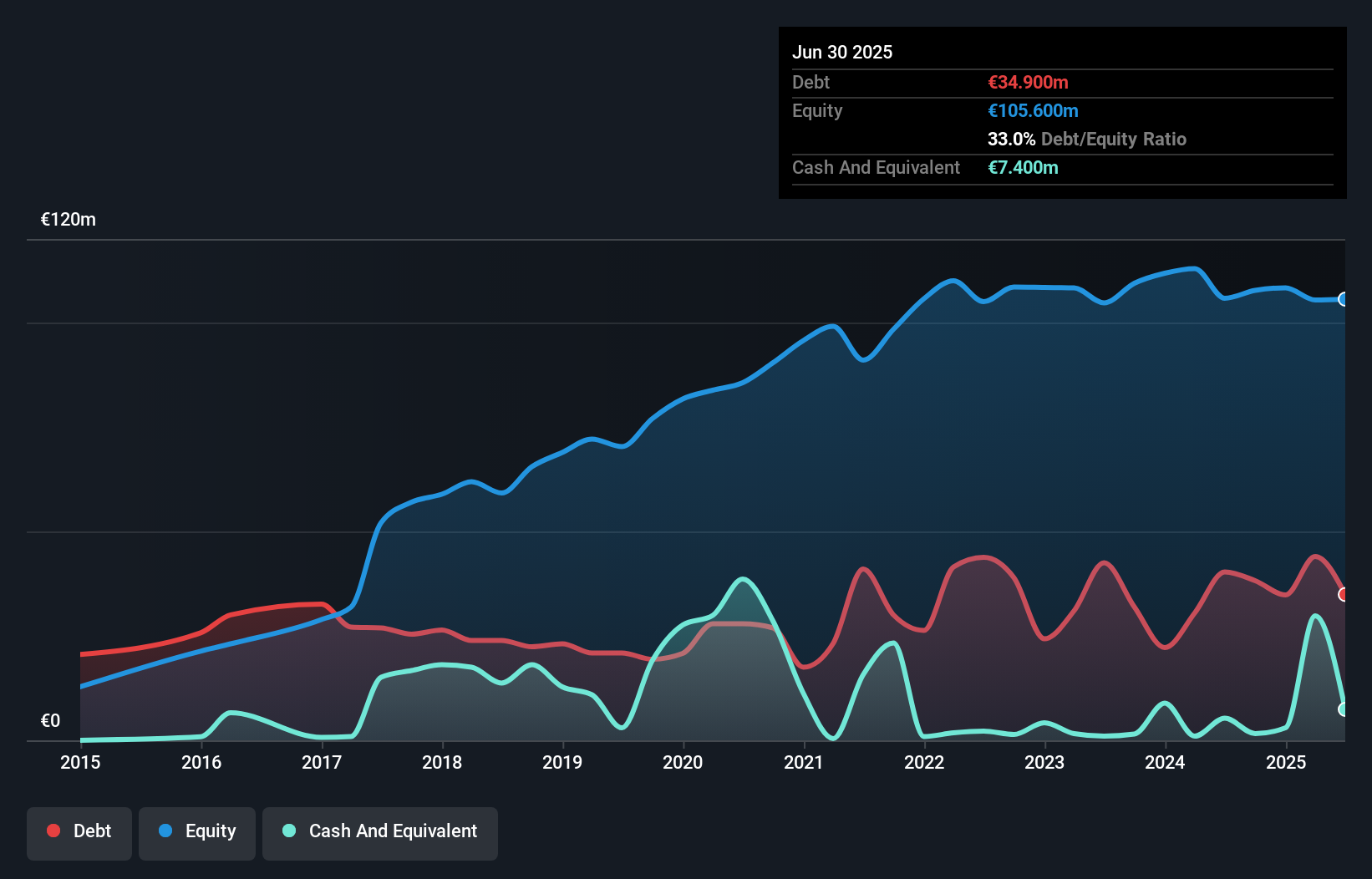

Kamux Oyj, with a market cap of €78.55 million, is navigating challenges in the European penny stock sector. Despite generating €954.9 million in revenue from its used car sales across Finland, Sweden, and Germany, the company remains unprofitable with increasing losses over recent years. Recent executive changes saw founder Juha Kalliokoski return as CEO amid struggles in Swedish and German markets. The company's debt is well-covered by operating cash flow (88.8%), but interest payments are not adequately covered by EBIT (0.7x). Kamux's dividend yield of 3.55% lacks earnings support, reflecting ongoing financial pressures.

- Dive into the specifics of Kamux Oyj here with our thorough balance sheet health report.

- Examine Kamux Oyj's earnings growth report to understand how analysts expect it to perform.

Taking Advantage

- Unlock our comprehensive list of 282 European Penny Stocks by clicking here.

- Looking For Alternative Opportunities? Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kamux Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:KAMUX

Kamux Oyj

Engages in the wholesale and retail of used cars in Finland, Sweden, and Germany.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives